- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Credit score

- :

- Improve your credit score

- :

- Why is My Credit Score Never the Same?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is My Credit Score Never the Same?

/ By Zina Kumok

Checking your credit score can be a bit overwhelming and even anxiety-inducing. Where do you get your score? Should you pay for it? Should you get it for free through your bank or credit card issuer? Why is your score different everywhere you look?

With all the questions you may have, I figured it might be best to just bring it back to the basics.

Differences Between Credit Scores

It’s a common complaint: you checked your credit score online and when you applied for a loan or new credit card, your score was different. What gives?

Well, there isn’t just one main scoring model. In fact, there are several and sites, such as Turbo, that provide a free score may use a different model than the particular bank, lender or credit card issuer that you contacted.

For example, when you check your credit score for free on an app like Turbo, you’re using the new Vantage 3.0 model from TransUnion. Vantage 3.0 is the latest scoring vehicle that allows millions of people to access their credit scores. For instance, Vantage doesn’t require users to have at least six month’s worth of credit history or an update on their credit history every six months.

The advantage of the Vantage 3.0 score is that it compiles more information from users, which means lenders have a better idea of what kind of borrower you might be. The better the predictive model is, the more likely it is that lenders will adapt it.

Another change is that Vantage 3.0 doesn’t report any collections that have been paid in full, a boon to those who are working on repairing their credit history. There’s also more detailed information and scoring related to delinquency and default.

Many people are aware of the FICO credit score which is popular with lenders. What they might not know is that scores for mortgages are factored differently than for credit cards. Because the lender is taking a bigger risk by approving you for a mortgage, they’ll scrutinize your account more carefully, sometimes resulting in a lower score.

The Fair Credit Reporting Act of 1970 stipulates what personal information can be gathered and used when determining your score. It also gives consumers certain rights as far as getting copies of their credit report and disputing inaccurate information.

How to Check Your Credit Score

You can check your credit score directly through an app like Turbo once a month for no extra fee. The score is compiled from the TransUnion credit bureau’s report. You’ll also see advice on how to increase your score, as well as any derogatory marks that might be dragging your score down.

If you want to check your credit report for more details, go to annualcreditreport.com. That’s the official site to pull your credit report from the three credit bureaus – TransUnion, Experian and Equifax. You can check your report for free once a year.

Consistently checking your credit report is important. According to the Consumer Financial Protection Bureau, mistakes are surprisingly common. The more often you check your credit score and report, the sooner you can see if there are any errors or negative marks. Worried checking your report will hurt your score? Read on Myth #1 in Farnoosh Torabi’s article on common misconceptions about credit.

How a Credit Score Is Compiled

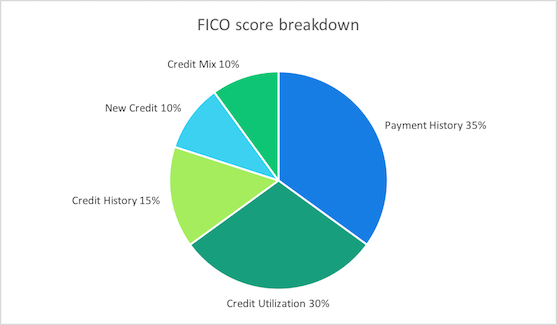

Your score is calculated from several different factors. The percentages vary by credit bureau, here’s a breakdown of the FICO score and Vantage 3.0:

The FICO credit score ranges from 300 to 850, with anything over 700 considered good or excellent. To qualify for a loan, you generally need a score of 600 or higher, although scores of 740 will get you the best interest rates.

The Vantage score works on the same range, but the bands are just a bit different. Read more about these bands here.

When to Check It

If you’re about to apply for a mortgage or other major loan, it’s helpful to check your credit score. You want to know if you have a good enough score to take advantage of the best interest rates or if you need to hold off on any major purchases. I like to check mine every month through Mint to make sure I’m right on track.

What’s Turbo and why are we talking about it?

Turbo is part of the Intuit family of products, just like us. We work with Turbo, TurboTax and Quickbooks to get all our customers on the right track financially. While Mint provides free credit scores to our customers, Turbo combines the same score, plus other information like verified IRS filed income and debt to income ratio to create a broader financial health profile. Try out our sister app to see where you truly stand financially – beyond the credit score.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is My Credit Score Never the Same?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is My Credit Score Never the Same?

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

OF77

New Member

Dawnbarajas

Level 1

Tamara603

New Member

ji1997

New Member

Dawn1315

New Member