- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I get tax deduction (NYS529 account) for the rent amount paid for my community college going beneficiary, if yes, where and how on the tax from?

Customer service of NYS529 suggested to check with accountant/ tax services. Beneficiary’s financial aid department is only aware of tuition amount deduction since the college doesn’t have dormitory.

My beneficiary is a full-time student living off campus and on the apartment lease as primary. Would I be able to get tax deduction for the rent amount paid because of my NYS529 account for my beneficiary? If yes, where and how on the tax from?

I sincerely thank you for your reply.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

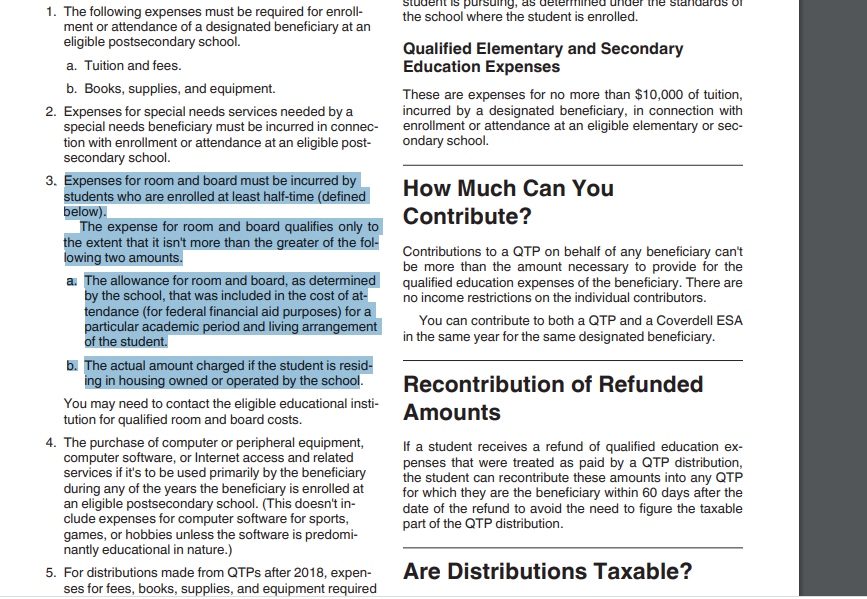

It depends. Please see the highlighted requirements below.

Questions to verify:

1. If your school does not have a dormitory, does your school still provide any allowance for room and broad that was included in the cost of attendance?

2. Is the off-campus apartment rent operated by your school?

If your school does not provide any allowance and the apartment is not operated by your school, you cannot claim any deduction on your federal tax return.

If your school provides an allowance or the apartment is operated by your school, you might be able to claim depends on the amount of the rent.

For NY state, contact NY Department of Taxation and Finance

**Mark the post that answers your question by clicking on "Mark as Best Answer"