- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: Schedule K-1 for Liquidated Partnership - Capital Gains and Cost Basis

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 for Liquidated Partnership - Capital Gains and Cost Basis

I'm helping an elderly parent get caught up with taxes. The questions below apply to 2018 taxes. We reside in the State of Arizona.

The question involves a limited partnership where my mother owns 66%. The partnership purchased land in 1998 that was used for farming purposes, and all partners sold the land in 2018 and ended the partnership. See below for a summary. The numbers may not add up exactly due to rounding to the nearest dollar.

1998:

Land purchased for $85,000

Cost basis for my mother = $85,000 x 0.66 = $56,100

2018:

Land sold for $193,115 x 0.66 = $127,456

Selling Expenses = $13,578 x .66 = $8,961

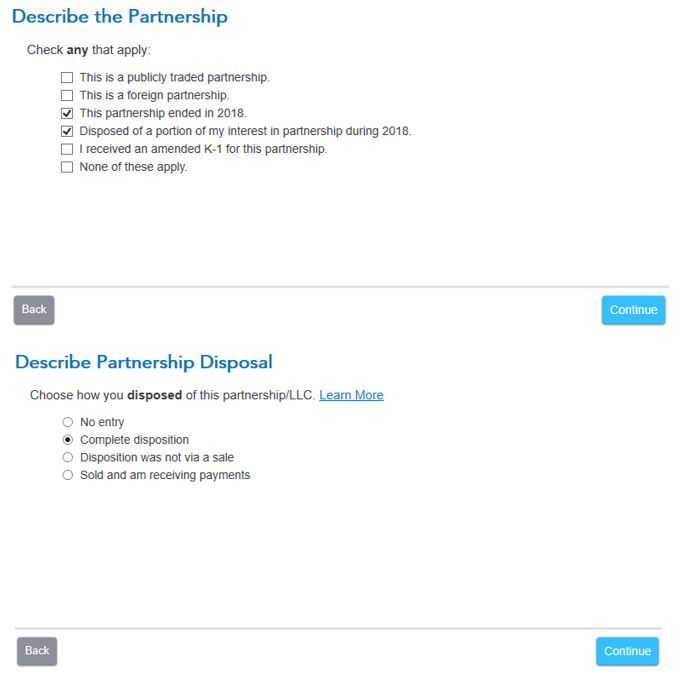

The sale and "Partnership Basis" was entered using the numbers above. I've checked the following boxes in TurboTax related to the K-1:

- This partnership ended in 2018

- Disposed of a portion of my interest in partnership in 2018

- Complete disposition

- Liquidated partnership interest

The Schedule K-1 shows a "Net long term capital gain" of $112,555 in Box 9a. The only capital gain I'm aware of is related to the sale of the property as mentioned above.

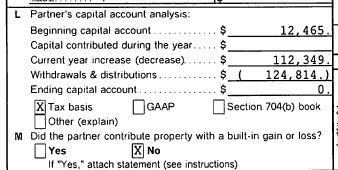

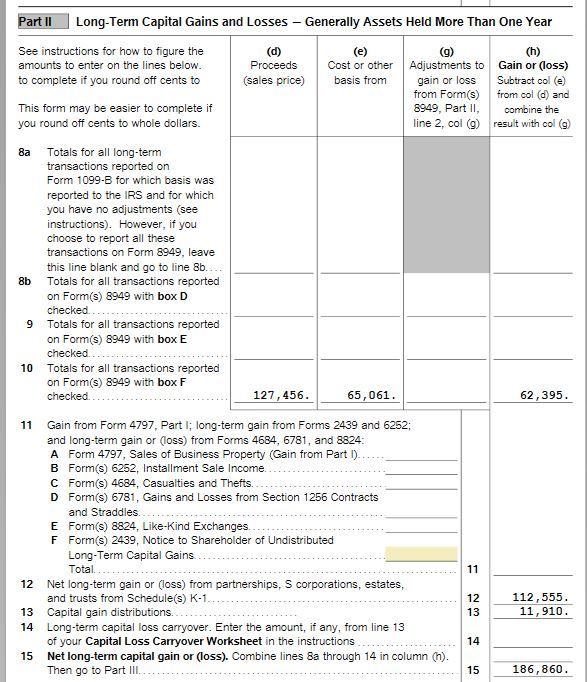

Box L shows the following:

Beginning capital account = $12,465

Capital contributed = $0

Current year increase = $112,349

Withdrawals = ($124,814)

Ending capital account = $0

Box 19a (Distributions) shows $124,814

The other boxes don't show anything beyond +/- $1000.

