- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

member percentages in a family owned LLC

How do I change member percentages in an LLC? Since the members are all family, are there any extra forms or tax consequences? We are updating our operating agreement.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

How? Are you using TurboTax Business?

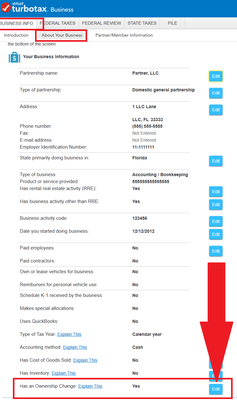

You first need to indicate that there was an ownership change in the About Your Business tab.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

In a partnership or S-Corp switch to the forms mode to make any changes you need to make.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

We do but I tried doing an test on our 2021 return but it does not ask me to change the %'s anywhere. I read all the other posts where they also did not get the question to change the %'s

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

I did that per other suggestions in this form but it does not carry through. I know other posted after you override the %'s, I would need to manually calculate changes for the K-1.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

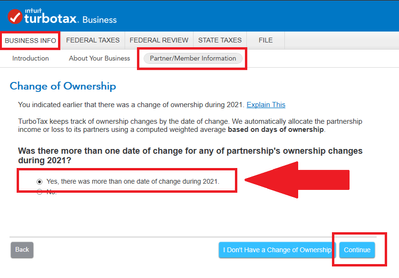

I did pick that and made the second date 1/2/21. It is having an flowing through. It is not very user friendly to change the %'s

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

even though only family members are involved changing member %'s may have tax consequences other than on just changing the amounts allocated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Correct; there are other considerations beyond how to enter the figures programmatically.

If this is a larger operation, professional guidance is recommended.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Thank you everyone. That is why I was using 2021 as a test so we could be prepared if there are tax consequences.

Since Turbo Tax does such a great job it would have us prepared if we need to pay in extra taxes.

Any help in getting 2021 test to work is appreciated.