- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

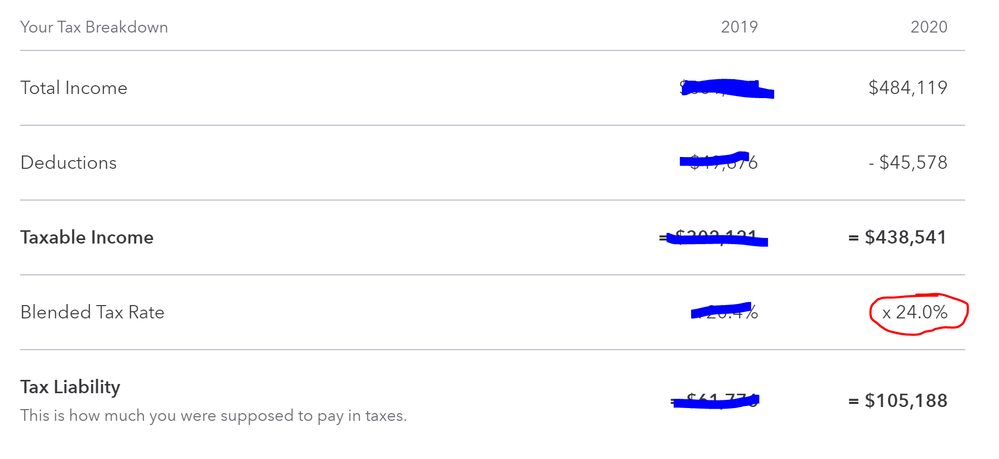

Federal Tax Liability Calculation Incorrect

Can anyone explain why TurboTax is calculating the blended tax rate incorrectly (married filing jointly)? It calculates here as 24% based on the taxable income but it should be closer to 23.5%. That difference amounts to almost 2,000 more taxes that TurboTax says that I owe that I don't. I suspect there is a rounding error here, but even then, if you multiply 24% times the taxable income the number is different from the tax liability listed which tells me they aren't rounding (only to show the above for ease of display). Either way it is somehow wrong. I've entered everything so far except my 1099-B, so perhaps that changes it? Either way it's weird that it would display those numbers so simply, and incorrectly.

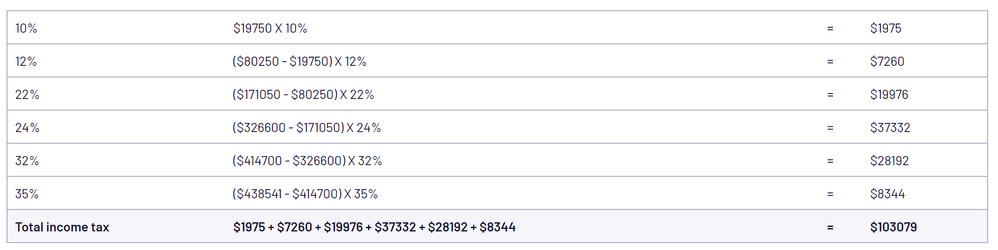

Here is how the calculation should be done.

After this and the absolute travesty that is the mortgage interest deduction worksheet / quiz, I might have to find an alternative to TT.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

The calculation is almost guaranteed to be correct (and technically TurobTax does guarantee that part in the end.)

Your mistake here is that you are assuming your tax calculation is that simple and odds are that it is not. Different parts of your income are taxed at different rates, so your tax isn't a function of just the bottom line taxable income then go to the tax tables but that only works if your income is 100% wages and nothing else (and even then, not always.)

Different parts of your income are taxed at different rates - such as capital gains, and dividends. You mention that you have a 1099-B, which means at your income level you are paying Net Investment Income tax of 3.8% on that income (most likely) but only on that income.

VERY few taxpayers can rely solely on the tax tables to determine their true tax liability. If it were really that simple, we wouldn't need software like TurboTax and we could just do this on pen and paper in a few minutes and be done, but it's not.

The 1098 issue is being corrected as well as other issues as is very common for this time of year, particular when there are many tax law changes.

I would relax, step away, and revisit the return closer to the date the filing season opens. By then the issues like 1098 entries and other items will have worked themselves out and your return will be more likely to be ready to file. The IRS hasn't even finished a fair number of forms and released them for use - so the software companies, all of them, are waiting for those final approvals before they can incorporate the forms.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

The screen you are looking at is just a summary of various pieces of tax information from your tax return. The 'blended' tax rate is not used on your actual tax return to calculate anything. If you want to see how your taxes were calculated, you need to look at your Form 1040 as well as the supplemental forms, schedules and worksheets. Your blended tax rate (tax liability divided by taxable income) is 23.5 which is rounded up to 24% on the screen.

The tax table you are looking at is for ordinary income only. Some income is taxed at different rates (Qualified Dividends/Long-Term Capital Gains are taxed at a lower rate than ordinary income). If you have any of the following included in your return, the tax table will not give you accurate results:

- Qualified Dividends and Capital Gain Tax Worksheet

- Schedule D Tax Worksheet

- Schedule J

- Form 8615

- Foreign Earned Income Tax Worksheet

And, TurboTax comes with an accuracy guarantee, see more - Your taxes done right, guaranteed

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

TurboTax seems to occasionally do incorrect calculations! When it subtracts my cost from my proceeds, it incorrectly gets a $3000+ Gain while is should be a $1000+ loss!! This is simple arithmetic that a 7 year old child could do so why should I pay for a program that cannot? I will NEVER use TurboTax again but since I am now almost finished with my 2021 tax return, what do I do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

When you refer to 'Proceeds less Cost' being incorrect, are you referring to a 1099-B entry?

If you could clarify your issue, we'll try to help.

Click this link for more info on Form 1099-B.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Has my problem where TurboTax calculates my capital Gain/Loss from my 1099-B incorrectly? When it subtracts my Cost from my Proceeds, it gets a positive number when it should be negative, or a Capital Loss. I want to file but cannot until this serious bug is fixed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

We need more details. Where does it show wrong? On the 1099B entry or on the actual 1040 line 7? Can you post a screenshot? I would try deleting that sale and re enter it. Double check the boxes for sales price and cost. They might be reversed from your 1099B form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

It is not one sale, it is ALL sales and comes up after all the sales are entered. I do not see a way to insert a Screenshot here, but I will enter what it looks like manually here:

Total gain or loss $3.267.74

Number of sales 307

Proceeds $487,161.08

Cost basis $488.264.94