- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

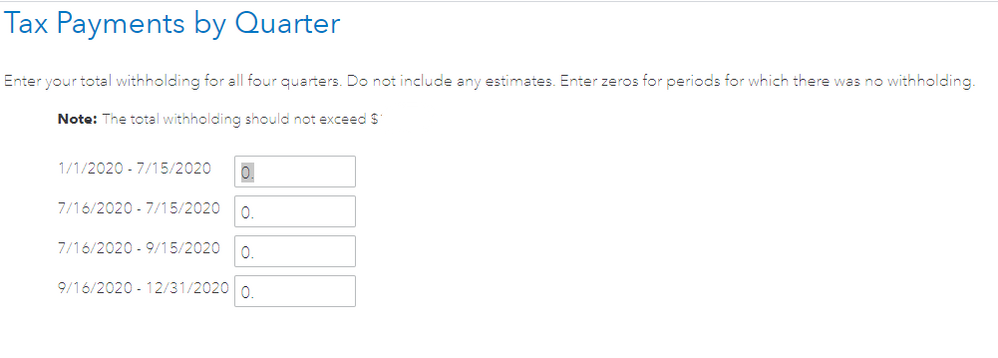

I'm going through the wizard for form 2210 and the "Tax Payments by Quarter" page where I enter the total withholding for all four quarters has incorrect dates on it.

"Enter your total withholding for all four quarters. Do not include any estimates. Enter zeros for periods for which there was no withholding."

Then it has four form fields denoted by dates, and the dates are showing incorrectly as follows:

1/1/2020 - 7/15/2020

7/16/2020 - 7/15/2020

7/16/2020 - 9/15/2020

9/16/2020 - 12/31/2020

The website needs to be updated to fix this problem.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

The IRS form 2210 for 2020 has not yet been released. Once the IRS releases it, then it will be available in TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

OK That's fine, but I was able to access this page and it still has an error that needs to be fixed. See image:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

We are aware of this experience. The Form 2210 is not yet available or ready for release and the release date is February 18th. The federal forms release dates can be viewed here.

You also have the choice of letting the IRS bill you later if you like.

- With your TurboTax account open search (upper right) for underpayment penalty > Enter > select the Jump to link in the search results.

- Follow the prompts to the screen shown in the image below.

If necessary you can delete Form 2210, using the instructions here.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

You do not actually need the 2210 should you be trying to pay in estimates, payments, or the like. Please, however, make sure - for your own benefit - to include tax year to which payment should be applied, along with your SS# or FID# should it be a business. Make sure to make a copy of the check and save it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

I see that IRS posted the form on February 9, two days ago (and two days ahead of schedule).

https://apps.irs.gov/app/picklist/list/formsPublications.html?sortColumn=postedDate&indexOfFirstRow=...

It hasn't found its way in Turbotax yet, it appears.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

It takes every tax software vendor time to get the final IRS form, make a mock-up that the IRS approves, code the XML generator that is used for the e-file format, write the code to populate the form, test the heck out of it not only on the 2210 itself but also every form that feeds into it and the form it feeds into (the 1040).

Of course, if you assume that there will be zero changes, you might do a lot of this before the final form is released by the IRS...but you have to balance the workloads of the 2210 accountant and programmers and testers with all the other last minute work that is going on as the IRS (and Congress) is changing the rules and forms for 2020 even now.

So announcing an estimated release date of 2/18/2021, just a week from now, is perfectly reasonable.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

"test the heck out of it not only on the [form] itself but also every form that feeds into it and the form it feeds into "

It seems this is the part that TurboTax leaves out.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

It appears TurboTax has now scheduled form 2210 for 2/25/2021, a week later than previously.

https://care-cdn.prodsupportsite.a.intuit.com/forms-availability/turbotax_fed_mac_individual.html