- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: If I gave the car away to salvation army . How do i report on taxes. I rented &hardly used it for business in 2019 as it wasnt functioning properly.I used it in 2018 ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I gave the car away to salvation army . How do i report on taxes. I rented &hardly used it for business in 2019 as it wasnt functioning properly.I used it in 2018 ?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I gave the car away to salvation army . How do i report on taxes. I rented &hardly used it for business in 2019 as it wasnt functioning properly.I used it in 2018 ?

To add the donation of a car to your return, please follow these steps:

- Click on Federal > Deductions & Credits [In TT Self-Employed: Personal > Deductions & Credits > I’ll choose what I work on.]

- In the Charitable Donations section, click on the Start/Revisit box next to Donations to Charity in 2019. [If you tracked your donations in ItsDeductible click on the Start/Revisit box next to Import from ItsDeductible Online.]

- If you haven't entered any information yet on your donations, you will see a Donations screen click the Yes box.

- If you've already started entering information on charitable donations, you will see a screen to Review All Your Charities. You can click on the Edit box next to the charity name or Add Another Charity to add a new donation.

- On the screen, Let's enter your donations one at a time, enter the name of the charity and click the Add box next to the type of donation--Items, Money, Stock or Mileage and travel expenses.

- If you are donating items, n the next screen, How Do You Want to Value Your Donations, if you haven't already calculated the value of your donations, TurboTax will help, using values from Its Deductible. Click on the Guide Me box.

- If you've already put a value on your donations, click on the I'll Value Them box.

- On the screen, Choose a category for this donation, mark the radio button for Car, boat or airplane

- Continue through the screens, entering the requested information.

Please see this article for additional information: How much can I deduct for donating a car?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I gave the car away to salvation army . How do i report on taxes. I rented &hardly used it for business in 2019 as it wasnt functioning properly.I used it in 2018 ?

To add the donation of a car to your return, please follow these steps:

- Click on Federal > Deductions & Credits [In TT Self-Employed: Personal > Deductions & Credits > I’ll choose what I work on.]

- In the Charitable Donations section, click on the Start/Revisit box next to Donations to Charity in 2019. [If you tracked your donations in ItsDeductible click on the Start/Revisit box next to Import from ItsDeductible Online.]

- If you haven't entered any information yet on your donations, you will see a Donations screen click the Yes box.

- If you've already started entering information on charitable donations, you will see a screen to Review All Your Charities. You can click on the Edit box next to the charity name or Add Another Charity to add a new donation.

- On the screen, Let's enter your donations one at a time, enter the name of the charity and click the Add box next to the type of donation--Items, Money, Stock or Mileage and travel expenses.

- If you are donating items, n the next screen, How Do You Want to Value Your Donations, if you haven't already calculated the value of your donations, TurboTax will help, using values from Its Deductible. Click on the Guide Me box.

- If you've already put a value on your donations, click on the I'll Value Them box.

- On the screen, Choose a category for this donation, mark the radio button for Car, boat or airplane

- Continue through the screens, entering the requested information.

Please see this article for additional information: How much can I deduct for donating a car?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I gave the car away to salvation army . How do i report on taxes. I rented &hardly used it for business in 2019 as it wasnt functioning properly.I used it in 2018 ?

If the vehicle was donated to a qualified charty (such as the salvation army) they will send you a 1098-C reporting the value of the donation. If you did not receive a 1098-C then you need to contact the donee to inquire about it.

Sometimes a charity will base the value of your vehicle donation on what they get for it if/when they sell it. So if you donated it in 2019 and they sold it in 2020, that would mean you would not get the 1098-C until next year, for your 2020 taxes. So this is one reason you "NEED" to inquire with the donee as to why you have not yet received a 1098-C.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I gave the car away to salvation army . How do i report on taxes. I rented &hardly used it for business in 2019 as it wasnt functioning properly.I used it in 2018 ?

Thanks for response.I gave it away in 2018 and got the 1098C .It was sold at bare minimum , so not much to claim but i was claiming it for business purposes and depreciation. Not yet sure proper way to list it without affecting prior year depreciation data

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I gave the car away to salvation army . How do i report on taxes. I rented &hardly used it for business in 2019 as it wasnt functioning properly.I used it in 2018 ?

Please clarify what you mean when you say that you donated the car in 2018 yet were using it in 2019. How was that possible? Is one of those years a typo?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I gave the car away to salvation army . How do i report on taxes. I rented &hardly used it for business in 2019 as it wasnt functioning properly.I used it in 2018 ?

Ofcourse its a mental typo. Gave away car in April 2019 . Last used it 2018 both business and private ,through End of Year 2018 . Didn't use it in 2019 . But claimed it on bu

Sorry for confusion .

I know am going to have some work when figuring out out for business taxes disposal .

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I gave the car away to salvation army . How do i report on taxes. I rented &hardly used it for business in 2019 as it wasnt functioning properly.I used it in 2018 ?

The easiest/simplest way is to just show the car as removed from the business for personal use in April 2019. Then you can claim/report the donation on the personal side under the Deductions & Credits tab in the Charitable Donations section. But you'll need to reduce the donation amount reported on the 1099-C, by the amount of depreciation you took on the vehicle while it was business use.

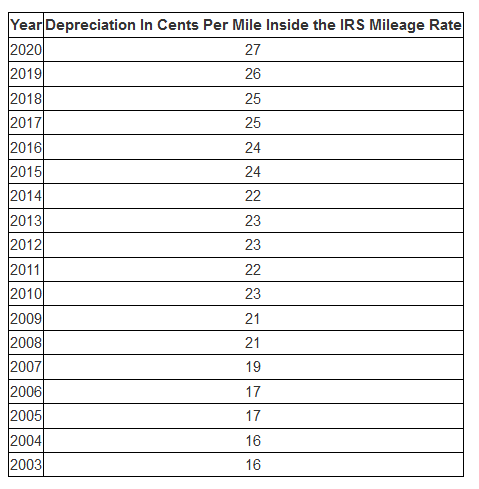

If you took the "per-mile" deduction each year the vehicle was business use, then a portion of that "per mile" deduction you got was depreciation. Just like the amount you can claim per mile each year changes, so does the depreciation amount.

Since you have a record of the starting/ending miles each year and the number of business miles driven each year, it's easy to figure the depreciation you got. Just use the chart below.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

kf_7

New Member

helper0628

New Member

hatteras1704

New Member

cmiville

New Member

WilHen02

Level 4