- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- Looks like TT tax the amount of gross distribution in 1099-Q, instead of earnings.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Looks like TT tax the amount of gross distribution in 1099-Q, instead of earnings.

Hi there,

Have any one had issues with TT on 529 Pan (1099-Q) distribution?

I think it should be simple and straight forward, but I am totally lost by TT's result.

Here is the story - my understanding is the "earnings" portion (Box 2) in 1099-Q is the real amount that will be deducted against education expenses (tuition, books and even room and boards, according to this article: https://www.savingforcollege.com/article/what-you-can-pay-for-with-a-529-plan), regardless the number in Box 1, "Gross distribution". However, that is not what I see on the version of TT I am using.

I just ran the following test:

If I enter gross distribution of 15k, earning is 5k, and basis is 10k, it shows my tax due is $1,702.

If I change the numbers: gross distribution is 10k, earning is 5k, basis is 5k, now it shows my tax due is $1208.

But the earning amounts are same in both cases! What happens?!?!?!

It looks to me this is a software bug.

Can anyone enlighten me on this?

I am using TT Home and Business edition.

Many thanks.

Vince

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Looks like TT tax the amount of gross distribution in 1099-Q, instead of earnings.

"my understanding is the "earnings" portion (Box 2) in 1099-Q is the real amount that will be deducted against education expenses"

No. It's the total distribution, shown in box 1.

The tax free amount is a ratio of expenses divided by distribution times the earnings

Example:

$10,000 in educational expenses(including room & board)

-$3000 paid by tax free scholarship

-$4000 used to claim the American Opportunity credit

=$3000 Can be used against the 1099-Q

Box 1 of the 1099-Q is $5000

Box 2 is $600

3000/5000=60% of the earnings are tax free

60%x600= $360

You have $240 of taxable income (600-360)

For more specific guidance, provide your educational expenses, separating room & board from tuition, fees & books.

For more about this subject, read on.

______________________________________________________________________

Qualified Tuition Plans (QTP 529 Plans)

It’s complicated.

For 529 plans, there is an “owner” (usually the parent), and a “beneficiary” (usually the student dependent). The "recipient" of the distribution can be either the owner or the beneficiary depending on who the money was sent to. When the money goes directly from the Qualified Tuition Plan (QTP) to the school, the student is the "recipient". The distribution will be reported on IRS form 1099-Q.

The 1099-Q gets reported on the recipient's return.** The recipient's name & SS# will be on the 1099-Q.

Even though the 1099-Q is going on the student's return, the 1098-T should go on the parent's return, so you can claim the education credit. You can do this because he is your dependent.

You can and should claim the tuition credit before claiming the 529 plan earnings exclusion. The educational expenses he claims for the 1099-Q should be reduced by the amount of educational expenses you claim for the credit.

But be aware, you can not double dip. You cannot count the same tuition money, for the tuition credit, that gets him an exclusion from the taxability of the earnings (interest) on the 529 plan. Since the credit is more generous; use as much of the tuition as is needed for the credit and the rest for the interest exclusion. Another special rule allows you to claim the tuition credit even though it was "his" money that paid the tuition.

In addition, there is another rule that says the 10% penalty is waived if he was unable to cover the 529 plan withdrawal with educational expenses either because he got scholarships or the expenses were used (by him or the parents) to claim the credits. He'll have to pay tax on the earnings, at his lower tax rate (subject to the “kiddie tax”), but not the penalty.

Total qualified expenses (including room & board) less amounts paid by scholarship less amounts used to claim the Tuition credit equals the amount you can use to claim the earnings exclusion on the 1099-Q.

Example:

$10,000 in educational expenses(including room & board)

-$3000 paid by tax free scholarship***

-$4000 used to claim the American Opportunity credit

=$3000 Can be used against the 1099-Q (usually on the student’s return)

Box 1 of the 1099-Q is $5000

Box 2 is $600

3000/5000=60% of the earnings are tax free

60%x600= $360

You have $240 of taxable income (600-360)

**Alternatively; you can just not report the 1099-Q, at all, if your student-beneficiary has sufficient educational expenses, including room & board (even if he lives at home) to cover the distribution. You would still have to do the math to see if there were enough expenses left over for you to claim the tuition credit. Again, you cannot double dip! When the box 1 amount on form 1099-Q is fully covered by expenses, TurboTax will enter nothing about the 1099-Q on the actual tax forms. But, it will prepare a 1099-Q worksheet for your records, in case of an IRS inquiry.

***Another alternative is have the student report some of his scholarship as taxable income, to free up some expenses for the 1099-Q and/or tuition credit.

On form 1099-Q, instructions to the recipient reads: "Nontaxable distributions from CESAs and QTPs are not required to be reported on your income tax return. You must determine the taxability of any distribution."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Looks like TT tax the amount of gross distribution in 1099-Q, instead of earnings.

as @Hal_Al points out the test is against Box 1.

the relationship of your expenses to box 1 determines the portion of Box 2 that is taxable,

If your qualified expenses are $5,000 and Box 1 is $10,000, then 50% of Box 2 is not taxable.

