- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal exemption allowances

I am a single working mom of 3 kids. Before the W4 changed I used to claim head of household with 2 allowances, however I have 3 kids. The last couple years I’ve claimed $6000 for for my 3 children and though less taxes are taken from my paychecks my refund was significantly smaller. I would like to have slightly more taxes taken from my paycheck and increase my refund. Not sure how to do this with the new W4 employee withholding certificate form. Any suggestions would be appreciated. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Hi, Nrthomas00:

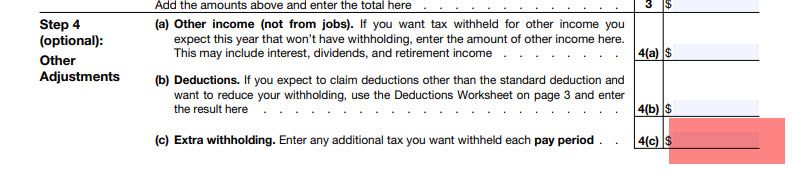

There are many paths up this mountain. For me, the simplest is to just add the additional amount you want withheld, per paycheck, to box 4c of your W-4 and turn it in to your payroll department. Here is a screenshot to show you what I mean.

Cheer this post by selecting the thumbs up!

**Mark the post that answers your question by clicking on "Mark as Best Answer"