- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wash Sale Rounding

I imported my 1099 from my brokerage and I'm running into the issue where my wash sale transaction is less than $.49 and when it rounds down and puts zero on the form I keep getting an error. When following the instructions on the program and the internet to remove the wash sale it tells me to go back to the income section and adjust it, but there is nothing to adjust. There is nowhere I can find to edit individual transactions. How do I edit this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

To enter a disallowed Wash sale:

Income & Expenses

- Scroll to Stocks, Mutual Funds, Bonds, Other

- Answer Yes to Did you sell stocks, mutual funds, bonds, or other investments in 2020?

- On the OK, what type of investments did you sell? screen, select Stock, Bonds, Mutual Funds. Then select Continue.

- From here, you can import or manually enter your 1099-B.

- Answer the questions about your sales. Choose to Enter sales one by one when asked.

- On the Now, we'll enter one sale on your 1099-B screen, enter your info.

- Check I have other boxes on my 1099-B to enter and enter the disallowed wash sale loss in box 1g.

- Select Continue and answer any follow-up questions.

Note: You'll need TurboTax Premier, TurboTax Live Premier, or TurboTax Self-Employed, TurboTax Live Self-Employed, to add any 1099-B forms.

- A wash sale occurs when an investor sells or trades a security at a loss, and within 30 days before or after, buys another one that is substantially similar.

- It also happens if the individual sells the security at a loss, and their spouse or a company they control buys a substantially similar security within 30 days.

- The wash-sale rule prevents taxpayers from deducting a capital loss on the sale against the capital gain.

- Wash Sale Rule

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

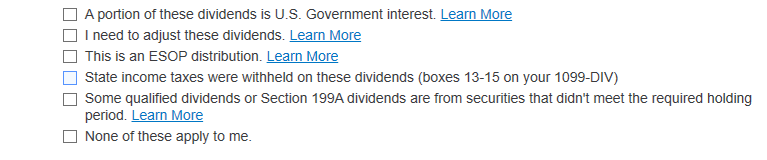

Still not working and I'm on desktop premier. I re-imported my 1099 and none of the questions gave me the option to edit anything. I can edit the amounts for boxes 1-12 and the only questions I get asked are attached. None of which allow me to edit anything individually. Its a 30 page list of transactions so I really don't want to type them all by hand. Hoping to just edit the wash sale part.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

The rounding error occurs because the IRS says that you can round off cents to whole dollars on your return and schedules. If you do round to whole dollars, you must round all amounts. To round, drop amounts under 50 cents and increase amounts from 50 to 99 cents to the next dollar. For example, $1.39 becomes $1 and $2.50 becomes $3.

If you have to add two or more amounts to figure the amount to enter on a line, include cents when adding the amounts and round off only the total.

If you are entering amounts that include cents, make sure to include the decimal point. There is no cents column on Form 1040 or 1040-SR.

Form 1099B doesn't allow a negative number for these transactions, so it causes an error.

Here is how to fix the issue in TurboTax:

You will need to revisit the input section for the Form 1099-B transactions. Use the following steps:

- On the top row of the TurboTax online screen, click on Search (or for CD/downloaded TurboTax locate the search box in the upper right corner)

- This opens a box where you can type in “1099-B” and click the magnifying glass (or for CD/downloaded TurboTax, click Find)

- The search results will give you an option to “Jump to 1099-B”

- Click on the blue “Jump to 1099-B” link

- Click Edit beside the institution name

- Click Edit beside each transaction that contains a wash sale adjustment amount of $0.49 or less

- Delete the wash sale adjustment amount and click Done

If this does not solve your issue, check the steps below to make sure that you entered the wash sale correctly. These are the original steps to enter a wash sale on your 2020 return:

SOLVED

- Open or continue your return in TurboTax and search for wash sales.

- Select the Jump to link at the top of the search results.

- Answer Yes to Did you sell stocks, mutual funds, bonds, or other investments in 2020?

- On the OK, what type of investments did you sell? screen, select Stock, Bonds, Mutual Funds. Then select Continue.

- From here, you can import or manually enter your 1099-B.

- Answer the questions about your sales. Choose to Enter sales one by one when asked.

- On the Now, we'll enter one sale on your 1099-B screen, enter your info. Check I have other boxes on my 1099-B to enter and enter the disallowed wash sale loss in box 1g.

- Select Continue and answer any follow-up questions.

Note: You'll need TurboTax Premier, TurboTax Live Premier, or TurboTax Self-Employed, TurboTax Live Self-Employed, to add any 1099-B forms.