- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I edit the recipient address for my 1099-INT?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

What do you mean? YOU are the recipient. Your address is entered in the personal information section. That is what is sent to the IRS.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Yes, I am aware. Turbo Tax seemed to be importing my recipient address from an external source, I am guessing my financial institution, but imported the incorrect information. This was causing an issue that I was not able to rectify at first but not it was been resolved.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

I am not sure what you mean. The address is not even part of the 1099-INT interview. What exactally are you looking at to see that?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

I have the same question. The info was imported from my bank but in the Review, it asked for the recipients' zip code and I accidently entered the wrong zip code. How do I correct it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

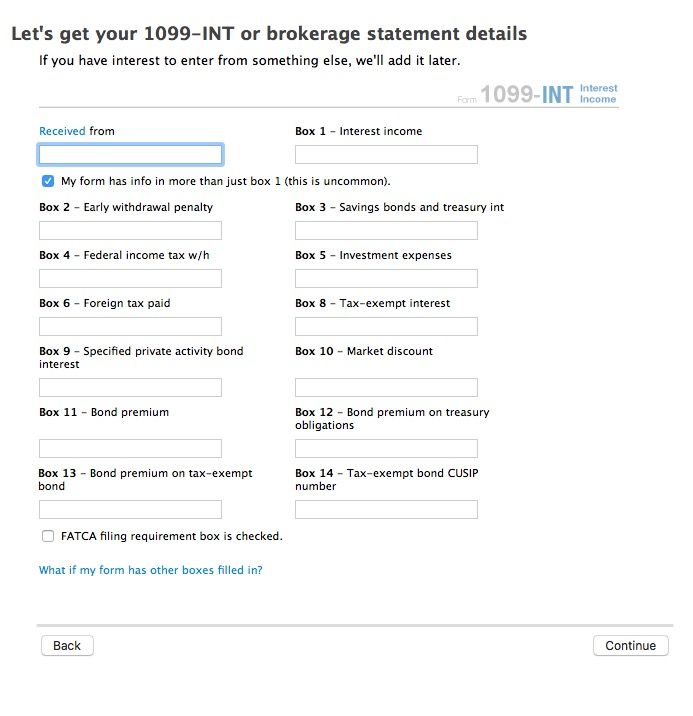

To edit your 1099-INT, please follow the instructions below:

- Open your return.

- Search 1099-INT with the magnifying glass tool.

- Click the Jump to link.

- Click on the 1099-INT entry.

- Click Edit.

- Follow the on-screen instructions.

If that does not work, please type your interest in manually.

To type your interest in manually, please follow the instructions below:

- Open your return.

- Search 1099-INT with the magnifying glass tool.

- Click the Jump to link.

- On the page Let's import your tax info, click Enter a different way.

- Click on 1099-INT

- On the page How do you want to enter your 1099-INT, click Type it in myself.

- On the next page enter the payer and the amount of interest.

- Please delete your original 1099-INT entries on the summary screen.

[Edited 4/10/22 l 4:14AM PST]

@znuser2973

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

inputting the 1099-INT form manually doesn't let me enter any real information about the bank (no TIN, no bank address, etc). only the actual bank (i.e. "X Credit Union"). Does it not need this information?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

No, this information does not get reported to any taxing authorities through your returns. The information is matched up via your social security number.

**Mark the post that answers your question by clicking on "Mark as Best Answer"