- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Div UTMA brokerage accts

I am using TurboTax to do my taxes.

I have a UTMA brokerage account for each of our four grandchildren. I received for each a Form 1099-Div for filing taxes. Each of my grandchildren are under 11 years of age. Each received under 1a. Total Ordinary Dividends $85.98 or less. Do I have to report this income in my taxes on a form 1099-DIV?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

No, you do not report it on your tax return, and if this is the only income your grandchildren have,they don't need to file tax returns and report it. The filing requirement for dependents are:

- Your earned income (money you made by working) exceeds $12,200

- Your unearned income (interest, dividends, capital gains, etc.) exceeds $1,100

- Your business or self-employment net income (gross minus expenses) is at least $400

- Your gross income (earned plus unearned) exceeds the larger of $1,100 or your earned income (up to $11,850) plus $350

But even if your income falls below these filing requirements, you'll want to file your own tax return to get a refund of any federal or state taxes withheld from your paychecks.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Hello, taking your advice I started a separate return in Turbo Tax for my daughter of 13 because her UTMA (my wife is the custodian) had ordinary/qualifying dividends and capital gains distributions over $1100 ($1268). The Federal Tax Summary section calculated a taxable income of $168, but a Federal Taxes You Owe amount of $0. Why is the amount $0? If this is accurate, do I need to file a tax return on behalf of my daughter?

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Yes, there is a requirement for the child to file a return however, I recommend you look at the option of including the child's unearned income on your return. You won't need to pay for another return. Here is applicable IRS Publication. Also, here is an extract that applies. In TurboTax, in the "Income & Expenses" tab scroll down to "Less Common Income" and there you will find the "Child's Income" topic.

Parent's Election To Report Child's Interest and Dividends (Form 8814)

You may be able to elect to include your child's interest and dividend income (including capital gain distributions) on your tax return. If you do, your child won't have to file a return.

You can make this election only if all the following conditions are met.

-

Your child was under age 19 (or under age 24 if a full-time student) at the end of the year.

-

Your child had income only from interest and dividends (including capital gain distributions and Alaska Permanent Fund dividends).

-

The child's gross income was less than $11,000.

-

The child is required to file a return unless you make this election.

-

The child doesn’t file a joint return for the year.

-

No estimated tax payment was made for the year, and no overpayment from the previous year (or from any amended return) was applied to this year under your child's name and SSN.

-

No federal income tax was withheld from your child's income under the backup withholding rules.

-

You are the parent whose return must be used when applying the special tax rules for children. (See Which Parent's Return To Use , later.)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

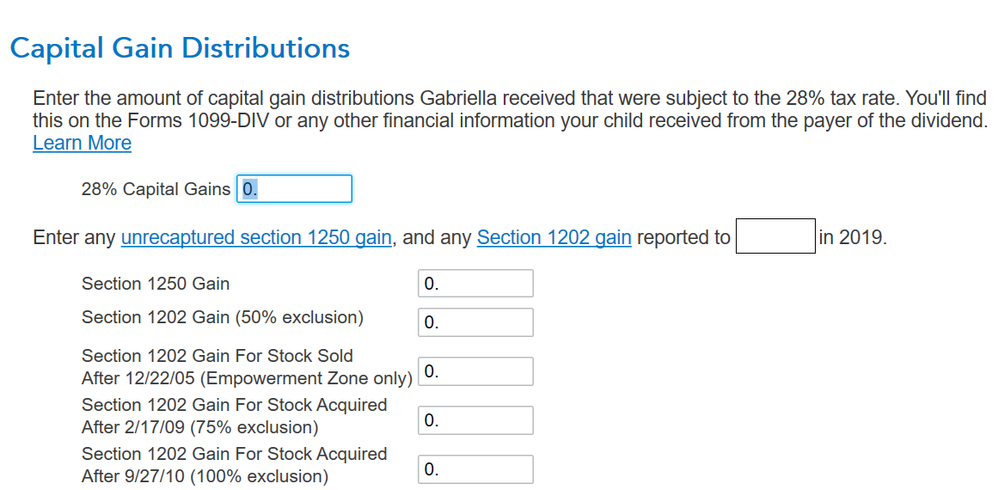

Thank you for your prompt reply. I took the route you suggested and followed the instructions under Child's Income... under Less Common Income. We have one 1099-DIV from an UTMA for my 13 year old. Mapping the language provided in TurboTax (TT) for form 8814 to the 1099-DIV was a challenge, not having much experience with the 1099-DIV. One question I have here is re: the TT page "Capital Gains Distributions". Is the amount we enter in "28% Capital Gains" the amount in box 2d of the 1099-DIV? My 1099-DIV labels box 2d as "Collectibles (28%) Gain". At first glance I thought this might be the amount in box 2b, which I had already entered on the previous TT page, but some research changed my mind, landing me on 2d. The section 1250 and 1202 gain amounts map to my 1099-DIV more clearly, by the way. Form 8814 calculates a 10% tax on the amount over $1,100 which in my case was not a significant amount. However, if I had chosen to file a separate return for her, I would have to pay for another return? The TT Deluxe CD cover states that 5 federal e-files are included. Wouldn't that cover my MFJ return and the one for my daughter, should I choose to go that route?

My other daughter (age 10) also has a 1099-DIV from an UTMA but the unearned income is less than $1,100. She has no earned income like her sister. A TT help topic indicates I don't need to file a separate return for her. Also on my return TT advises me not to add her income under Less Common Income like I did for her sister. Is it true that the IRS is not interested in me reporting this daughter's unearned income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

The 28% capital gains tax rate applies to sales of collectibles and that is what is reported in box 2(d) on the form 1099-DIV. I'm not sure where you saw a question regarding that in TurboTax, I just see this screen when I enter dividend income for a child in TurboTax:

You can prepare her tax return for no additional charge since you are using the desktop version of TurboTax.

If any of the children have unearned income under $1,100, then they don't need to file a tax return and their income does not need to be reported on anyone else's tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Hello again. I'm referring to the next page from the page you shared. I decided that input "28% Capital Gains" is box 2d on the 1099-DIV. Would you be able to confirm that choice as correct? I was able to map the page you shared to my 1099-DIV, but this page was not as clear to me.