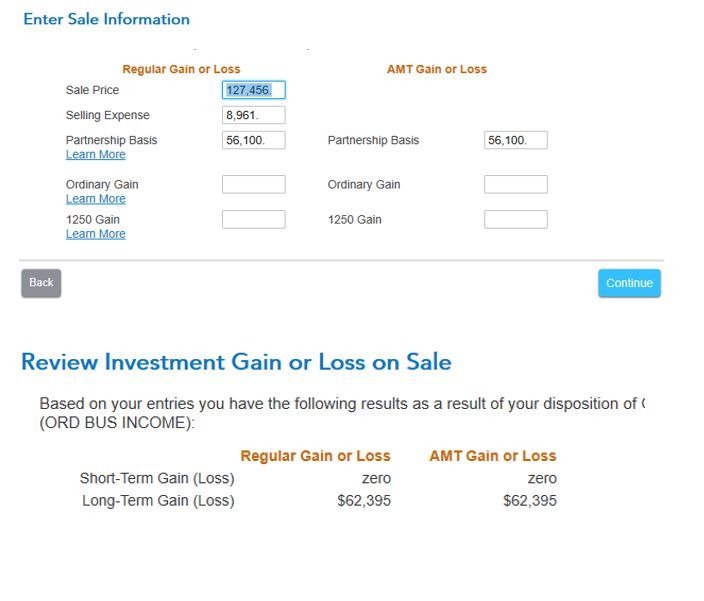

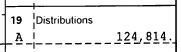

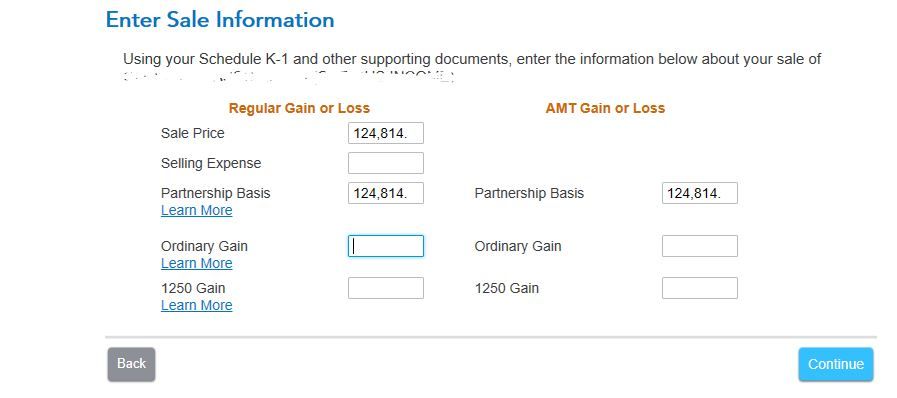

Numbers shown in TurboTax in Schedule D:

Proceeds = $127,456

Cost Basis = $56,100 + $8,961 = $65,061

Gain or Loss = $127,456 - $65,601 = $62,395

Net long-term capital gain (Line 15:)

$62,395 (see above)

$112,555 (from Schedule K-1, Box 9a)

$11,910 (from non-related investments)

----------------------------------------------------------

$186,860 Total Net Long-Term Cap. Gain (Line 15)

Question: Isn't Turbotax counting capital gains twice by adding the $62,395 and $112,555?

The odd thing is, if I delete everything related to the sale, reducing Line 15 to $124,465, the federal tax owed increases, even though the amount on Line 15 decreases.

I've reached out to the person who prepared the Schedule K, but haven't heard back.

Any advice or input regarding this would be appreciated.

Thanks.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 for Liquidated Partnership - Capital Gains and Cost Basis

This looks correct based on your facts.

The $112,555 gain is properly reported as this is your Mom's share of the partnership gain on the sale.

The $11,910 is from other investment activity noted by you.

The ordinary gain issue is related to whether some of the gain needed to be recharacterized as ordinary income. Since this was land, there does not appear to be any Section 751 property that would require recharacterization. So zero appears accurate based on your facts.

Also keep in mind the date of replies, as tax law changes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 for Liquidated Partnership - Capital Gains and Cost Basis

That LP passed through the gain from the sale on the K-1 there will be additional gain when you enter a sale price and basis for the disposition of the partnership interest.

