- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: K-1 Code K,V

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 Code K,V

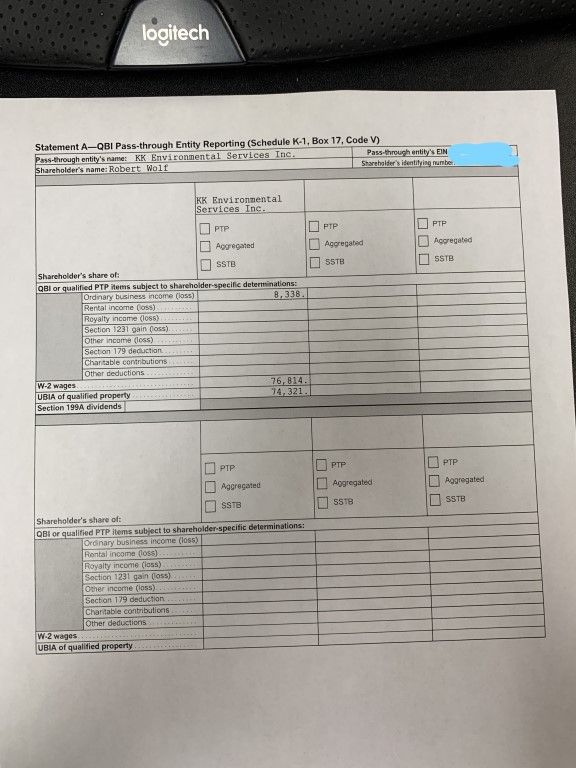

My K-1 l am having a hard time figuring out what number I use when I am trying to enter them into the my personal taxes about my 179 Sale.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 Code K,V

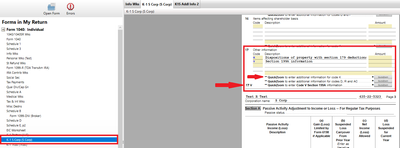

Which numbers, exactly? You can use Step-by-Step Mode and simply follow the prompts. but it is typically more straightforward, as well as easier, to enter the information in Forms Mode (if you are using a desktop version of TurboTax).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 Code K,V

Which numbers, exactly? You can use Step-by-Step Mode and simply follow the prompts. but it is typically more straightforward, as well as easier, to enter the information in Forms Mode (if you are using a desktop version of TurboTax).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 Code K,V

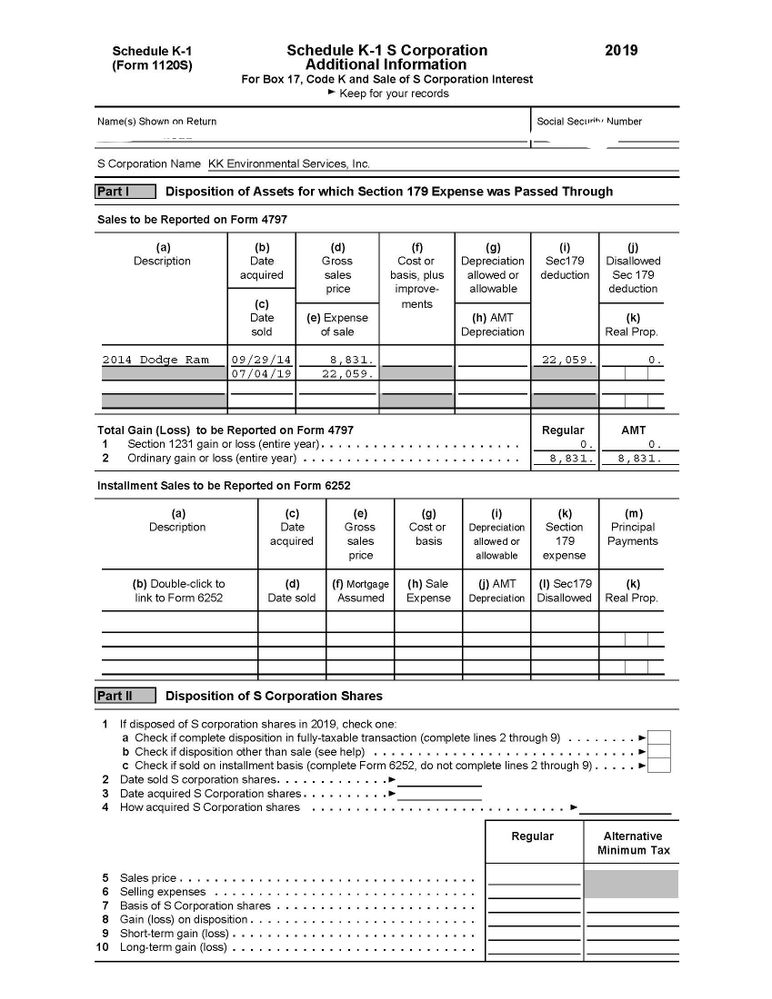

It starts by asking to enter the amounts for box K so I entered 22,059 and for box V 8,831, not sure if that is right. Then it asks for expense of sale which I am not sure what to put in, then it asks for deprecation and deprecation AMT, which once again not sure what to put in, then 179 expense and expense disallowed. I am trying to get these numbers to fill in what its asking for the number I received on my K-1 in the pictures I posted of it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 Code K,V

Do you think that i filled out the numbers correctly based on what was on my K-1 shown above.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 Code K,V

I believe the figure you have in (e) belongs in (f); cost or basis.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 Code K,V

So what goes in (e)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 Code K,V

Selling expenses, if any, such as sales commissions, legal fees, escrow charges, et al.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 Code K,V

Ok I was just entering what was listed on my K-1, sure do appreciate your help, as you can tell I am not very good at this section.

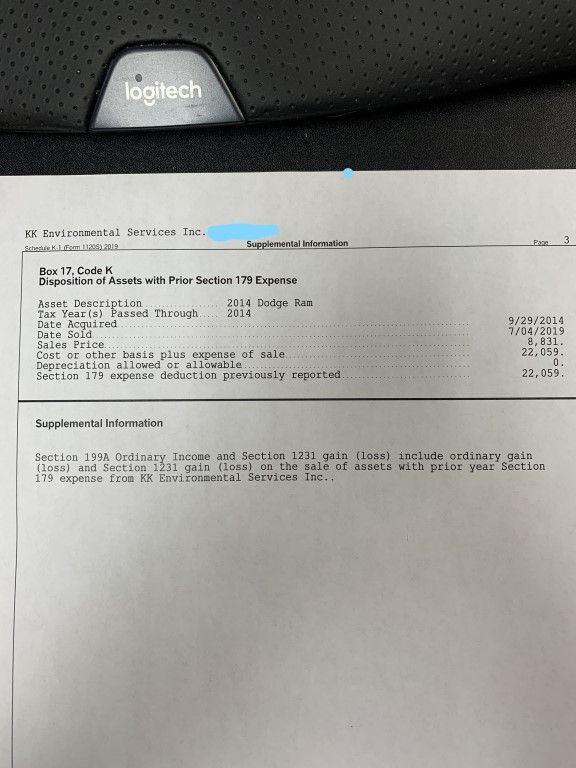

Code K

Disposition of Assets with Prior Section 179 Expense

Asset Description. . . . . . . . . . . . . . . . . . . 2014 Dodge Ram Tax Year(s) Passed

Through. . . . . 2014

Date Acquired. 9/29/2014

Date Sold. . . . . 7/04/2019

Sales Price. . . . 8,831.

Cost or other basis plus expense of sale. . 22,059.

Depreciation allowed or allowable. . . . 0.

Section 179 expense deduction previously reported . . 22,059.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 Code K,V

I understand and, if the transaction involved only the sale of a vehicle then, most likely, there were no selling expenses (i.e., the cost/basis was just reported).

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

lacienv28

New Member

gredeich

Level 1

jisles62

New Member

CptBuckSnort

New Member

chubsmommy

New Member