- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Does turbotax home and business cover depreciation, specifically the section 179 deduction?

Announcements

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does turbotax home and business cover depreciation, specifically the section 179 deduction?

Topics:

posted

July 7, 2020

11:49 AM

last updated

July 07, 2020

11:49 AM

Connect with an expert

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

3 Replies

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does turbotax home and business cover depreciation, specifically the section 179 deduction?

Yes. The Online Self Employed version should too.

July 7, 2020

11:52 AM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does turbotax home and business cover depreciation, specifically the section 179 deduction?

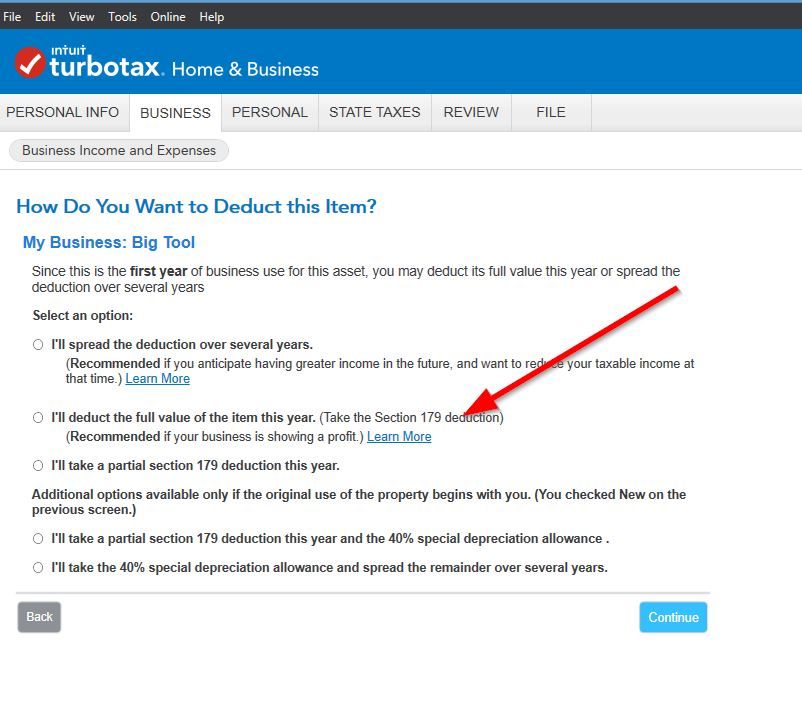

Screen Shot of Windows Home & Business

July 7, 2020

11:56 AM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does turbotax home and business cover depreciation, specifically the section 179 deduction?

But in many or most cases using the Special Depreciation Allowance (Bonus depreciation) is better than using Section 179. So you many want to use that instead.

July 7, 2020

2:04 PM

372

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

dmarchello

New Member

mishelk

New Member

kenning2

New Member

chill63b-yahoo-c

New Member

jraybe1

Level 1