If your qualified expenses are $5,000 and Box 1 is $7,500, then 67% of Box 2 is not taxable.

If your qualified expenses are $5,000 and Box 1 is $5,000, then 100% of Box 2 is not taxable.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Looks like TT tax the amount of gross distribution in 1099-Q, instead of earnings.

Thank you very much, @Hal_Al .

Now I know the law much better.

However, though what you said make sense, it still does not match what I am encountering. Here is my real situation:

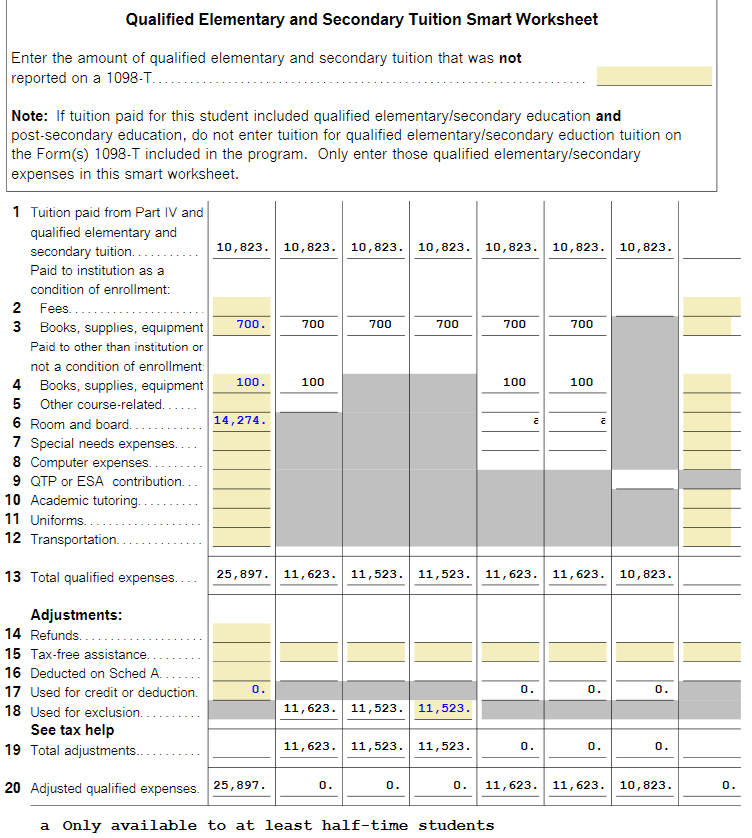

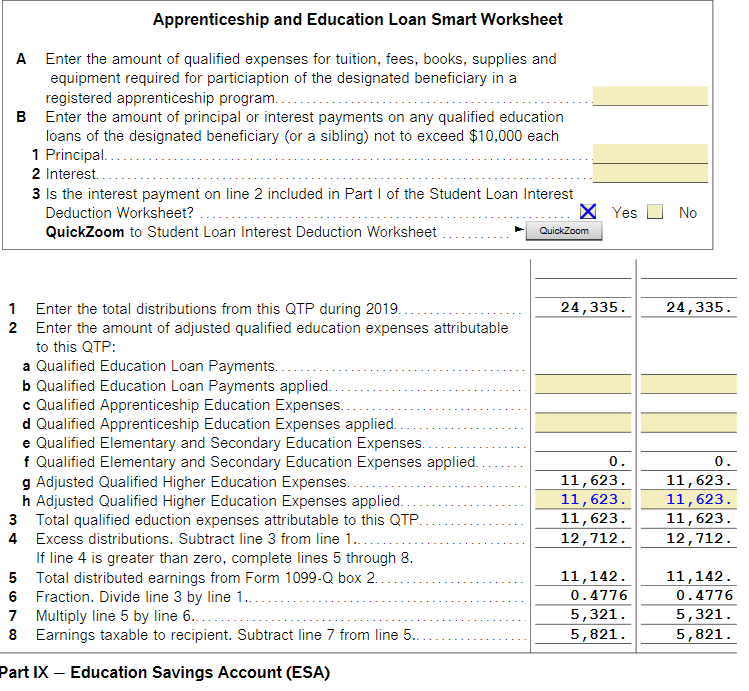

- My 1099-Q data are:

- Gross distribution (box 1): $24,334

- Earnings: $11,142

- My son's college expense info are: (data are from the school bills I paid in last year):

- Tuition: $10,823

- Book: $700

- Room and board: $14,274

- My son received no scholarship, and no any tax-break credits in last year.

- Total expense is $25,697, which is high than the gross distribution, let alone the earnings.

- Based on the example you gave, the entire $25,697 can be used against the 1099-Q.

- And 100% of the 1099-Q earnings are tax free.

- Before I entered 1099-Q data, TT shows my tax due is $568

- After I entered 1099-Q data, my tax due becomes $2,547!

