- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: Using TT Premier, it's generating Form 1120S during Federal Error Checking ...? Why, I'm an individual. Who is the S Corp?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Using TT Premier, it's generating Form 1120S during Federal Error Checking ...? Why, I'm an individual. Who is the S Corp?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Using TT Premier, it's generating Form 1120S during Federal Error Checking ...? Why, I'm an individual. Who is the S Corp?

Ok, since no one was answering and after several days Intuit has not returned a requested call, I input one of the K-1 partnerships into the Form 1120S Name and used their Tax ID. Then after error check showed no issues, I again went to the forms and deleted the newly created Form 1120S. Error check ran again error free this time. Whew, now I can file.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Using TT Premier, it's generating Form 1120S during Federal Error Checking ...? Why, I'm an individual. Who is the S Corp?

My screen shows that you are using the online version of TurboTax but doesn't tell me what flavor (deluxe? Premier? self-employeed?)

It's physically impossible for any online version of TurboTax to generate an 1120-S. At best, it's asking you to enter or do something with an 1120-S K-1 maybe. So can you be more specific?

The only possible way to generate an 1120-S with a TurboTax product, is if you are using Turbotax Business (different from Home & Business). TurboTax Business is only available as a CD/download product that you physically install on your windows computer. (it's not available as an online product, or for MACs.)

TurboTax Business can only be used to complete and file a tax return for a non-breathing, non-living separately taxable entity, such as a Partnership, Multi-Member LLC, C-Corp, -S-Corp, Estate, or Trust. Turbotax Business can not be used to file a 1040 of any type, because that program does not include the IRS Form 1040 of any type.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Using TT Premier, it's generating Form 1120S during Federal Error Checking ...? Why, I'm an individual. Who is the S Corp?

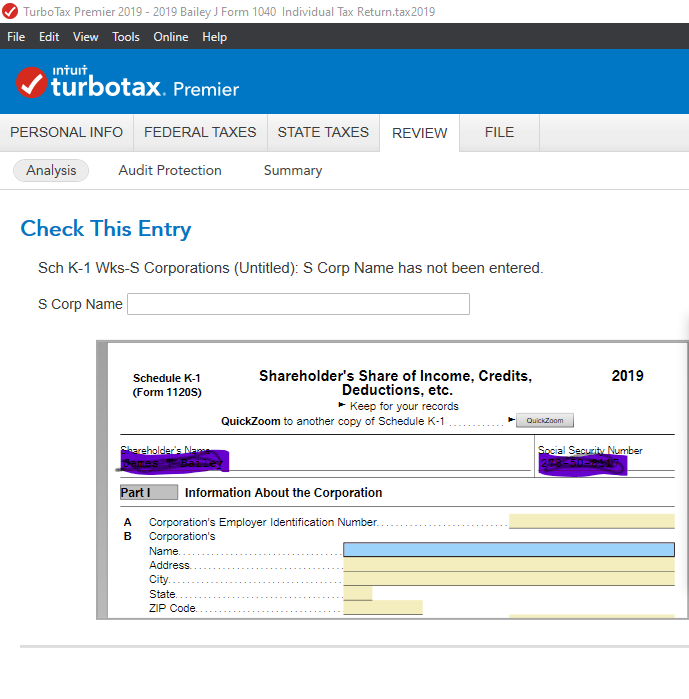

I'm using a desktop version of TurboTax Premier, filing 1040 as individual. After running the federal error checking, it's bringing up a Form 1120S asking me for the Corporation's name and Tax ID. Perhaps you see why I'm confused. I'm not a corporation, nor am I pretending to be.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Using TT Premier, it's generating Form 1120S during Federal Error Checking ...? Why, I'm an individual. Who is the S Corp?

Notice in the upper left hand corner I have TT Premier 2019 and you see the below Form 1120S it's trying to create with me as the shareholder. It's requesting the name of the corporation and it's Tax ID. Can someone explain why and how do I get rid of it. It's not listed in my forms so I can't just delete it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Using TT Premier, it's generating Form 1120S during Federal Error Checking ...? Why, I'm an individual. Who is the S Corp?

Ok, since no one was answering and after several days Intuit has not returned a requested call, I input one of the K-1 partnerships into the Form 1120S Name and used their Tax ID. Then after error check showed no issues, I again went to the forms and deleted the newly created Form 1120S. Error check ran again error free this time. Whew, now I can file.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

semperfi_vaughn

New Member

mj306

New Member

tmf5

New Member

fardwarker

New Member

Gail70

Level 1