- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Real Estate Sale entry on form 1065

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Real Estate Sale entry on form 1065

Where do I enter the sale of a piece of real estate owned by the family LLC?

The LLC got $200K which was evenly distributed between each of the 7 members of the LLC.

It doesn't seem to work out on the 'Ordinary Business Income' line of 1065. If I enter the distributions as well as the income, It seems to screws up the K-1 calculations.

And it doesn't really work in Rental Income.

Do I need an additional form?

Any advice?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Real Estate Sale entry on form 1065

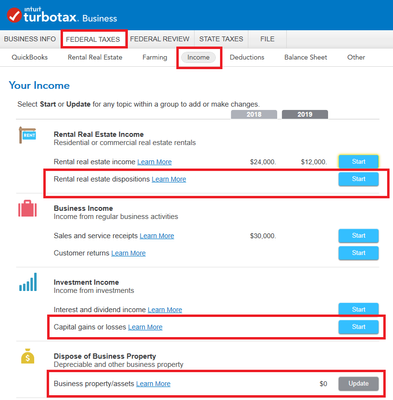

You can enter the sale of the piece of real estate as the sale of a business asset. To do this in your 1065 return, please follow these steps:

- Click the Federal Taxes tab and then Income.

- On the screen, Your Total Business Income, in the Dispose of Business Property section, click the Start/Update box next to Business Property/Asset Disposal.

- Continue through the screens, entering the requested information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Real Estate Sale entry on form 1065

If the real estate owned by the LLC was held for rental use, enter the transaction under Rental real estate dispositions.

If the real estate owned by the LLC was being used in the actual business of the LLC, enter the transaction in the Dispose of Business Property section.

If the real estate owned by the LLC was held for investment purposes (which sounds likely), enter the transaction under Investment Income (Capital gains or losses).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Real Estate Sale entry on form 1065

Thanks for guidance. But how do you enter in improvements made to the house to increase the cost basis? Looks like Turbo Tax is already recapturing the depreciation over the years which is good. The house bought in 2008, improvements made and turned into a full rental property in 2015. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Real Estate Sale entry on form 1065

You have to enter each improvement as a separate asset in TurboTax.

The foregoing assumes you cannot take advantage of the $2,500 de minimis safe harbor.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

StaceyVA

New Member

nrp13

Level 1

nrp13

Level 1

jsonp

Returning Member

yayaroon

Level 1