- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Business deductions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business deductions

I own a custom club and golf repair shop. This past year I purchased demo golf clubs, shafts and a computer for the business. I'm I able to write these items off as supplies?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business deductions

Whether these costs can be deducted as business expenses, or must be listed as assets, depends on the purchase price. In general you can list a purchase as a business expense if the amount per item or invoice is less than $2500.

Click here for more information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business deductions

JulieS, please referring to your reply. Where on form Sch C would I add these expenses? I think line #22 but I'm not sure. Thanks again for your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business deductions

JulieS, please referring to your reply. Where on form Sch C would I add these expenses? I think line # 22 but I'm not sure. Thanks again for your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business deductions

Items that cost $2,500 or less can be taken as an expense this year and don’t have to be depreciated over time. To do this, an annual election must be made. It’s called the De Minimis Safe Harbor election.

How do I do this with TurboTax?

After entering your business expenses, you will go to the Assets/Depreciation area. The first screen will ask: Did you buy any items that each cost $2,500 or less in 2019? It’s asking about any items that you haven’t entered yet as expenses.

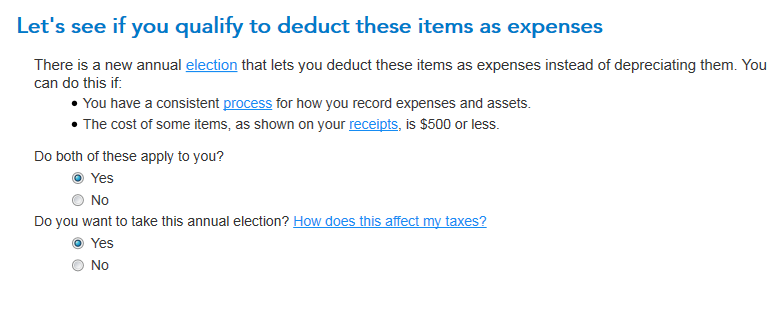

If you say Yes, here’s the next screen:

We ask a couple of questions and if you say Yes they both apply to you, we ask if you want to take the election to expense items costing $2,500 or less. If you say Yes to that question, TurboTax will add the De Minimis Safe Harbor Election form to your tax return.

The next screen in TurboTax has you review other items you bought. If every item you bought cost $2,500 or less, TurboTax will take you back to Your Business screen and you can enter those additional items in the Business Expenses area and not have to depreciate them. TurboTax will assign these expenses to the appropriate line on Schedule C.

If some items cost $2,500 or less and some cost more, the next screen asks you about Building Improvements. After answering the questions about Building Improvements, you can determine which items you will still depreciate and which items you choose to expense.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

calderad07

New Member

ahmad-hashem-net

New Member

karlameyer

Level 1

Nickstax15

New Member

BobK59

Level 2