- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter my dental insurance premiums for S-corp

My self-employment health insurance deduction from medical insurance premiums paid for by my single-member S-corp seem to flow through from my marketplace 1095-A fine, and are correctly shown in Sch 1: Self-Employed Health Insurance Deduction.

But, what about dental insurance deductions also purchased through the marketplace? I don't have a 1095-A for those, and in the K-1 entry box where health insurance premiums are mentioned turbotax has a note saying these figures aren't used anywhere.

Where do I enter dental insurance premiums?

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Those are added to all the other medical expenses on the Sch A if you itemize deductions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

No I don't think that is correct. I am not itemizing my deductions. I am claiming the self-employed health insurance deduction which shows up on Line 29 on the new 1040 Schedule 1. What shows up is the data from entering form 1095-A but I did not get one of these for separate dental insurance premiums.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

First, if you got the insurance thru the same company thru the ACA then both premiums will be on the ONE 1095-A form they issue. If they did not you will enter the dental insurance in the Sch C input section as if you did not get the 1095-A.... this is most unusual.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

No. I did not get insurance through the same company on the ACA. As non-pediatric dental insurance does not get a tax credit there is no 1095-A issued. But I understand it is still included in the self-employed health insurance deduction.

Also I am talking about an S-corp with a K-1 so there is no Sch C associated with this self-employment, so I don't understand how I can input it into this section?

I also can't work out how to manually override the number in Turbotax desktop.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

First NEVER override anything unless specifically told to do so by TT support ... overrides void the accuracy guarantee and may keep you from efiling.

Next, mentioning the S-corp to begin with would have been helpful ... watch for the screen in the K-1 entry section that asks about health insurance for you as an employee since you are an employee and should have been taking a salary and issuing yourself a W-2 since you are technically not self employed. @dmertz can you assist ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

you have a problem for a S-Corp shareholder. to deduct as self-employment health insurance, the IRS requires that the insurance must be included on your W-2 as wages (not subject to FICA or Medicare). not on w-2 or no W-2 then no deduction except on schedule A. in addition no salary can raise audit issues with the IRS. the IRS requires S-corp shareholders who perform services for their corp to take reasonable compensation. failure, if caught, will result insubstantial penalties interest and taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Thank you. However, the instructions by that check box do not make sense to me as I did not personally pay health and dental insurance premiums. The S-corp paid them directly. The amount is included on my W-2 as wages.

To the other poster, yes, I do have a reasonable salary from the S-corp and a W-2. That is not the reason for this post.

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

However, following your instructions does allow me to add this extra premium for dental insurance paid directly by the S-corp and included in my W-2 wages, and calculates the deduction correctly. Not an entirely clear paragraph from Turbotax IMHO. Thank you for your kind assistance!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

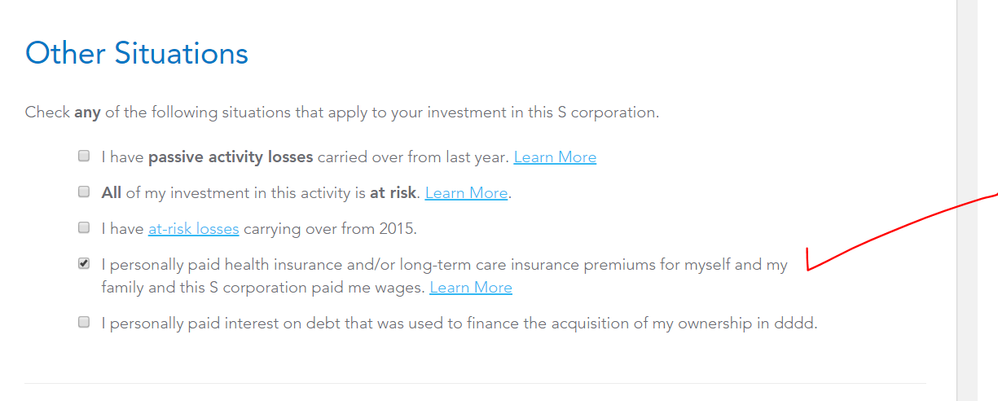

I'm not sure if this is how you entered it, but what follows seems to be how to make the entries for this situation:

Because the S corp included on your W-2 the cost of healthcare, you effectively paid the healthcare cost yourself. When entering the Schedule K-1 (form 1120S):

- Mark the checkbox that indicates that you personally paid health insurance.

- For Health Insurance Premiums You Paid, enter just the amount paid for the dental insurance.

When entering the Form 1095-A:

- Mark the box indicating that you are self-employed and bought a Marketplace plan. (With respect to the self-employed health insurance deduction you are considered self-employed.)

- Associate the Marketplace insurance with your S corp income.

This combination should allow TurboTax to prepare Form 8962 to calculate your annual contribution amount and PTC. TurboTax should then include on Schedule 1 line 16 the sum of your annual contribution amount and the amount you paid for dental insurance. The only case I can see where there might be a problem is if the iterative calculation of PTC does not converge due to being on the threshold between two tiers on the percentage of the poverty line.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Thank you. This is a very clear answer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

I appreciate the explanation by dmertz. It matches what other experts have posted on this question. However, it produced a faulty result in my case. (I’m using TT IRS Free File.)

First I entered the data from Form 1095-A. TT filled in “self-employed health insurance deduction” (Sch. 1, line 16) with the correct number: my out-of-pocket payments for medical insurance minus the PTC. So far, so good.

Then I entered my dental insurance payments in the K-1 section as dmertz describes. This caused Sch. 1, line 16, to drop by a large, random amount — the opposite of what it should have done.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

TurboTax doesn't seem to always produce an optimal result when the iterative calculation does not converge. It might be necessary to do a manual calculation and explicitly enter the self-employed health insurance deduction amount. See the Self-Employed Health Insurance Deduction and PTC section IRS Pub 974: