- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: Form 1041 Estate Tax Return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1041 Estate Tax Return

Am preparing Form 1041 for my father-in-law's estate. His daughters sold his house in 2018 and each of them received a 5-digit payout from it in 2019. When I prepare the Form in TurboTax, the K-1s all come back blank with no figures listed in Box 1, 2, or 3. The house was appraised for $430k but sold for 400k. Is the blank K-1 due to the fact that, on paper, the house sale reflected a realized loss of 30k, and thus none of the daughters technically experienced a capital gain (and thus don't owe any tax on it)? How should the payout be reflected on their individual 1040 returns? Thanks much for any help/insight on this.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1041 Estate Tax Return

@canastasio wrote:

How should the payout be reflected on their individual 1040 returns? Thanks much for any help/insight on this.

Net losses from the estate can only be distributed after termination when the estate is filing its final return.

If that is the case here, then indicate that the estate is filing its final return (under General Info>>About Your Trust or Estate).

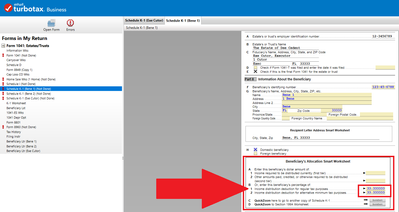

Subsequently, enter Forms Mode (click the icon in the upper right side of the screen), click each K-1 form under Forms in My Return, and enter each beneficiary's percentage in the Beneficiary's Allocation Smart Worksheet (see screenshot).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1041 Estate Tax Return

@canastasio wrote:

How should the payout be reflected on their individual 1040 returns? Thanks much for any help/insight on this.

Net losses from the estate can only be distributed after termination when the estate is filing its final return.

If that is the case here, then indicate that the estate is filing its final return (under General Info>>About Your Trust or Estate).

Subsequently, enter Forms Mode (click the icon in the upper right side of the screen), click each K-1 form under Forms in My Return, and enter each beneficiary's percentage in the Beneficiary's Allocation Smart Worksheet (see screenshot).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1041 Estate Tax Return

I have the turbotax home and business.

How do I get the tax return # 1041? It does not downoad

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1041 Estate Tax Return

@24152415e You need TurboTax Business in order to prepare a 1041 (Home & Business does not support Form 1041 preparation, only K-1 (1041) entry).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1041 Estate Tax Return

@24152415e The Home & Business program won't prepare a 1041. Did you buy the separate Business program here? https://turbotax.intuit.com/small-business-taxes/ Do you have a Windows computer? Where do you get stuck trying to download it?

Turn off your antivirus. Use a different browser to download it like Chrome or FireFox. It doesn’t like IE11.

How to install Turbo Tax on Windows

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1041 Estate Tax Return

Found the link I was looking for.

If you are having trouble downloading to Windows

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1041 Estate Tax Return

Thanks Tagteam! Still confused though -- this return isn't the final return, as the estate's funds weren't expended within the 2018 tax return's time frame. But the beneficiaries received funds from the sale of the house in summer 2019, so I presumed they had to report that when they filed 2019 taxes this year. Perhaps I'm not clear on what the expectation is for them to report the funds. Also still not clear why the K-1s would be blank -- shouldn't they show either a positive or negative number for the house ale proceeds? Do they not report them until after the final return is submitted, at which time the K-1s would then get populated with the capital loss incurred by the sale of the house?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1041 Estate Tax Return

In order to file Fed form 1041 for the estate of my aunt who passed in 2019, I understand that I need to download the Turbo Tax Business edition. Before doing so, please confirm that I can complete the Fed and CA state returns, and that the returns can be downloaded, completed, and submitted via an Apple Mac.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1041 Estate Tax Return

@Gmoney43 wrote:

In order to file Fed form 1041 for the estate of my aunt who passed in 2019, I understand that I need to download the Turbo Tax Business edition. Before doing so, please confirm that I can complete the Fed and CA state returns, and that the returns can be downloaded, completed, and submitted via an Apple Mac.

The TurboTax Business Edition can only be installed on a Windows based personal computer, not on a Mac or online.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1041 Estate Tax Return

Sorry NO. Turbo Tax Business can only be installed on a Windows computer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1041 Estate Tax Return

I had exactly the same question. So I cannot use Turbotax for generating trust returns on my Macintosh? Bummer. I am not going to buy a wintel computer just for that. Now I will have to try to do it by hand, or go to H&R Block or someone else to do that for me?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1041 Estate Tax Return

@wrendahl wrote:

Now I will have to try to do it by hand, or go to H&R Block or someone else to do that for me?

Whatever suits you, but I would highly recommend against trying to do the return manually unless it is extremely uncomplicated (as in only simple interest for income, no K-1s, etc.).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1041 Estate Tax Return

i have already file federal and state return for 2020. now i find out that i need to file a form 1041 on

a estate bank account what program i need to file a 1041 form

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1041 Estate Tax Return

For form 1041, you can use TurboTax Premier or Self Employed. Please refer to the following help article for the product information.

TurboTax 2020 Online product guide

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1041 Estate Tax Return

@aaronperry1 wrote:

.....i need to file a form 1041 on a estate bank account what program i need to file a 1041 form

Make sure the estate is actually required to file a 1041 (generally $600 or more in gross income).

See https://www.irs.gov/instructions/i1041#idm140229151947712

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

The Cocoa Kid

New Member

msatterwhi009

New Member

mustang-deck

New Member

dawn42

New Member

tiggerpounce

Returning Member