- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: Business changed type of organization from a sole proprietorship to an LLC. Does this get entered as a new and separate business from the sole proprietorship version on Schedule C?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business changed type of organization from a sole proprietorship to an LLC. Does this get entered as a new and separate business from the sole proprietorship version on Schedule C?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business changed type of organization from a sole proprietorship to an LLC. Does this get entered as a new and separate business from the sole proprietorship version on Schedule C?

If it is a single-member LLC (without an election to be treated as an S corporation for federal income tax purposes), then the LLC is disregarded, and your income and deductions are reported on Schedule C.

Simply put, the LLC is no different than a sole proprietorship for federal income tax purposes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business changed type of organization from a sole proprietorship to an LLC. Does this get entered as a new and separate business from the sole proprietorship version on Schedule C?

@ponies2100112 wrote:

Do we enter this as a totally separate business from the sole proprietorship business on Schedule C or just combine them on Schedule C?

Since you mentioned "we", most here will presume that this is a multi-member LLC and, as such, the LLC will be required to file Form 1065 (if operating as a partnership).

See https://www.irs.gov/instructions/i1065#en_US_2021_publink11392vd0e555

If both members of this LLC are you and your spouse (and there are no other members), and you hold your interests in the LLC as community property in a community property state, then you have the option of filing two Schedules C (one for each of you).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business changed type of organization from a sole proprietorship to an LLC. Does this get entered as a new and separate business from the sole proprietorship version on Schedule C?

Sorry it's a single member LLC.

Since it's a single member LLC do you need to create a new Business on schedule C or can the income and expenditures be mixed in with the sole proprietorship version of the business?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business changed type of organization from a sole proprietorship to an LLC. Does this get entered as a new and separate business from the sole proprietorship version on Schedule C?

If it is a single-member LLC (without an election to be treated as an S corporation for federal income tax purposes), then the LLC is disregarded, and your income and deductions are reported on Schedule C.

Simply put, the LLC is no different than a sole proprietorship for federal income tax purposes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business changed type of organization from a sole proprietorship to an LLC. Does this get entered as a new and separate business from the sole proprietorship version on Schedule C?

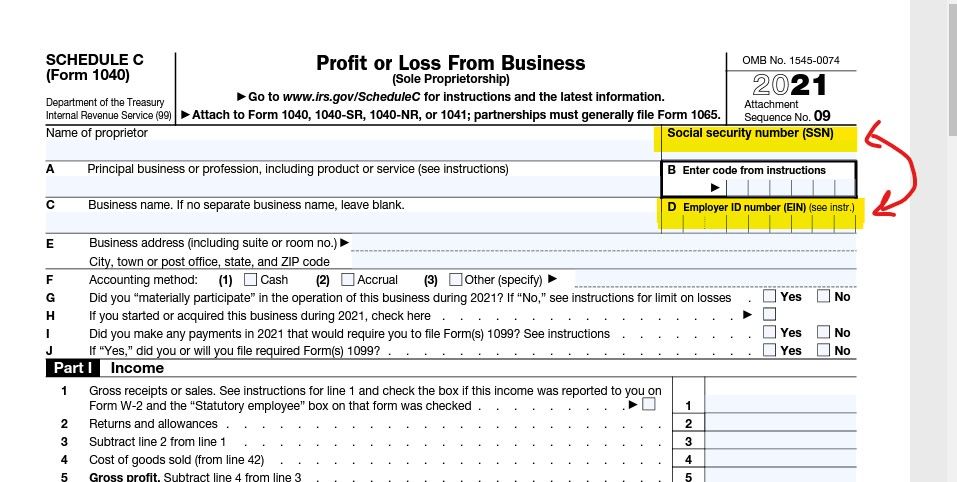

If the business is the same as it was before you got the LLC designation then you still file the same Sch C like you did in the past and add the EIN to the business ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business changed type of organization from a sole proprietorship to an LLC. Does this get entered as a new and separate business from the sole proprietorship version on Schedule C?

Thanks, the EIN on schedule C will be the LLC's EIN and the EIN from the w9 will be the sole proprietorship EIN as the IRS states to not use LLC's EIN for single member LLCs treated as disregarded entities.

Will that confuse the IRS having 2 different EINs on schedule C? One that you report as the LLCs EIN and the sole proprietorship's EIN from the 1099?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business changed type of organization from a sole proprietorship to an LLC. Does this get entered as a new and separate business from the sole proprietorship version on Schedule C?

You CANNOT enter 2 EIN numbers on the Sch C so if you "upgraded" the sole prop to an LLC (a state designation only) then use the LLC EIN only going forward. If you have given a W-9 to anyone using the old EIN then give them an updated W-9 with the new EIN so the 1099 issued at the end of the year has the updated EIN. But even if someone issues one in the old EIN you can still enter it on the Sch C as both EIN numbers have been linked to your SS# anyway.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business changed type of organization from a sole proprietorship to an LLC. Does this get entered as a new and separate business from the sole proprietorship version on Schedule C?

IRS states to not put LLC EIN on w9 for single member LLC's classified as disregarded entity.

For federal income tax purposes, a single-member LLC classified as a disregarded entity generally must use the owner's social security number (SSN) or employer identification number (EIN) for all information returns and reporting related to income tax. For example, if a disregarded entity LLC that is owned by an individual is required to provide a Form W-9, Request for Taxpayer Identification Number (TIN) and Certification, the W-9 should provide the owner’s SSN or EIN, not the LLC’s EIN.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business changed type of organization from a sole proprietorship to an LLC. Does this get entered as a new and separate business from the sole proprietorship version on Schedule C?

If you cannot use the EIN on the W-9 they why bother even getting one? None of my clients in the past 30 years have had an issue using the LLC EIN on the W-9.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business changed type of organization from a sole proprietorship to an LLC. Does this get entered as a new and separate business from the sole proprietorship version on Schedule C?

I agree. Just wish the IRS didn't make this so confusing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business changed type of organization from a sole proprietorship to an LLC. Does this get entered as a new and separate business from the sole proprietorship version on Schedule C?

you use the term "we". if multiple parties are involved you no longer have a sole proprietorship.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business changed type of organization from a sole proprietorship to an LLC. Does this get entered as a new and separate business from the sole proprietorship version on Schedule C?

single person LLC. I'm just helping my wife set things up.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

zariasimone

New Member

susanware1111

New Member

katiebecker1

New Member

Kamarie94

New Member

0af7713afee1

New Member