- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- Re: Why am I being taxed on my scholarship money that is used only for tuition? I believe I shouldn't have to pay that and I owe a very large amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I being taxed on my scholarship money that is used only for tuition? I believe I shouldn't have to pay that and I owe a very large amount.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I being taxed on my scholarship money that is used only for tuition? I believe I shouldn't have to pay that and I owe a very large amount.

You are correct that scholarships can be taxable if they are used for the following items:

- Room & board

- Travel & incidental expenses

- Any fees, books & supplies not required for classes

Scholarships are not taxable if used at an eligible school for a degree if:

- Tuition & fees

- Fees, books, supplies needed for classes

- Scholarship or fellowship for services from:

- National Health Services Corps Scholarship Program

- Armed Forces Health Professions Scholarship & Financial Assistance program

Review your input.

If you received a 1098-T, ensure that the information is entered as follows:

- Go to the Federal section of the program.

- Select "Deductions & Credits"

- Select "Expenses and Scholarships (Form 1098-T)" and click start

- Select "Edit" to review your input.

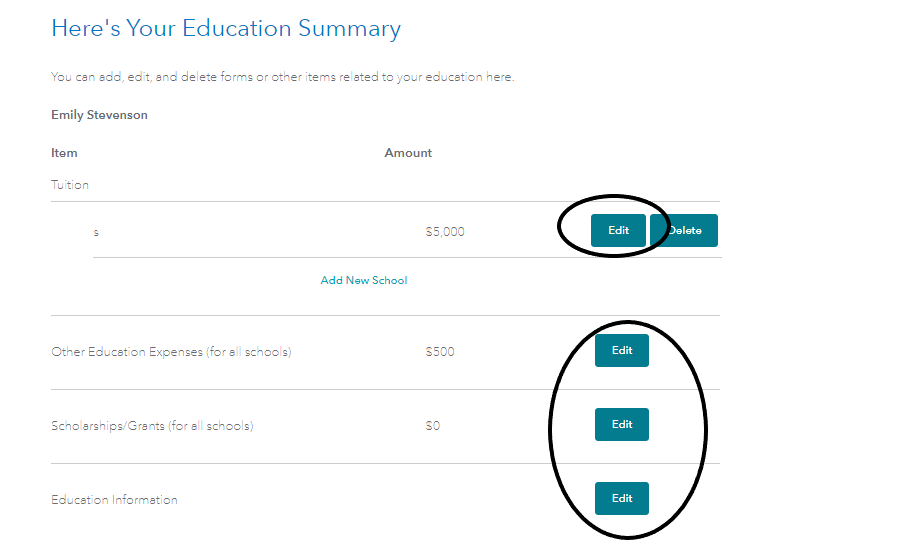

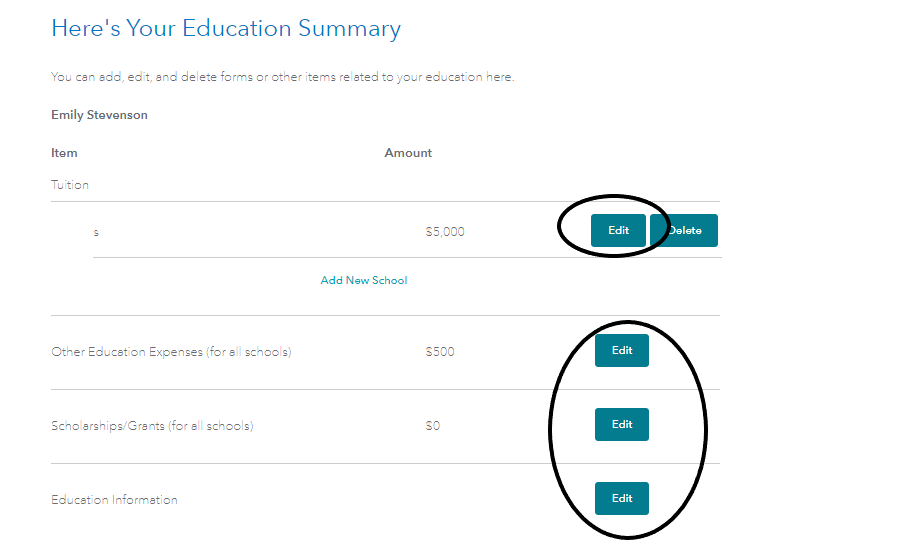

Once you review the above, you can also review each section on the following page to ensure you have entered all applicable expenses.

Be aware, it is possible your tuition was paid at the end of 2018 and picked up on your 2018 Form 1098-T. If this is the case, your scholarship income may very well be taxable as you have already taken the tuition deduction in the prior year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I being taxed on my scholarship money that is used only for tuition? I believe I shouldn't have to pay that and I owe a very large amount.

The questions I've reviewed don't seem to report my precise problem except one but he said he deleted everything and re-entered and it was ok.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I being taxed on my scholarship money that is used only for tuition? I believe I shouldn't have to pay that and I owe a very large amount.

You are correct that scholarships can be taxable if they are used for the following items:

- Room & board

- Travel & incidental expenses

- Any fees, books & supplies not required for classes

Scholarships are not taxable if used at an eligible school for a degree if:

- Tuition & fees

- Fees, books, supplies needed for classes

- Scholarship or fellowship for services from:

- National Health Services Corps Scholarship Program

- Armed Forces Health Professions Scholarship & Financial Assistance program

Review your input.

If you received a 1098-T, ensure that the information is entered as follows:

- Go to the Federal section of the program.

- Select "Deductions & Credits"

- Select "Expenses and Scholarships (Form 1098-T)" and click start

- Select "Edit" to review your input.

Once you review the above, you can also review each section on the following page to ensure you have entered all applicable expenses.

Be aware, it is possible your tuition was paid at the end of 2018 and picked up on your 2018 Form 1098-T. If this is the case, your scholarship income may very well be taxable as you have already taken the tuition deduction in the prior year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Luke338482

New Member

mrsystem

Level 1

KarenHL

Level 1

ndfontenot

New Member

sun8

New Member