- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

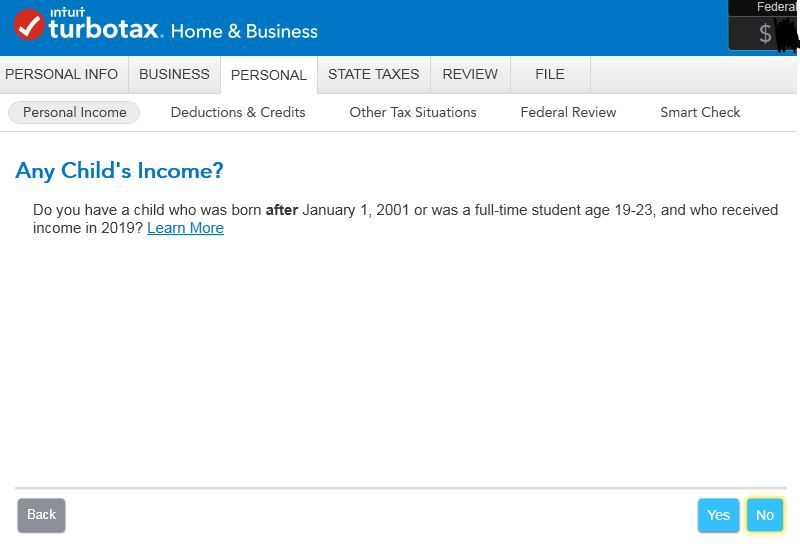

Any Child's Income?

During the Personal Income section of the interview, we are asked "Any Child's Income?". The text below states, "Do you have a child who was born after...who received income in 2019? Learn More". Unfortunately, the Learn More link does not explain what Income is. Is Income defined as Earned Income or could scholarships/grants that exceed qualified education expenses also qualify as income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

You can NOT report you child's earned Income or taxable scholarships/grants on your tax return*. If his only income is from interest and dividends, Alaska PFD or capital gains distributions shown on a 1099-DIV, there is a provision for entering it on your return, using form 8814. Enter at Less common income / Child's income.

*You do not report his/her income on your return. If it has to be reported, at all, it goes on his own return. If your dependent child is under age 19 (or under 24 if a full time student), he or she must file a tax return for 2019 if he had any of the following:

- Total income (wages, salaries, taxable scholarship etc.) of more than $12,200.

- Unearned income (interest, dividends, capital gains) of more than $1100.

- Unearned income over $350 and gross income of more than $1100

- Household employee income (e.g. baby sitting, lawn mowing) over $2100 ($12,200 if under age 18)

- Other self employment income over $400, including box 7 of a 1099-MISC

Even if he had less, he is allowed to file if he needs to get back income tax withholding. He cannot get back social security or Medicare tax withholding.

In TurboTax, he indicates that somebody else can claim him as a dependent, at the personal information section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Thank you for the thorough answer; however, I"m still unclear on what the question is truly asking? "Child's Income"... My son only had a 1099-INT from savings bonds and taxable scholarship money. He did not have any Earned Income. Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

You cannot report his income on your tax return. If he only had 1099-INT income, you could. But, since he also has taxable scholarship income, he must file his own return. If the interest was less than $350 and the scholarship and interest together was less than $12,200, he is not required to file or report the income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Thank you for the quick response. I've attached a screenshot of the question. From your answer, I will select No, correct? He only made $700 on a 1099-INT for savings bonds (Series I and EE) and $2000 in taxable scholarships (total scholarships - QEE).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Hal_Al, please help with the clarification.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

OK. Thanks for the screen shot. I see your dilemma.

Technically, you answer yes ($700 is more than $350 and $2700 is more than $1100). He is required to file a tax return.

When you answer yes, on that screen, the follow up screens will eventually tell you that you don't qualify to include the child's income on your return. He will have to file his own return.

He will be allowed a standard deduction of $2350 ($2000* + 350). He will pay tax on $350 of interest (2700-2350 = 350). So,about $35 of tax.

*Taxable scholarship is treated as earned income, but only for the purpose of calculating the standard deduction.