@Rick19744 knows a lot about LP and partnership tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 for Liquidated Partnership - Capital Gains and Cost Basis

You have quite a bit of work to do and I will summarize what you have and how this works:

- First and most important, is that you need to determine your mother's tax basis in the partnership. This began with whatever the initial capital contribution was in 1998 and is adjusted EVERY year for the applicable items on the K-1 that is issued.

- Since you are completing a 2018 return, Schedule L is most likely irrelevant information for purposes of completing your tax return. This information could have been presented in a number of ways, and regardless, you need to determine your tax basis separately as noted in item 1 above.

- There will be two gain or loss transactions that you are dealing with; one is at the partnership level and those items are reflected on the K-1. This is the gain or loss of assets sold at the partnership level and being allocated to the partners, and the second, will be the gain or loss that your Mom realizes from the termination of the partnership.

- So the first thing you need to do is just enter the K-1 items as reflected on the K-1.

- At some point you will need to indicate in TT that this is a final K-1.

- Once you indicate that the K-1 is final, TT will then ask for the selling price and the cost basis (tax basis). This is what was discussed in item 1 above. Without this, you will not be able to determine or provide TT with the necessary information.

- When you are determining your tax basis and adjusting it for the final K-1 items, DO NOT reflect any distributions at this point. The distribution reflected on the final K-1 will be your selling price. Once you determine your tax basis, this will then be your cost basis. TT will then determine a gain or loss as appropriate and reflect this on form 8949 and Schedule D.

- I would delete all information you have currently input and follow the steps above.

- No, there are not two gains as you believe there is. As noted above, the gain coming through on the K-1 is from the sale of assets by the partnership. These items will increase or decrease your tax basis depending on whether they are gains or losses.

Also keep in mind the date of replies, as tax law changes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 for Liquidated Partnership - Capital Gains and Cost Basis

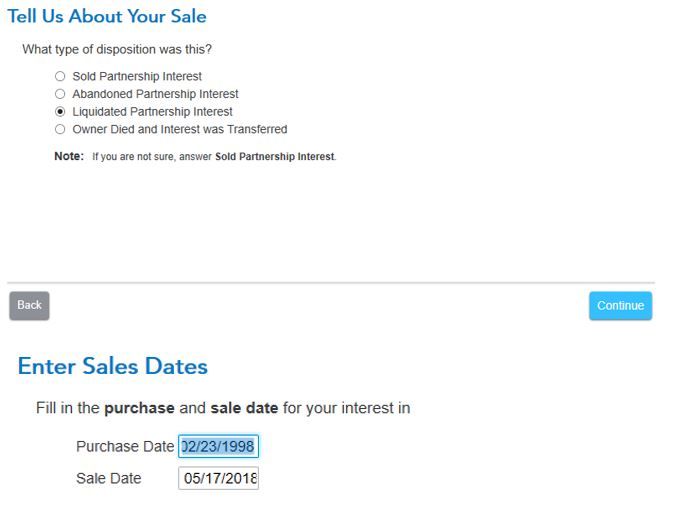

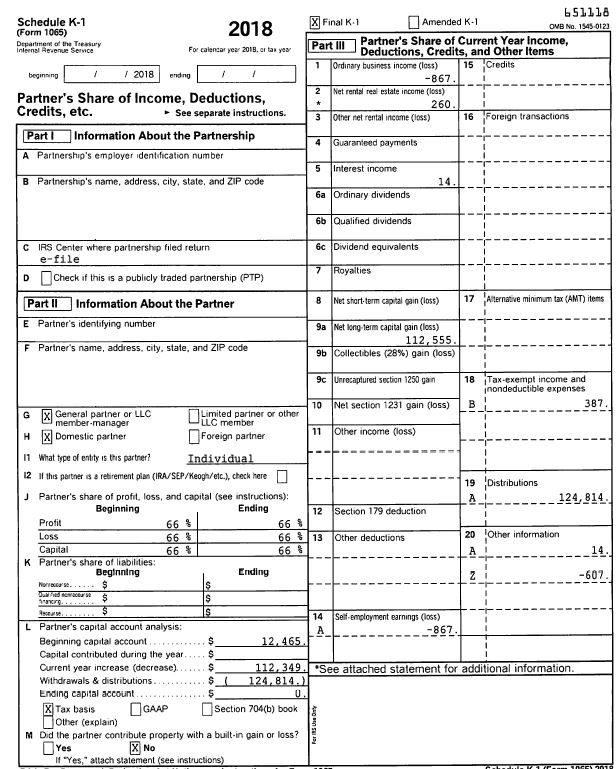

Thanks everyone for the responses and information. There are a few things still unclear to me, so I've noted these items and questions in bold text below, along with screenshots for clarification.

"There will be two gain or loss transactions that you are dealing with; one is at the partnership level and those items are reflected on the K-1. This is the gain or loss of assets sold at the partnership level and being allocated to the partners, and the second, will be the gain or loss that your Mom realizes from the termination of the partnership."

The only significant gain or loss for 2018 involved the sale of the property. I assume this is the first transaction you refer to reported in Box 9a ($112,555). Is the second item completely independent from the sale of the property? I guess I don't understand what the second gain/loss includes.

"So the first thing you need to do is just enter the K-1 items as reflected on the K-1.

Done.

"At some point you will need to indicate in TT that this is a final K-1."

"Once you indicate that the K-1 is final, TT will then ask for the selling price and the cost basis (tax basis). This is what was discussed in item 1 above. Without this, you will not be able to determine or provide TT with the necessary information. "

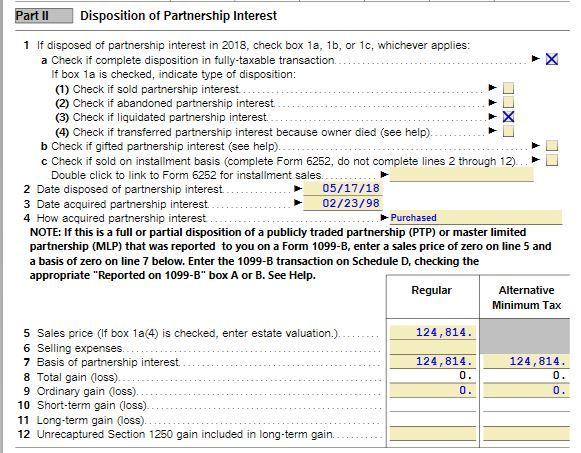

I believe I've entered this properly to indicate the final K-1. See screenshots below.

"When you are determining your tax basis and adjusting it for the final K-1 items, DO NOT reflect any distributions at this point. The distribution reflected on the final K-1 will be your selling price. Once you determine your tax basis, this will then be your cost basis. TT will then determine a gain or loss as appropriate and reflect this on form 8949 and Schedule D."

Does this mean I shouldn't enter the $124,814 shown on the K-1 (see below)?

"No, there are not two gains as you believe there is. As noted above, the gain coming through on the K-1 is from the sale of assets by the partnership. These items will increase or decrease your tax basis depending on whether they are gains or losses."

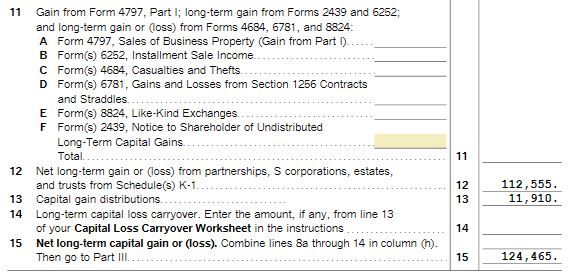

It just appears to me that what's shown is not a true 'gain', but reflects the gross amount received without accounting for the original cost of the property. How does TurboTax know the $112, 955 reported in Box 9a is included in the 'Sale Price' as part of the liquidation? Below is what it shows for Schedule D.

Thanks again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 for Liquidated Partnership - Capital Gains and Cost Basis

To respond to your follow-up:

- Yes, the two gain / loss transactions are completely separate and independent.

- One is the gain / loss attributable to the partnership selling the assets in the business

- The second is a gain / loss attributable to your Mom's investment in the partnership

- The second gain or loss is arrived as discussed in my original response. You need to determine the tax basis in the partnership investment. As noted previously, you cannot determine the overall gain or loss on the investment until this is determined.

- Only check the box that the partnership ended in 2018. Uncheck the other box.

- How are you arriving at selling expense of $8,961? You most likely don't have any selling costs.

- How are you arriving at the cost basis? Have you determined your tax basis? Your tax basis is the cost basis. How are you arriving at the $56,100?

