- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: Tenatative Business Income

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tenatative Business Income

On Form 1120S, Depreciation Options, Line 3A for Section 179 depreciation lists 'Tentative Business Income' and posts a number that is considerably higher than my actual net imcome and this causes TurboTax to calculate my 179 depreciation incorrectly, causing my TurboTax net income to be a loss. Section 179 depreciation requires a rollover for any amount that puts you in a loss. Any ideas? Thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tenatative Business Income

@mattoxpools wrote:

TurboTax is asking me this question but it is not showing up on Form 4562 or on the 1120S pages 1

It is not showing up on page 3 (Schedule K) or Form 4562??

I recently did a test return with the approximate figures and the deduction appears on Schedules K, K-1, and Form 4562 (the latter with the carryover to 2020).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tenatative Business Income

@mattoxpools wrote:

Section 179 depreciation requires a rollover for any amount that puts you in a loss. Any ideas? Thanks!

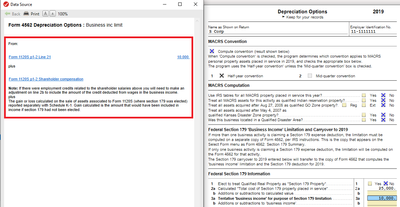

I am not certain what is happening behind the scenes in the program, but the data source for the line you mentioned in your post is your ordinary business income or loss plus shareholder compensation (see screenshot).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tenatative Business Income

Figure taxable income for this purpose by totaling the net income and losses from all trades and businesses you actively conducted during the year. Net income or loss from a trade or business includes the following items.

• Section 1231 gains (or losses).

• Interest from working capital of your trade or business.

• Wages, salaries, tips, or other pay earned as an employee.

For information about section 1231 gains and losses, see chapter 3 in Pub. 544.

In addition, taxable income is figured without regard to any of the following.

• The section 179 deduction.

• The self-employment tax deduction.

• Any net operating loss carryback or carryforward.

• Any unreimbursed employee business expenses.

In addition to the business income limit for your section 179 deduction, you may have a taxable income limit for some other deduction. You may have to figure the limit for this other deduction taking into account the section 179 deduction. If so, complete the following steps.

For further information on your Section 179 deductions see IRS Publication 946.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tenatative Business Income

line 10 adds back compensation to shareholders-employees.

here are the instructions from IRS form 4562 line 10

S corporations. Enter the smaller of

line 5 or the corporation's total items of

income and expense described in

section 1366(a) from any trade or

business the corporation actively

conducted (other than credits,

tax-exempt income, the section 179

expense deduction, and the deduction

for compensation paid to the

corporation's shareholder-employees).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tenatative Business Income

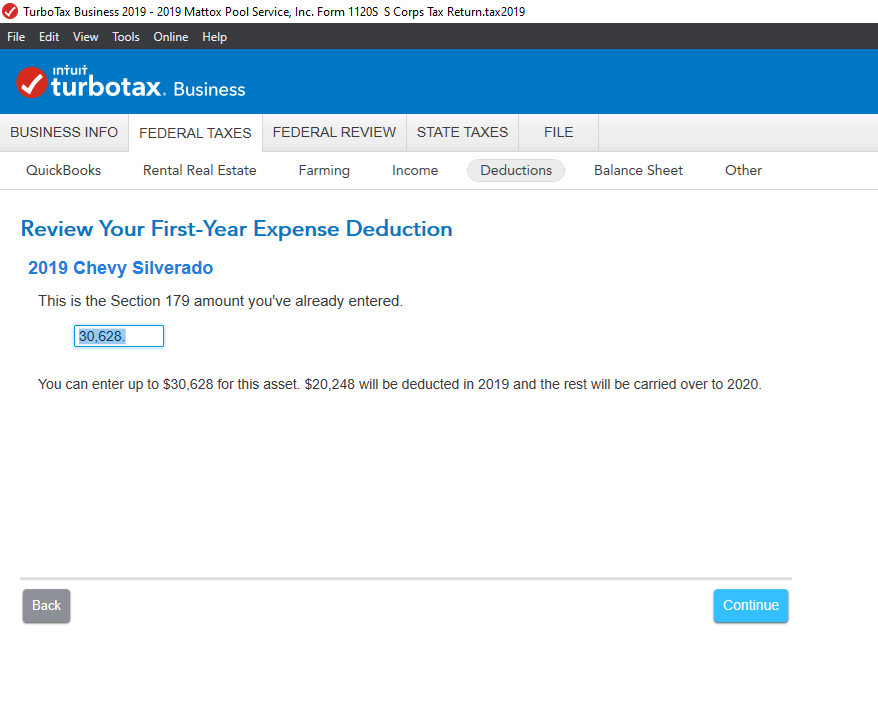

Thank you for your responses yesterday. They were very helpful. I now understand where TurboTax is calculating the 'Tentative Business Income' on Line 3A of the 1120S Depreciations Options form. However, I still have one question about whether a Section 179 depreciation expense can exceed the company's net income. See the attached screen shot where it appears that I should be able to depreciate only $20,248 (my net income) instead of the total cost of the asset $30,628. TurboTax is asking me this question but it is not showing up on Form 4562 or on the 1120S pages 1

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tenatative Business Income

@mattoxpools wrote:

TurboTax is asking me this question but it is not showing up on Form 4562 or on the 1120S pages 1

It is not showing up on page 3 (Schedule K) or Form 4562??

I recently did a test return with the approximate figures and the deduction appears on Schedules K, K-1, and Form 4562 (the latter with the carryover to 2020).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tenatative Business Income

Page 3 Schedule K Line 1 shows $20248. Schedule K Line 11 shows $30628. Schedule K Line 18 shows -$10380.

Form 4562 Line 8 and 9 show $30628. Line 11 shows $124248 (Compensation of Officers is $104000). Line 12 shows $30628 and Line 13 shows $0.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

anon30

Level 3

kare2k13

Level 3

BSSE1

Level 1

wufibugs

New Member

taxpreparer101k1

New Member