- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- Re: Return rejected for form 8863

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Return rejected for form 8863

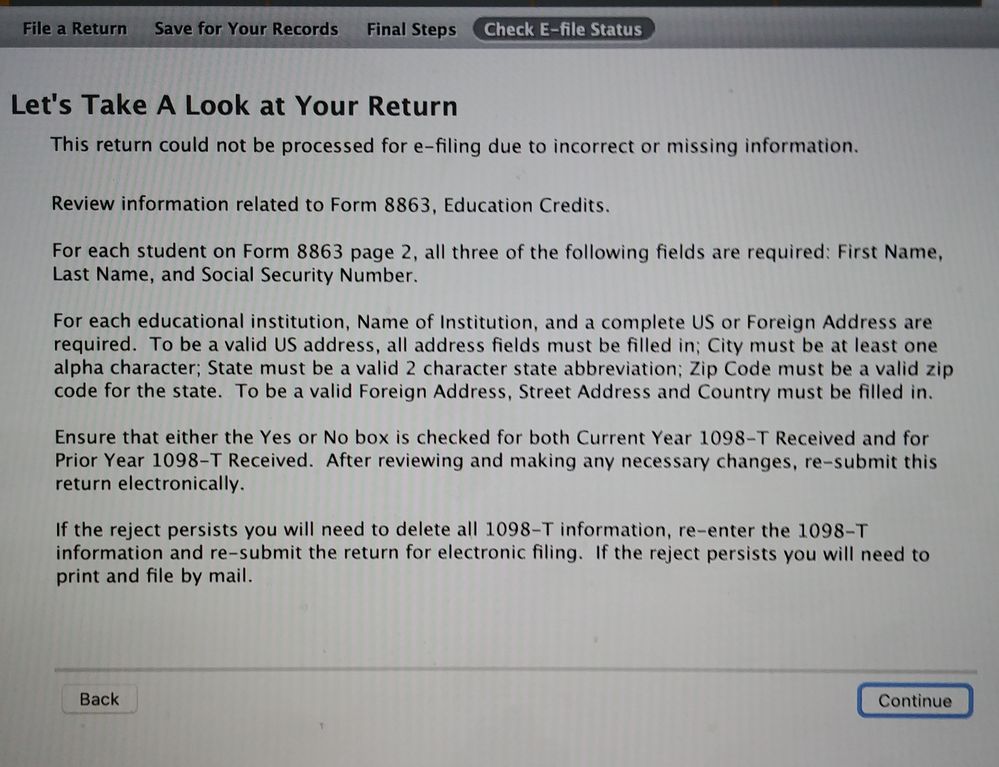

my taxes have been rejected saying I need to review information related to form 8863. I dont see where the requested info is missing. I have gone over each area they are asking for such as student name, ss#, school address and if both boxes are check for current year 1098-T and prior year. I see no reason why these are getting rejected. We as the parents are claiming our 19 year old as a dependent and claiming her school expenses. The other child is 17 and we are claiming her college expenses too.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Return rejected for form 8863

Try to delete the 1098-T information and enter it again.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Return rejected for form 8863

I have done that. I have deleted my kids and still it gets rejected. There is no 1098-t for the second school.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Return rejected for form 8863

If you have done all you can and still can't get the e-file process to work, you can just mail it. If you are not ready to do that yet, you can clear the entire return and start from scratch.

- If you haven't already done so, sign in at TurboTax.com

- On the welcome back screen, in the left-side menu, select Tax Tools, and then select Clear & Start Over (click or tap the 3 lines in the upper-left corner if you don't see this menu).

- Answer Yes in the pop-up to confirm.

- After your entries have been cleared out, we'll prompt you to select a TurboTax product so you can start over from the very beginning.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Return rejected for form 8863

I have been having the same issue, as many others have on the support board. Deleting and restarting doesn't work for someone who has put many hours into putting together their taxes. I've already done the recommended options of clearing cache and re-entering the 1098-T's (multiple times). And printing out to mail in seems like a poor workaround answer to something we've all paid for to e-file so NOT to print and mail.

With multiple occurrences on this board, how do we elevate this issue to address what is clearly either a

1) software bug issue or

2) requires more detail on reject data?

Please, please help us out on this. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Return rejected for form 8863

I did find that a street address was mis-spelled and a box wasn't checked on one of the forms. I fixed it and then re-submitted only to have it rejected again. After 6 rejections I deleted out the 1098-Ts and decided to try once again before mailing the taxes. I completely closed my turbo tax and restarted my computer (MAC). I checked for turbo tax updates once again and re-entered the 1098-Ts again and it was finally accepted. I don't believe it was necessarily an issue on my end. Also Turbo tax was no help in my trying to figure out the issue. Turbo tax just gave a few things to look at but didn't specify any real fix or issue after those areas were all checked.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Return rejected for form 8863

Thank you for posting Monica C! I was about ready to give up when I saw your post.

All I did was reboot the computer and restart TurboTax (windows), it suddenly had some updates to install that were new. I tried to read the release notes but it referred to a turbotax site that referred to general support site where the info is nonexistent. There was a state, federal and program updates marked critical. From there I went in to e-file again and viola! I got the federal acceptance!

Solved for me!

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

green2ski

Level 2

elfretz

Level 1

Dlozano2068

New Member

Klyons

New Member

narviaf

New Member