- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal Tax Return - S-Corporation Form 11205

Federal tax return S-Corporation Form 11205 not needed and somehow in my return. I do have a K-1 partnership which I filled out but no S-Corporation Form 11205; not needed How to delete?,

Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

You might have started the K-1 section for the 1120-S, in which case you can easily delete it in the program using the Delete button (take care not to delete the K-1 for the 1065).

You also might have a phantom K-1 in your file which you can delete using the instructions at the link below.

https://ttlc.intuit.com/community/using-turbotax/help/how-do-i-delete-a-k-1/00/26655

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Thanks for the recommendation.

However, I only see one K-1 that was entered by me in the Federal return and it is correct. If I go through the steps for the correct K-1 which bring me back to the K-1 Summary pages which again only shows the one I need. I believe I am good on the federal side.

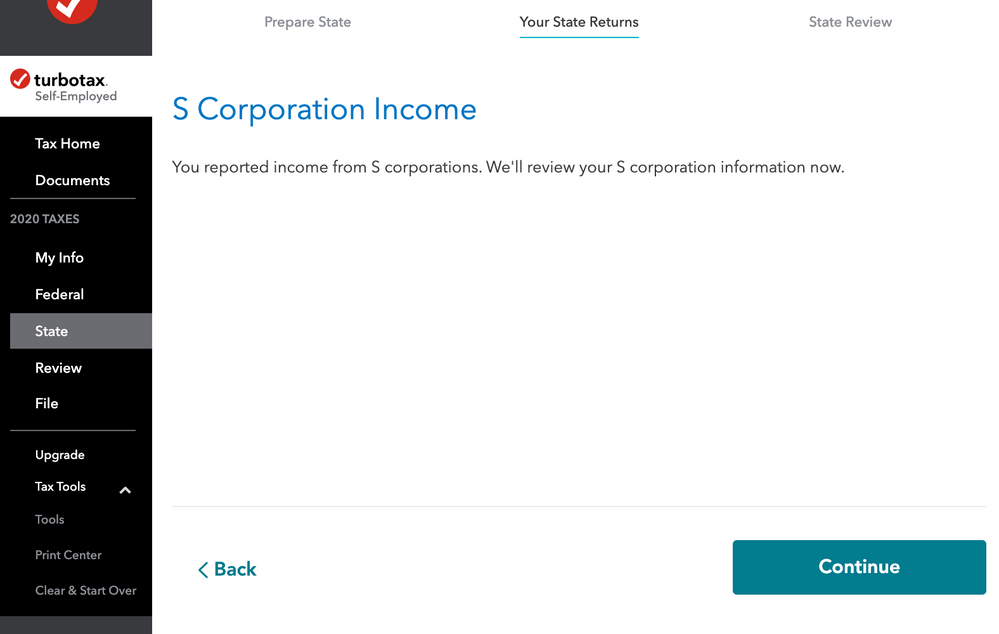

However, if I proceed into the NJ state return and fill the K-1 screens including the NJK-1 partnership information, it is asking for an S Corporation Income with "You reported income from S corporations. We'll review you S corporation information now.". I do not have any S corporation information. Any idea how the state form received this; I though this maybe coming from the Federal tax forms?

I apologize I was not clear last time. Please advise.

Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

@VPJr wrote:....I do not have any S corporation information. Any idea how the state form received this; I though this maybe coming from the Federal tax forms?

I have done quite a few test returns with various versions of TurboTax and have noticed that the state-specific K-1s can be "sticky"; they never seem to disappear. In fact, those K-1s have even regenerated after restarting the program despite the fact that I deleted them in Forms Mode (in the desktop versions).

The only thing I can suggest, assuming your state-specific K-1 cannot be deleted, would be to ensure that it is zeroed out. I have gone through the entire process and have not experienced any issues with the program with a blank state-specific K-1.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Thanks again for hanging in there with me.

I will try to delete in forms. Again I have a valid K-1 partnership but no S corporation so just want to eliminate the S corporation on the State filing.

If you try to continue through the S corporation on the state return it errors out, not allowing you to continue and wanting you to enter valid entries; so deleting I think is the only way.

I will advise in a few hours as have a meeting to attend.

Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

@VPJr Hi! I have the exact same problem! I am at the NJ state return portion and it says I have reported income from S Corporation which is NOT true.. and I am stuck!! Were you able to fix this and how?