- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Instructions on how to amend 2015 and 2016 returns in TurboTax to enter a carryback NOL from 2017

After I select "amend return" in TurboTax 2016, where do I go to enter the 2017 NOL carryback? When I choose Casualty loss, it appears I am entering a loss for 2016 rather the carryback for the loss from 2017.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Instructions on how to amend 2015 and 2016 returns in TurboTax to enter a carryback NOL from 2017

In the search box enter NOL carryback ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Instructions on how to amend 2015 and 2016 returns in TurboTax to enter a carryback NOL from 2017

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Instructions on how to amend 2015 and 2016 returns in TurboTax to enter a carryback NOL from 2017

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Instructions on how to amend 2015 and 2016 returns in TurboTax to enter a carryback NOL from 2017

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Instructions on how to amend 2015 and 2016 returns in TurboTax to enter a carryback NOL from 2017

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Instructions on how to amend 2015 and 2016 returns in TurboTax to enter a carryback NOL from 2017

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Instructions on how to amend 2015 and 2016 returns in TurboTax to enter a carryback NOL from 2017

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Instructions on how to amend 2015 and 2016 returns in TurboTax to enter a carryback NOL from 2017

In the search box enter NOL carryback ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Instructions on how to amend 2015 and 2016 returns in TurboTax to enter a carryback NOL from 2017

This thread is totally useless.

WHAT needs to be done (conceptually) is laid out in the tax instructions (NOL Pub 536 and Form 1045 instructions).

HOW TTAX actually supports an NOL carryback is the actual question we all are asking. ALl TTAX seems to accept is a new loss -- wortheless in this situation.

BTW, nothing comes up in the search for NOL carryback in prior years, and the "Find" box is missing from 2017!! :(

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Instructions on how to amend 2015 and 2016 returns in TurboTax to enter a carryback NOL from 2017

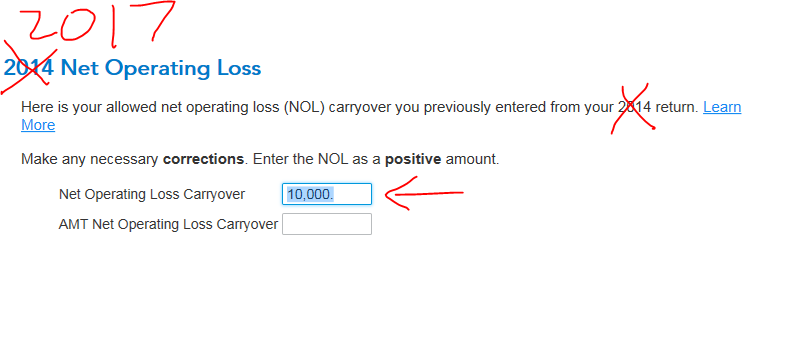

Ok ... in the 2015 program you do enter NOL in the search box then jump to that section and enter the 2017 NOL carryback amount on the screen that says 2014 carryforward ... this will put the amount on line 21 of the form 1040 as needed.

Of course, since the 2015 tax year is closed for amended returns you really need to use the form 1045A to get the refund. I would seek local professional assistance in this matter.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

windtree4

Level 1

dimi1927

Level 3

Mimi1944

New Member

magellan0

Level 2

kare2k13

Level 3