- How are your proceeds ($127,456) different than your distribution ($124,814) that is reflected on the final K-1? Where are you getting the proceeds figure?

- Respond to the above before moving on.

Also keep in mind the date of replies, as tax law changes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 for Liquidated Partnership - Capital Gains and Cost Basis

See responses below in bold.

"Only check the box that the partnership ended in 2018. Uncheck the other box."

Done. This didn't appear to change the numbers in TurboTax regarding taxes owed.

"How are you arriving at selling expense of $8,961? You most likely don't have any selling costs."

Total selling costs are $13,578 for commissions and title fees. $13,578 x 66% = $8,961.

"How are you arriving at the cost basis? Have you determined your tax basis? Your tax basis is the cost basis. How are you arriving at the $56,100?"

The total purchase price in 1998 was $85,000. $85,000 x 66% = $56,100

How are your proceeds ($127,456) different than your distribution ($124,814) that is reflected on the final K-1? Where are you getting the proceeds figure?

This is one of the questions I've sent to person who prepared the K-1 regarding the difference between $127k and $124k. The $127,456 is my calculation based on the following:

$193,115 sale price x 66% = $127,456

Net proceeds = $127,456 - $8,961 = $118,495*

Net long-term capital gain = $118,495 - $56,100 = $62,395

*There is a payment to mother for $118,495 based on the checking account for partnership, so I believe I'm on the right track here.

My conclusion is that the $62,395 amount is the only significant income generated for my mother from the partnership in 2018. The full K-1 is shown below with the personal information removed. There are various other amounts regarding income and losses on the K-1, but they don't appear significant enough to make up the difference between the $124k and $127k.

You mentioned that I should NOT include distributions. Is this still the case, and should I zero out the amount from Box 19a?

Thanks again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 for Liquidated Partnership - Capital Gains and Cost Basis

if these are on the k-1 or partnership return the numbers do not make sense

your mother's basis and the partnership reporting can be completely different.

it would seem that the partnership would report the total capital gain as follows

193115-13578-85000 = 94537 + 11910 =106447 (the partnership is showing an additional income(?) of 5902 (112349-106447) - don't know where this came from based on what you supplied. this should be somewhere on the k-1's

her k-1 would report capital gains of 106447* 66% = 70255

the other partners owning 34% k-1's would report the difference.

Net long-term capital gain (Line 15:) whose line 15 partnership or hers

$62,395 (see above) - this would be her share of the gain on the farm land sale

$112,555 (from Schedule K-1, Box 9a) - makes no sense

$11,910 (from non-related investments)

----------------------------------------------------------

$186,860 Total Net Long-Term Cap. Gain (Line 15) if this is partnership schedule D it makes no sense based on what you provided.

if partnership capital gains are $186K but schedule L only shows an increase of $112K

where did the difference of $74K go?

what you present is very confusing because it seems at times you're reporting what's on her k-1 and at other times what's on partnership's forms other than the k-1's

therefore, you would best protect your parent by hiring a pro to go over the partnership return. if their K-1 isn't right then the other partners' k-1 aren't likely to be correct either.

I'm actually surprised that the partnership did not receive a notice from the IRS asking for an explanation of discrepancies.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 for Liquidated Partnership - Capital Gains and Cost Basis

You definitely need to have a one on one with a tax professional as you are mixing partnership and personal tax implications.

- You should not have any selling expenses at your Mom's level. If the land, etc was titled in the name of the partnership, the selling expenses you mention should have been accounted for at the partnership return level. If not, then the partnership return needs to be amended.

- Your cost basis is completely off base. As noted previously, that may have been the starting point for your Mom's tax basis (cost), but that amount should have been adjusted ANNUALLY based on the information provided on the K-1. So in order to determine your true tax basis, you need to locate K-1's since 1998 and compute your tax basis. As stated before, you cannot determine your overall gain or loss at your Mom's level unless you know the tax basis. And only if this figure is accurate, will you be able to determine the correct tax liability.

- For your sales proceeds, once again, you are mixing (incorrectly) partnership level transactions and individual level tax implications. Your sales proceeds for TT purposes and determining your Mom's overall gain or loss is what you ACTUALLY received from the partnership as a liquidating distribution. At this point, without any other information, that appears to be the $124,814 reflected on the K-1.

- Based on the information on the K-1 alone, your Mom's tax basis is $112,349. This is in no way her true tax basis, but this goes to show you that the $56,100 figure you are using is not accurate.

