- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Well can i go back to change info on my taxes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Well can i go back to change info on my taxes

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Well can i go back to change info on my taxes

Once a tax return has been filed it cannot be changed, canceled or retrieved

You will have to wait for the IRS to start accepting or rejecting 2020 tax returns on February 12, 2021

If the return is rejected you can make the necessary changes and e-file again.

If the return is accepted you will have to amend your original tax return. An amended return, Form 1040X, can only be printed and mailed to the IRS, it cannot be e-filed. The IRS will take up to 16 weeks or longer to process an amended tax return.

Before starting to amend the tax return, wait for the tax refund to be received or the taxes due to be paid and processed by the IRS.

See this TurboTax support FAQ on amending a tax return originally completed and filed using the 2020 TurboTax online editions - https://ttlc.intuit.com/community/amending/help/how-do-i-amend-my-turbotax-online-return/01/27577

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Well can i go back to change info on my taxes

I need to change the amout that I put down as tax withheld from my pension

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Well can i go back to change info on my taxes

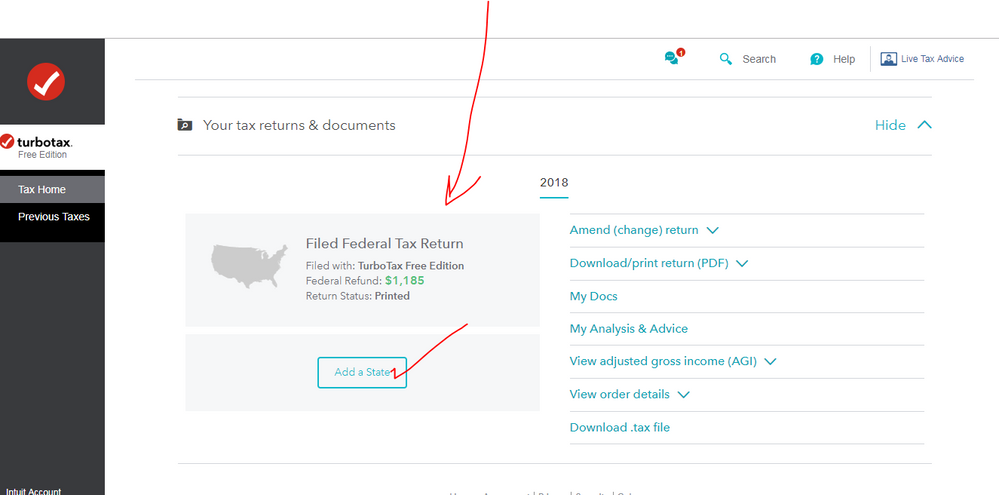

If you have NOT yet filed and when you log in you do NOT see Pending then scroll down and click on ADD A STATE to open the return back up ...

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

rena_8232

New Member

wbjamaica-aol-co

New Member

mattyboi16

New Member

elahoo

New Member

DMHarley

New Member