- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am ready to e file my Fed & State but I was not asked to give my IP pin. What should I do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

You no longer need a PIN number from last year to electronically file your return as the IRS did away with this verification method. You will need your 2018 AGI (Adjusted Gross Income) as the IRS is using for security verification.

If you used TurboTax last year you can view your 2018 AGI by selecting Documents on the left hand side of your screen. Select View Documents from: Select 2018 on the drop down menu.

OR

You can obtain a copy of last year's tax transcript online using IRS link: Transcript

OR

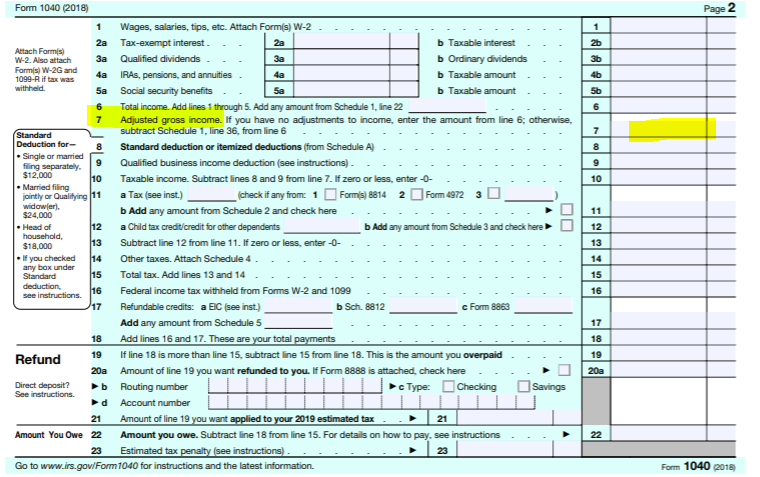

If you have a copy of your 2018 tax return, your AGI is located on line 7.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Were you a victim of identity fraud and did you get an IP Pin from the IRS?

https://www.irs.gov/identity-theft-fraud-scams/get-an-identity-protection-pin

here is TT entry https://ttlc.intuit.com/community/entering-importing/help/how-do-i-add-or-remove-my-6-digit-ip-pin/0...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

WAIT ?

PIN (5 digit) ?

or IP PIN (6 digit)

The "IP PIN" Is in a special place in the Federal section...on the Other Tax Situations page