- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

override

I need to override a box, but the program will not let me in forms mode.

\

any suggestions?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

It depends.

What are you trying to do?

Overriding entries in the forms is not recommended as it could disrupt the calculations performed by TurboTax.

Entries should only be made in the input section to ensure the program works accurately.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

What box? Why?

There is almost NEVER a reason to override.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

No; it did not answer my question, but I found another workaround.

I certainly recognize that overriding the program is generally frowned upon but is sometimes essential. The program would be more useful to me if I had the option to override whatever field I needed to.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Exactly what is "essential".

We cannot answer your question because you did not tell us what you are trying to override - how to do it depends on what it is.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

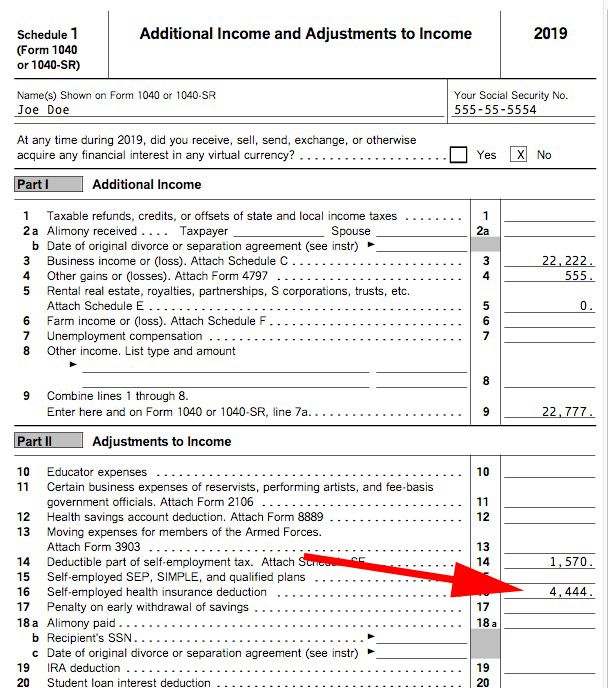

This particular issue was box 16 on schedule 1 (which flows tot eh 1040WKSHT).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

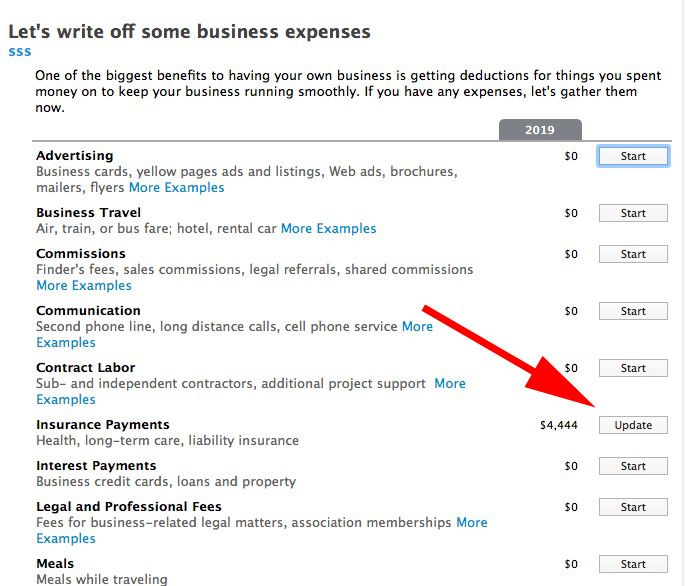

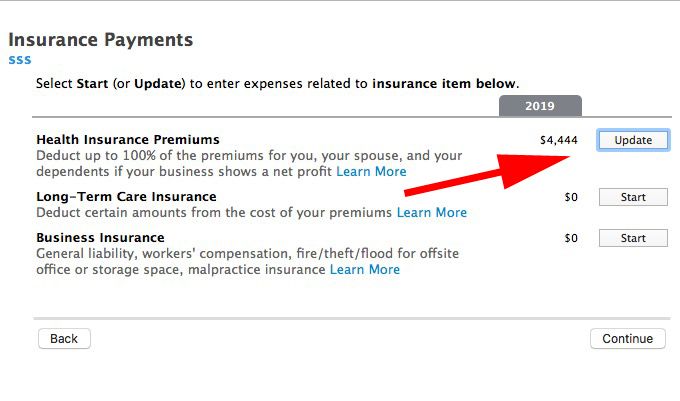

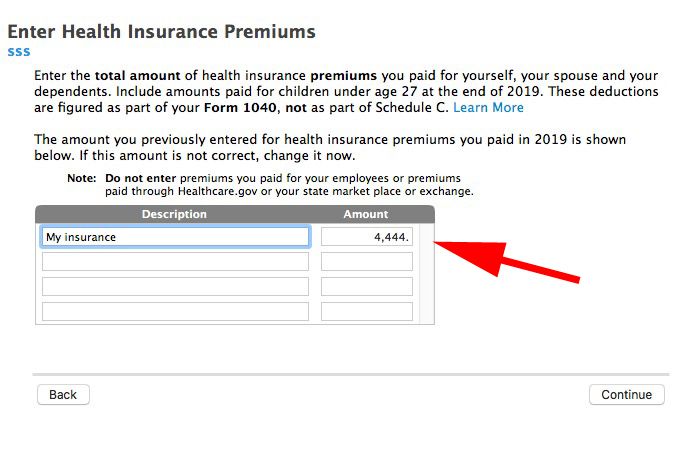

That is entered in the business expenses section - no override is necessary.

It depends on the type of business but most Schedule C business can be entered as in example.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

macuser_22 has shown you exactly how to enter the self-employed health insurance deduction the "right" way (i.e. no override needed).

But note that TurboTax may have to limit or eliminate this deduction based on your Schedule C income and/or your self-employed SEP, SIMPLE, and qualified plan deduction.

Is your issue that you entered the health insurance deduction in the interview but nothing appeared on line 16 on Schedule 1 (1040)?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Close, but I do not file schedule C. Applicable because I am a part-owner of an S corporation; that did not come up at all in the interview.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

If you are a more than 2% owner of a subchapter S corporation, then please do the following:

This amount is entered on the K-1. Return to this K-1 and follow these steps to enter the health insurance premiums:

- Click on the Federal Taxes tab or Personal (for Home & Business version)

- Click on Wages and Income or Personal Income

- Scroll down to Business Investments and Estate/Trust Income

- Schedules K-1 Click Update

- Schedules K-1 or Q screen, Do you want to Review - click Yes

- Tell Us About Your Schedules K-1 screen, click Update by 1065 or 1120S Form

- Click Edit by your K-1

- Click through the screens until you see the "Other Situations" screen

- Check the box for "I personally paid health insurance..." - Continue

- Enter the amounts requested for this K-1

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

That is basically what I did through the forms. thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

That's fine, except that the act of overriding voids the Tax Accuracy Calculation Guarantee. That's why we strongly encourage users to not override anything except in the most extreme cases.

**Mark the post that answers your question by clicking on "Mark as Best Answer"