- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: Does ANYONE UNDERSTAND: Publication 536 (2018), Net Operating Losses (NOLs) for Individuals, Estates, and Trusts

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does ANYONE UNDERSTAND: Publication 536 (2018), Net Operating Losses (NOLs) for Individuals, Estates, and Trusts

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does ANYONE UNDERSTAND: Publication 536 (2018), Net Operating Losses (NOLs) for Individuals, Estates, and Trusts

It is somewhat confusing and complex and, frankly, that is why many taxpayers consult a tax professional when faced with this scenario; it is actually beyond the purview of do-it-yourself software and, in fact, TurboTax neither supports calculating an NOL nor does the program provide affirmation that you have an NOL.

Since you mentioned the 2017 tax year, hopefully you waived the carry back period for 2017 because, otherwise, you would now need to amend your 2017 return (i.e., it is too late to make a carry forward election for 2017). A carry forward election does not need to be made for the 2018 tax year since the Tax Cuts and Jobs Act (TCJA) eliminated the option to carry back an NOL for most taxpayers. Further, I presume you are at least aware that you need to calculate the carry forward one year at a time (e.g., calculate 2017 first and carry that forward to 2018 and then calculate 2018).

Regardless, if you provide more details here, perhaps one or more of the SuperUsers and/or TurboTax Employees can be of some assistance. Failing that, a tax professional would be your best option.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does ANYONE UNDERSTAND: Publication 536 (2018), Net Operating Losses (NOLs) for Individuals, Estates, and Trusts

- Yes I did NOT carry-back.

- I understand it is one year at a time per pub 536...

- My questions are re: the NOL calculation itself. As I explained if you read the examples in 536 it makes a lot of sense however the worksheet they provide (worksheets one and two) do not get me to the same answer....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does ANYONE UNDERSTAND: Publication 536 (2018), Net Operating Losses (NOLs) for Individuals, Estates, and Trusts

- My point is that 536 is basically pretty simple. It says take you loss, subtract off the other deductions, if there is anything left - that is the carryover.

- HOWEVER, when I use the new worksheets I get a very different answer and have not been able to figure it out - YET....

Lastly, are you saying that turbo tax should NOT e used if you have a NOL carryover - I have previously used it....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does ANYONE UNDERSTAND: Publication 536 (2018), Net Operating Losses (NOLs) for Individuals, Estates, and Trusts

@granfalloom wrote:Lastly, are you saying that turbo tax should NOT [b]e used if you have a NOL carryover - I have previously used it....

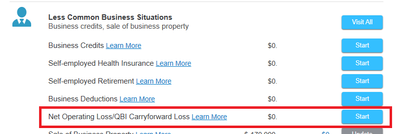

No, I am not saying that, exactly. TurboTax can indeed be used if the user thereof is able to accurately figure the NOL carryover. In fact, the program actually has a specific section for users to enter the carryover amount, (see screenshot below from TurboTax Home & Business).

I was merely pointing out that the calculation can be complicated and many taxpayers, therefore, need professional guidance. Regardless, you will have to post more details in order to get assistance from anyone on this board. Also, you might be able to find some online calculators if you do a web search.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does ANYONE UNDERSTAND: Publication 536 (2018), Net Operating Losses (NOLs) for Individuals, Estates, and Trusts

in it's simplest a NOL for any year is the excess of items of business losses over items of business income reduced but not below zero for the excess, if any, of non-business income over non-business expenses.

worksheet 1 is for the current year (2018) NOL

note that line 1 for individuals should be the same as line 10 on form 1040 adding back any amount on line 9 of the form. if would need to be a negative number to have an NOL.

worksheet 2 is for figuring the NOL carryover from 2017 to 2019, if any

if you have questions about certain lines you can repost

in the example given these are what each line would be

line 1: -14,350

lines 2 and 4: 1000

line 6: 12000

line 8: 425

line 9: 11575

line 12 and 13: 2000

line 15: 1000

line 22: 1000

line 25: -14350+11575+1000

= -1775

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

MS456

Level 2

tmf5

New Member

nandkv-online

Level 2

TyrolView

Returning Member

eric_l

Level 3