- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: I own a small business. I am doing 2020 returns. Ho do I calculate the amount of my tax bill that I can defer?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I own a small business. I am doing 2020 returns. Ho do I calculate the amount of my tax bill that I can defer?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I own a small business. I am doing 2020 returns. Ho do I calculate the amount of my tax bill that I can defer?

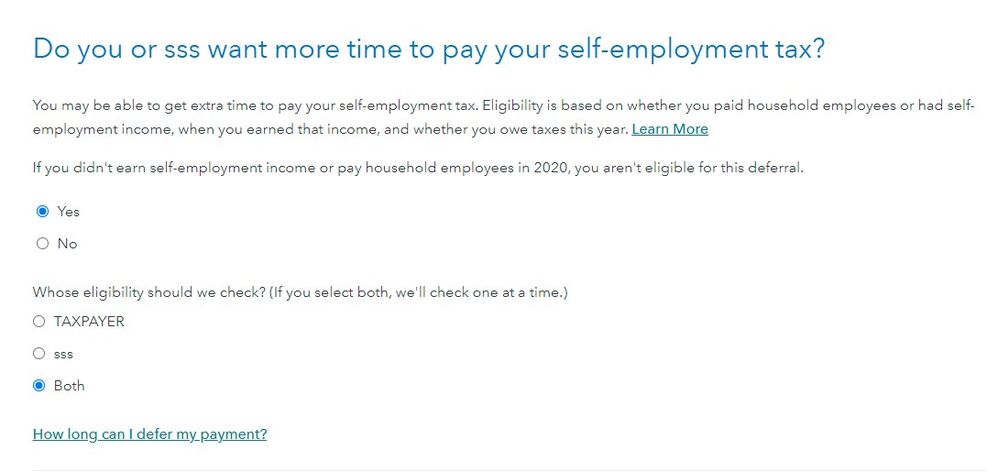

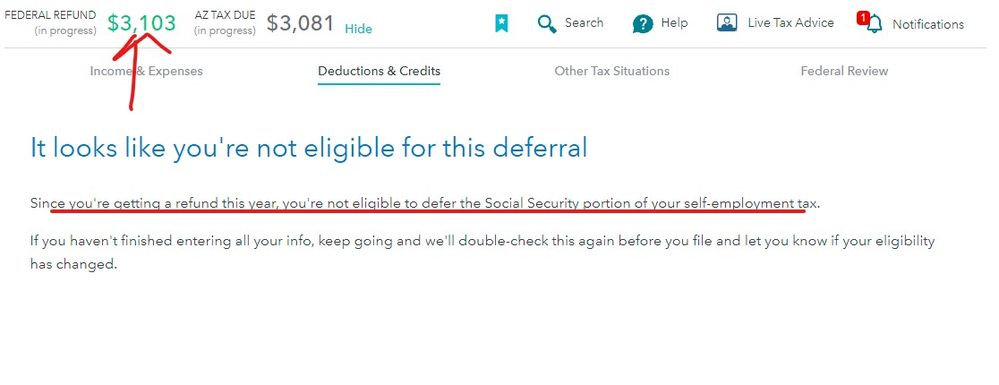

The only tax you can defer is part of the self-employment tax, and only under certain circumstances. If you don't have a balance due on your tax return (i.e. you are getting a refund) you probably cannot defer any tax. TurboTax will ask you how much of your self-employment income was earned from March 27 to the end of the year. It will then calculate the maximum amount you can defer and ask you how much you want to defer.

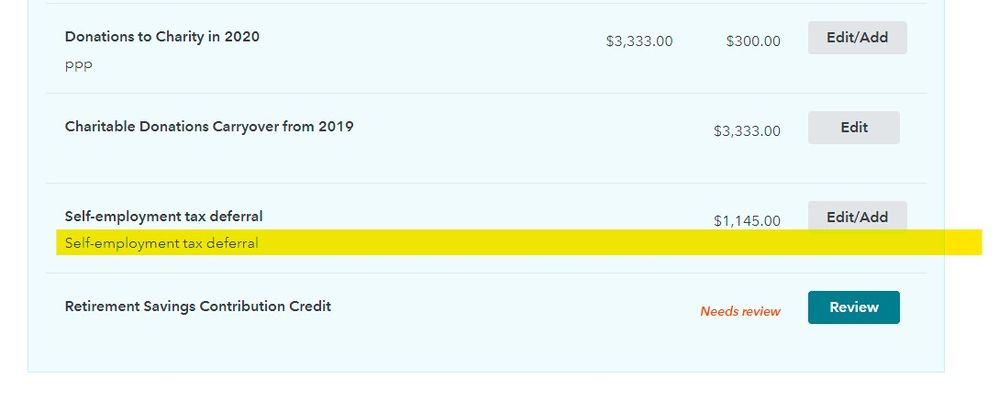

I'm not sure how you get to this in Self-Employed Online. It's probably in the Personal section under Deductions & Credits > Tax relief related to COVID-19 > Self-employment tax deferral. If you have trouble finding it, a TurboTax Live tax expert might be able to help.

Note that the first half of the deferred self-employment tax has to be paid by December 31, 2021.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I own a small business. I am doing 2020 returns. Ho do I calculate the amount of my tax bill that I can defer?

After you finish the Sch C section the deferral is mentioned ... it comes later in the program.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

roypimjasmine2485

New Member

helloTT102

New Member

TurboLover2

Level 4

msatterwhi009

New Member

mustang-deck

New Member