- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Community Property

I was divorced all of 2019. I received community property income from my ex for art that he painted and royalties from books he illustrated. I file HOH. How do I enter the income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Community property is property that you had ownership interest in so there is not income to report for property that you already owned. If you will continue to receive royalties directly form the payer then you should receive a 1099-MISC to report it. If the ex receives the royalty and then pays you as part of the divorce settlement then the spouse must pay any tax and it is probably non-reportable alimony to you.

If assets were sold then the divorce decree should specify who is to pay the tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

The divorce decree states that "The community property income from the community property Artwork

shall be taxable to each party equally". He is in posession of the paintings and prints that I have a 50% ownership of. The only documents I receive from my ex are royalty statements from the book publisher and receipts for the sale of the original paintings/prints. The question I have is how do I enter the income received on my tax return using turbo tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Art has no tax value until sold.

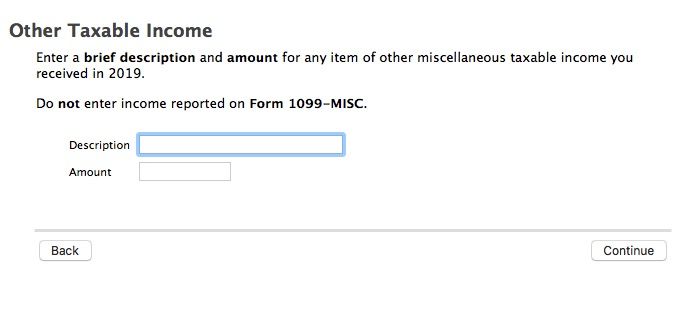

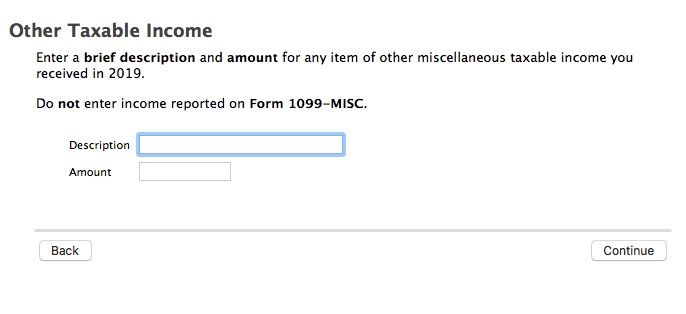

Other income would be miscellaneous income entered under "Less Common income -> Miscellaneous Income-> Other reportable income -> Any taxable income.