- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

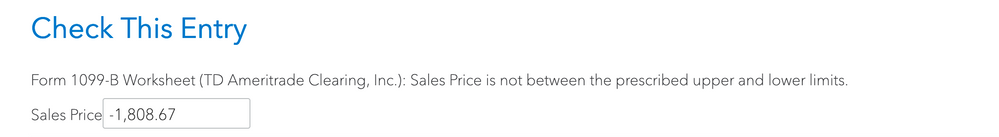

1099-B Worksheet CHECK THIS ENTRY: Sales Price is not within the prescribed upper or lower limits

Sales Price is not within the prescribed upper or lower limits error. This continues for EVERY transaction with a negative dollar amount (whare are capital losses). If you change the value, then it effects the capital gain/loss.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

You cannot enter a negative number in that field.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Okay.

What number should be represented in that field? There is no "Sales Price" field in a 1099-B. The field (I believe) is auto-calculated based on (Proceeds..1d) - (Cost Basis...1e) on the 1099-B for each of the individualize transactions. In my case I have 74 transactions pulled in from TD Ameritrade.

If you zero out the number (make a non-negative) your total capital gains goes UP and is not represented correctly, thus effecting your total return (which then become inaccurate).

You cannot zero out the number and complete an accurate representation of your 1099-B.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

I am simply informing you that the field will not accept a negative number.

You can make an adjustment in the program but a negative number in that field will throw an error.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

I am having this exact same issue too. Why isn't there a simple fix for this? This seems to be a frequent problem for people with options contracts...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

I'm having the exact same problem as well. It seems like an error that the box does not allow negative numbers. It's supposed to be box 1d from the 1099-B...well my 1099-B has plenty of entries with negative numbers in box 1d. What is the suggested workaround exactly?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

The rep said that an "update" was coming on 2/11 to fix this issue, but I'm not sure how confident she was in this disclaimer, or if she was just repeating that particular date from previous years. I highly recommend everyone who is having this issue call in to file a report that they're having this issue, so that TurboTax's team makes it a priority to fix this common issue ASAP.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

I too am having the same problem for every negative sales price . Data imported right from TD Ameritrade. Rep told me program is correct and not a bug but no help on anything to remove the errors. It looks like it will let me file but I don't like all the errors (60 for me). Anyone know if TaxAct or another program is able to handle this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

having the same problem If you put a zero in box 1 d. This will affect your net short term capital gain/loss # Any idea what the fix is?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

There has been a change by the IRS starting with the 2020 tax returns that will reject any return filed with a negative number reported in the proceeds or cost basis fields for Schedule D. TurboTax is flagging these situations ahead of time before the return is filed in order to prevent the IRS rejection. Some brokers are still using the old convention for reporting negative values and have not updated their reports to match the IRS.

The error message reported by TurboTax is telling you that the number entered cannot be negative.

Gains from expired options are reported by entering the gain amount in the proceeds column and no amount in the cost basis column. The end result here would be positive.

Losses from expired options are reported by entering the loss amount in the cost basis column and no amount in the proceeds column. The end result here would be negative.

No negative numbers should be entered in either the cost basis or proceeds fields.

If negative numbers have been imported through your brokerage statement, you will need to edit the entries to make the correction.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

I faced a similar situation during the review phase. I went into the 1099-B transaction and started fixing the CALL Options

My options were expired and I kept the premium (short term gain).

- However, in TurboTax, when I choose Expired (between Sold or Expired), then the Proceeds textbox disappears. In the end, it shows 0.0 for both Proceeds and Cost basis.

- When I choose, Sold (between Sold or Expired), then the Proceeds textbox appears. In the end, it shows both Proceeds and Cost basis.

However, this looks incorrect since I did not sell the option.

Is this a bug in TurboTax? Or should I go with the second choice? At least in the second choice, the tax is computed correctly though I really did not make gain from the selling an option

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

I will email TD Ameritrade right now to see if they are aware of this IRS change and see if they will send out amended 1099 documents. Why would the phone rep tell me that there was going to be a new software update on 2/11? Should I be expecting one from TurboTax to correct this issue? Or, should I rush TD Ameritrade to start processing new 1099s? I prefer not waiting till the deadline to take care of these matters. Thank you for your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

It is unclear @quantbone2020 what rep are you talking about? Turbotax or brokerage firm?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

I found this information from IRS: https://www.irs.gov/pub/irs-pdf/i1099b.pdf

Box 1d. Proceeds Enter the gross cash proceeds from all dispositions (including short sales) of securities, commodities, options, securities futures contracts, or forward contracts. Show a loss, such as one from a closing transaction on a written option or forward contract, as a negative amount by enclosing it in parentheses

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

I was speaking to a phone rep with TurboTax that had assured me a "big update" was coming on 2/11 to the software, but Annette is now stating that the IRS rejects tax returns with negative numbers, and now you have provided us an IRS link that shows that they would accept negative numbers in Box 1D using parentheses. May we have some clarity on the matter?