- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: Loan repayment

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Loan repayment

I loaned my LLC funds over the past several years and started paying these loans back in 2018. Where do you enter the payback amounts in Turbo Tax for Business. I can only find the interest paid area, but the payments are not interest but capital repayment. Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Loan repayment

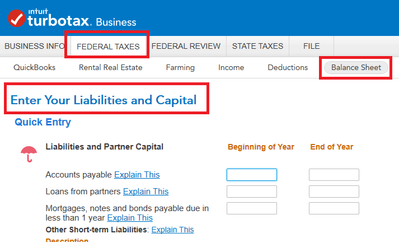

Liabilities and Partner Capital page in the Balance Sheet section of the program.

[Federal Taxes tab>>Balance Sheet]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Loan repayment

there is no place to enter repayments. the repayments simply reduce the amount reported on line 19a of the balance sheet

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Loan repayment

The original poster indicated they are using TurboTax Business. A screenshot is below.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Loan repayment

Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Loan repayment

Thanks

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

davidcotey

New Member

chunhuach

Level 1

SelenaP

New Member

dhornbytax

New Member

cespirit

New Member