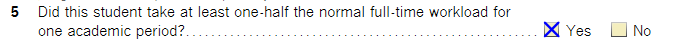

So obviously, I am taxed on the 1099-Q gross distribution. The only explanation I can come up with is TT does not consider the "room and board" expense be tax reduction-able. Since my son attended college, based on what I read, room and board expense should be counted as qualified education expense.

Do you have any insight on this?

Besides, the 2nd last paragraph in your reply catch my eyes:

**Alternatively; you can just not report the 1099-Q, at all, if your student-beneficiary has sufficient educational expenses, including room & board (even if he lives at home) to cover the distribution. You would still have to do the math to see if there were enough expenses left over for you to claim the tuition credit. Again, you cannot double dip! When the box 1 amount on form 1099-Q is fully covered by expenses, TurboTax will enter nothing about the 1099-Q on the actual tax forms. But, it will prepare a 1099-Q worksheet for your records, in case of an IRS inquiry.

Should I just totally forgot 1099-Q and 1098-T, since I am sure I have enough expenses to cover the distribution? I just don't want to get audit because I miss an item in my filing. I don't think I can get any tuition benefit due to my household AGI.

Thanks for you attention and time!

Vince

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Looks like TT tax the amount of gross distribution in 1099-Q, instead of earnings.

Q. Should I just totally forgot 1099-Q and 1098-T, since I am sure I have enough expenses to cover the distribution?

A. Yes. Your audit risk does not go up. Either way, no entries go on your actual tax forms.

If your Modified Adjusted gross income is more than $90K (180K married joint), you are correct, you are not eligible for a tuition credit or deduction. So, you can omit the 1098-T also.

"The only explanation I can come up with is TT does not consider the room and board". The more likely error (we've seen it before), TT is assigning some expenses to the tuition credit (as much as $10K) even though you are not eligible.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Looks like TT tax the amount of gross distribution in 1099-Q, instead of earnings.

Thanks for your response, @Hal_Al.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Looks like TT tax the amount of gross distribution in 1099-Q, instead of earnings.

I found the worksheets for student in TT, and I could see the Room and board expense was NOT used in the calculation. Now I wonder why? and is there any trick to fix it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Looks like TT tax the amount of gross distribution in 1099-Q, instead of earnings.

Aha, I found the reason.

Somehow in the student info, the checkbox for "is at least half-time student" checkbox was not checked. Very interesting. My son received two 1098-T, one is for his regular school, the other is for an interest club. The latter one is neither a full-time nor half-time student. After I read somewhere in the forum saying having non fall-time/half-time 1098-T expense may screw the Room and board expense consideration, so I have deleted the entry. In other words, now there is only one 1098-T entry in the system, which is the one for a full-time student. However, it appears TT did not update the status of the student and the student is still considered as taking a non-qualified program.

After I manually checked the checkbox, the tax due number became what I expect to see! 🙂

Sigh. Intuit should fix this bug!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Looks like TT tax the amount of gross distribution in 1099-Q, instead of earnings.

I have a different problem with the 1099Q. My ten years were up, so the Texas Tomorrow Fund closed out my granddaughter's account. On the 1099Q it shows gross dist. of $29,109 and earnings of $15,763. In another box is my basis $13,345. The basis is what I paid in to the account with after tax dollars. I believe I should only be paying taxes on the earnings, not the gross dist. as that makes me pay taxes twice on $13,345. Any enlightenment, please. Turbo Tax is making me pay for the gross dist.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Looks like TT tax the amount of gross distribution in 1099-Q, instead of earnings.

I agree that the Box 2 number is the only thing that is taxable..

why do you think that TT is taxing you on the BOX 1 entry?

look on Schedule 1, line 8 - you should see the $15763 (Box 2) entry there, \

where on Form 1040 do you see $29109?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Looks like TT tax the amount of gross distribution in 1099-Q, instead of earnings.

I'm having the same issue. Took out a $20000 non qualified distribution. TT appears to treat the entire amount as taxable income. Only the earnings portion should be taxable

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Looks like TT tax the amount of gross distribution in 1099-Q, instead of earnings.

The earnings portion + a 10% (of the earnings) penalty. That may be what you're seeing

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Looks like TT tax the amount of gross distribution in 1099-Q, instead of earnings.

TT added $20000 gross to income and dropped my expected refund from $4040 to owing $250+ . The earnings were $10267. So even if I was in a 25% bracket, seems like the tax would go up by about $3500 ( 25% of $10276 plus 10% of $10267)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Looks like TT tax the amount of gross distribution in 1099-Q, instead of earnings.

You can't go by "eye ball" estimates. TT should put $10267 on line 8 of schedule 1 and $1027 on line 6 of Schedule 2. That's all you need to verify.

Another thing to be aware of: when your total income increases, you eligibility of other tax benefits changes. Two common examples:

1. More of you social security becomes taxable

2. You get less Earned Income Credit and/or less Additional Child Tax Credit

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

sanderfoottara

New Member

koonsup

New Member

sopa643479

New Member

jjyoo92

New Member

hwy407

New Member