- See below for some guidance on what is included each year (from annual K-1) in updating your tax basis. Ignore the discussion of liabilities as that will only complicate the computation.

The partner's basis in the partnership can be increased or decreased by certain items:

- The partner's additional contributions to the partnership, including an increased share of, or assumption of, partnership liabilities.

- The partner's distributive share of taxable and nontaxable partnership income.

- The partner's distributive share of the excess of the deductions for depletion over the basis of the depletable property, unless the property is oil or gas wells whose basis has been allocated to partners.

Decreases. The partner's basis is decreased (but never below zero) by the following items:

- The money (including a decreased share of partnership liabilities or an assumption of the partner's individual liabilities by the partnership) and adjusted basis of property distributed to the partner by the partnership. This includes annual distribution, except for the final K-1 liquidating distribution.

- The partner's distributive share of the partnership losses (including capital losses).

- The partner's distributive share of nondeductible partnership expenses that are not capital expenditures. This includes the partner's share of any section 179 expenses, even if the partner cannot deduct the entire amount on his or her individual income tax return.

- The partner's deduction for depletion for any partnership oil and gas wells, up to the proportionate share of the adjusted basis of the wells allocated to the partner.

Also keep in mind the date of replies, as tax law changes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 for Liquidated Partnership - Capital Gains and Cost Basis

Thanks for the responses.

The $11,910 is from my mother's personal investments, not related to the partnership. When you exclude that, I would expect to see the $62,395 for her share of the gain, as you've noted (not factoring in the points brought up by Rick19744).

Thanks for the additional information. Perhaps the annual adjustments you've mentioned, including past contributions are already factored into the Beginning Capital Account (Box L). The language below is from the 2018 Schedule K-1 Form 1065 Instructions:

"For Item L, “tax basis capital” means (i) the amount of cash plus the tax basis of property contributed to a partnership by a partner minus the amount of cash plus the tax basis of property distributed to a partner by the partnership, net of any liabilities assumed or taken subject to, in connection with such contribution or distribution; plus (ii) the partner's cumulative share of partnership taxable income and tax-exempt income; minus (iii) the partner's cumulative share of taxable loss and nondeductible, noncapital expenditures."

The person who prepared the K-1 said she would be getting back to me later this week, so hopefully that will help clear things up.

Thanks again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 for Liquidated Partnership - Capital Gains and Cost Basis

Because this is a 2018 K-1, what box is checked in box L?

What box was checked on the 2017 K-1?

Also keep in mind the date of replies, as tax law changes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 for Liquidated Partnership - Capital Gains and Cost Basis

For the 2018 K-1, "Tax Basis" is checked (see screenshot above).

Same goes for the 2017 K-1.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 for Liquidated Partnership - Capital Gains and Cost Basis

ok. Since you have not maintained a separate tax basis and the preparer has marked tax basis on the K-1, at this point that is what we will rely on.

So here is what you have for the gain / loss on your Mom's investment:

Sales proceeds = distributions on line 19 = $124,814

Tax basis (cost basis) before any distributions = $124,814

That means your Mom has no gain or loss on the liquidating distribution.

The above two amounts are what you need to include when asked by TT.

Also keep in mind the date of replies, as tax law changes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 for Liquidated Partnership - Capital Gains and Cost Basis

Ok, great. Thanks.

Does the information below look correct based on what you've described? I've entered an 'ordinary gain' of zero since this was flagged by TurboTax. Schedule D is still showing a capital gain of $112,555 from the partnership as shown below (3rd screenshot), carried over from Box 9a from the K-1. There were no other significant sources of gain in the partnership from 2018 other than the property sale.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 for Liquidated Partnership - Capital Gains and Cost Basis

This looks correct based on your facts.

The $112,555 gain is properly reported as this is your Mom's share of the partnership gain on the sale.

The $11,910 is from other investment activity noted by you.

The ordinary gain issue is related to whether some of the gain needed to be recharacterized as ordinary income. Since this was land, there does not appear to be any Section 751 property that would require recharacterization. So zero appears accurate based on your facts.

Also keep in mind the date of replies, as tax law changes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 for Liquidated Partnership - Capital Gains and Cost Basis

Perfect. Thanks again!

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

JamesT81

Level 2

VERYfrustrated1

Level 1

Joheti

New Member

David2024

Level 2

DLK59

Returning Member