- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Life Estate - 1099S - Proper way to record

Hi,

My mother had her home in a Life Estate, with me and my 2 other siblings as Joint Tenants with Rights of Survivorship. My questions is how do I properly record this in TurboTax? Some points of note:

On the date of inheritance, the fair market value was $385k. We sold the property not too long afterwards for the same amount, 385k. The proceeds from the sale were 128k after paying closing costs, reverse mortgage company, etc. We each received a 1099-S form listing the total gross proceeds of 128k. I would have expected that form to just show my 1/3 which would have been about 42k, but that's not what I'm seeing. So in TurboTax, do I just list the investment type as "other", and select "inheritance" with the fair market value of 385k and the net profit of 42k (my 1/3 payment)? Also, would I categorize it as a non-investment property for personal use, which would record the sale as a $0 loss?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

--So, yes, 1/3 of the gain figure goes in the net proceeds box.

--Is $385k the total price? If so, just enter 1/3 of that for your share ($128,333) for the fair market value of the property when your mother passed away.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

If your mother has passed away you get a full step up in basis to the fair Market Value of the property on the date of your mothers passing. So your basis & sale price are both $385,000 and you do not have long term capital gains. So no taxes due.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

My situation is very similar to the one I am commenting on.

If you have a stepped up basis and sell very soon after death, I think you could actually have a loss which you could report up to $3000 in the year sold.

Stepped up basis $385K

Sold for $385K less some fees (ie $365,000)

So how again is this reported to the IRS using Turbo Tax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

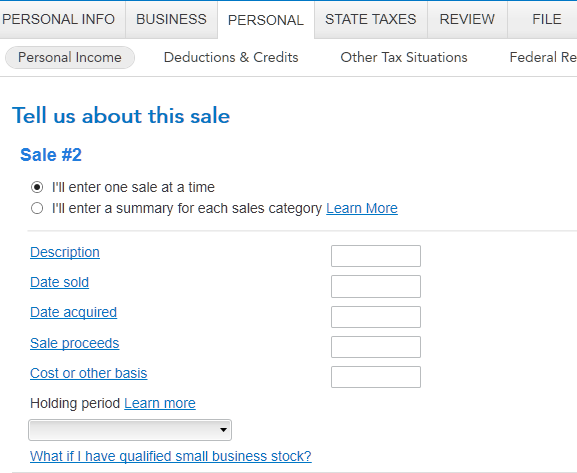

@juva: Here are the steps to report in TurboTax, as outlined by Irene S in an earlier post:

- Click on Federal Taxes > Wages & Income [In TT Self-Employed: Personal > Personal Income > I'll choose what I work on].

- In the Investment Income section click on the Start/Revisit box next to Stocks, Mutual Funds, Bonds, Other. [See Screenshot #1, below.]

- If you have already entered some investment sales, you will see a screen Here's the investment sales info we have so far. Click on the Add More Sales link. [Screenshot #2]

- If you haven't already entered some investment sales, you will see a screen Did you sell any investments in 2016? Click the Yes box.

- On the screen, Choose the type of investment you sold, mark the button for Everything Else and click Continue. [Screenshot #3]

- On the next screen, enter the sale information. Be sure to enter the net proceeds and mark whether income taxes were withheld or not. [Screenshot #4]

- Continue through the screens, entering the requested information.

If this information does not address all your questions, please respond to this answer string with additional information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

The screen that you are showing is what you would use to enter the data for a sale that was recorded on a 1099-S.The form has changed slightly since the prior tax year. If you sold a house, you would enter the information on the page that you are showing. This information would flow to Form 8949 and Schedule D.

**Mark the post that answers your question by clicking on "Mark as Best Answer"