- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: Small business grants

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Small business grants

I received 3 grants totaling around $10,000 for our business to pay for the ongoing expenses during covid(March-December). A report with receipts were required and so was a w9. Where is this to be entered into turbo tax?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Small business grants

I am interested in knowing this information too, I got one as well and have no clue where to enter the information on the grant

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Small business grants

You may be talking about the Paycheck Protection Program but there were other programs available in different localities.

Under the Paycheck Protection Program, if you meet the qualifications of the program, some or all of the proceeds "you receive from the loan forgiveness is not part of your gross income and therefore isn’t taxable."

If you are talking about programs other than the Paycheck Protection Program, you would have to investigate the specifics of each program.

However, this is a fast-changing area of tax law. Be sure to check here for the most up to date tax information and changes.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Small business grants

My wife received 3 business grants for corvid relief for her business. Do we list this money as income, and, is it considered taxable income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Small business grants

The Grant my business received was not from the PPP program. It was a grant to assist my business due to Covid. I have an S-corp. I can't figure out where I list this 1099-misc on Turbo Tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Small business grants

If you received PPP loan, you can apply for Loan Forgiveness. To qualify for the 1st and 2nd draw of loan forgiveness, at least 60% of the PPP loans were spent towards payroll costs.

Generally, forgiven loan is ordinary income, but Congress exempt forgiven PPP from federal taxation. If your loans were forgiven, then no income to report. You may refer to your state revenue how are they treating forgiven loans; if forgiven loans are taxable income or if expenses not allowed using PPP loans.

SBA offers Paycheck Protection Program loans to businesses with 20 or less employees and sole proprietors only from Wednesday, February 24 through Wednesday, March 10, 2021.

See, sba.gov,, link for more information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Small business grants

What about a grant my s corp received to help with covid related issues? I received a 1099misc and don't know how or where to file this on turbotax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Small business grants

If you received 1099-MISC for the income, it means the amount was reported to the IRS as your income and you have to include it in your Form 1120S. You can report is as Other income / Government grant.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Small business grants

thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Small business grants

I recieved a small business loan and grants to small business due to the pandemic where or how do I include this information

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Small business grants

The loans and grants are not taxable income on your business returns. Use the funds for business operations and report the expenses as you normally do. You can deduct any interest you have paid on those loans as well. But you do not need to report the income as it is not taxable. @drroyann

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Small business grants

That is incorrect. Some grants ARE taxable to the business. It would be quite helpful if someone would answer the OP's question ( not a PPP or EIDL Grant)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Small business grants

Not talking about PPP or EIDL Grant. Most local grants are taxable to the business. Any guidance on reporting on a 1120-s AND related K-1??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Small business grants

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Small business grants

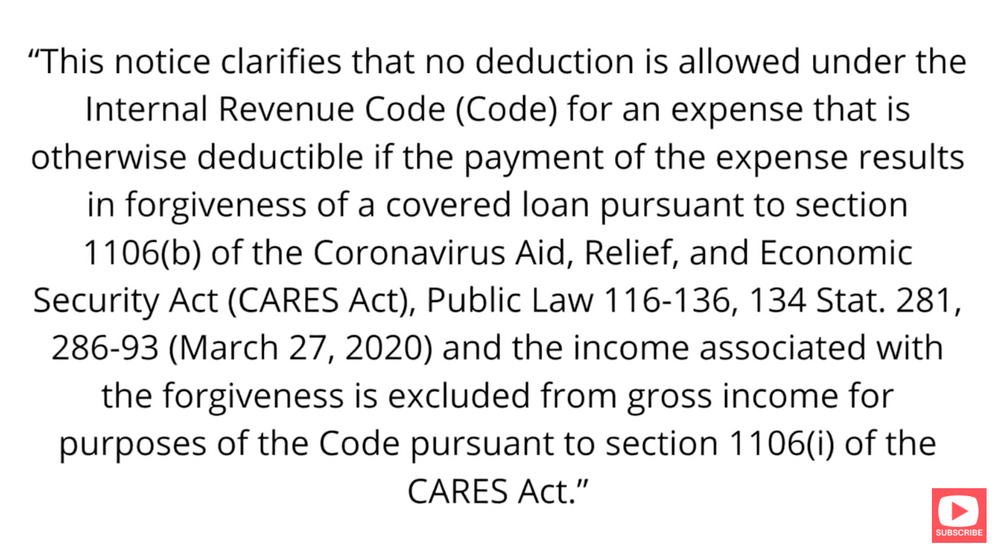

You are posting old law. The law was changed. PPP forgiven loans and EIDL Grants are 100% non-taxable. You can deduct the expenses for which funds were used.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Larrypeggy16

New Member

kare2k13

Level 4

BSSE1

Level 1

sullydopeferd

New Member

KBWright5

New Member