- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: Schedule K-1 Profit Percentage

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 Profit Percentage

I have an LLC with 2 partners. It's a computer repair business where we get the share of the profit that we worked for. So if I earned $100 and the partner earned $50, our profit share on the K1 has been relavtive to that, not to the ownership percentage.

This year, the other partner has decided to take off and didn't do any work. I would like the K-1 to show 0% profit percentage, and he not now any taxes on his personal taxes, because he didn't make any money.

In TurboTax I've entered that, but have an error check with the following message: Schedule K-1 Worksheet: Initial/Final Profit %: Profit percentage before/after zero should be populated with the percentage that existed immediately before the partner's termination.

What do I do? He is not being removed as a partner right now in the company.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 Profit Percentage

@ideal_trucks It does make sense, but you simply do not understand how to enter it.

To start, you indicate the partnership makes special allocations (as I believe you did). Subsequently, you need to enter Forms Mode and enter an "A" code on page 4 on Schedule K of Form 1065. Thereafter, you need to open the Schedule K-1 Worksheet and enter your allocation as 100% (by ratio) and the amount of income (which would also be 100% according to your original post).

This is neither a typical Form 1065 scenario nor is it a simple return to prepare. If you cannot follow the demo, or the instructions above, contact Support (link below) and perhaps they can walk you through the procedure step by step.

https://ttlc.intuit.com/community/using-turbotax/help/what-is-the-turbotax-phone-number/00/25632

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 Profit Percentage

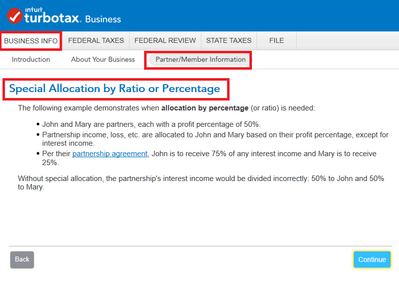

In the Business Info tab, you need to click About Your Business, and then scroll down and click the Edit button to the right of Makes special allocations. Change the default "No" to "Yes". Later, you should come across a screen that instructs you how to enter special allocations (go through the demo).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 Profit Percentage

I went through the special allocations demo, and It didn't seem like it made sense to my situation. We have to income, other than services rendered. I simply did all the work this year, and will recieve 100% of profit, and he receives 0%.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 Profit Percentage

@ideal_trucks It does make sense, but you simply do not understand how to enter it.

To start, you indicate the partnership makes special allocations (as I believe you did). Subsequently, you need to enter Forms Mode and enter an "A" code on page 4 on Schedule K of Form 1065. Thereafter, you need to open the Schedule K-1 Worksheet and enter your allocation as 100% (by ratio) and the amount of income (which would also be 100% according to your original post).

This is neither a typical Form 1065 scenario nor is it a simple return to prepare. If you cannot follow the demo, or the instructions above, contact Support (link below) and perhaps they can walk you through the procedure step by step.

https://ttlc.intuit.com/community/using-turbotax/help/what-is-the-turbotax-phone-number/00/25632

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 Profit Percentage

Schedule K-1 Worksheet: Initial/Final Profit %

The answers given to this question do not answer the question.

My business partner did not receive income this year. She still owns 50% of the business.

I checked "special allocations"

For me - Started the year owning 50% of the business, 50% profit, 50% - end of year:100% profits, 50% losses - at the end of the year I still own 50% of the business.

My business partner started the year owning 50% of the business, 50% profit, 50% - end of year:0% profits, 50% losses - at the end of the year I still own 50% of the business.

I still get a message asking about

Profit percentage before/after zero should be populated with the percentage that existed immediately before the partner's termination.

If I go into Forms Mode I cannot find a page 4 to enter an "A" code on Schedule K of Form 1065

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 Profit Percentage

@bethgjohnson wrote:The answers given to this question do not answer the question.

Same advice @bethgjohnson: You should go through the demo (see screenshot below). If you do not understand how to complete the 1065 for your particular scenario, you should seek guidance from a tax professional.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 Profit Percentage

How do we enter the same percentages on 2021 tax returns for multi member llc

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 Profit Percentage

Using TurboTax Business, when you walk through the member/partner info section it will ask you the profit and loss percentage of each person. You will need to enter it for each person, one at a time, when you fill out the rest of their information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

joycesyi

Level 2

Chilbig02

New Member

gb1

Level 3

shiwenyuan0406

New Member

rf78801

Level 2