- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Should I amend my 2019 tax so my dependent mother can receive Stimulus check

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should I amend my 2019 tax so my dependent mother can receive Stimulus check

@barbjkus - @Critter - let's go back to the facts (hopefully I have them correct) because this is getting a little fuzzy

Facts:

- Adult Child claimed her adult mother on the child's tax return.

- Adult Child can not pass the test to claim Mother as a dependent because Adult Child does not provide more than 50% of Mother's financial support.

Under the assumption that the facts above are accurate, Adult Child MUST amend.

Why?

Adult Child's return is not correct because the Mother was claimed when the Adult Child was not entitled to do so. That means Adult Child potentially received (and probably did!) the $500 Other Dependent Tax Credit, which she would not be entitled to.

The fact that Mother never filed (and she wasn't required to) and therefore never stated that she could be claimed by someone else is immaterial. What is material is that the Adult Child's tax return was incorrectly filed in the first place.

In effect, Mom will not receive the $1200 that she is entitled to because Adult Child incorrectly filled out the 2019 tax return by claiming Mom when the tests for claiming were not met.

So, yes, doing the right thing means amending, sending back the $500 and ensuring Mom gets her $1200 that she is entitled to. If you convince Mom not to file, she is out $1200 she is entitled to BY LAW.

Sorry for the bluntness...... doing the right thing is tantamount (and eliminates the IRS finding this first, which could create fines and penalties....)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should I amend my 2019 tax so my dependent mother can receive Stimulus check

Shouldn't have turbotax caught this? I mean isn't turbo tax supposed to guarantee that?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should I amend my 2019 tax so my dependent mother can receive Stimulus check

I'm with you on this @barbjkus. I have also claimed my mom as my dependent and when I was going through dependent section of my tax return, I honestly and correctly answered questions such as "do you provide 50% for your dependent? " (which I clearly clicked NO) "do you provide more than 10% for your dependent? ( I clicked YES) "do you live with the dependent?" (I clicked NO) and turbotax put $500 credit in my return for me. I clearly indicated that I DO NOT provide 50% for my mom, yet Turbotax still put $500 credit at the end. Then does this mean Turbotax software made a mistake for that $500 credit??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should I amend my 2019 tax so my dependent mother can receive Stimulus check

In my case there was another question in line of "do you and other family members collectively provide more than 50% for your dependent?" Which I said yes, and another question that asked something like "will you be the only one who is going to claim the dependent and nobody else?"

So maybe that is what makes the difference? As long as only one person out of group of people who support the dependent claim the dependent then it is ok?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should I amend my 2019 tax so my dependent mother can receive Stimulus check

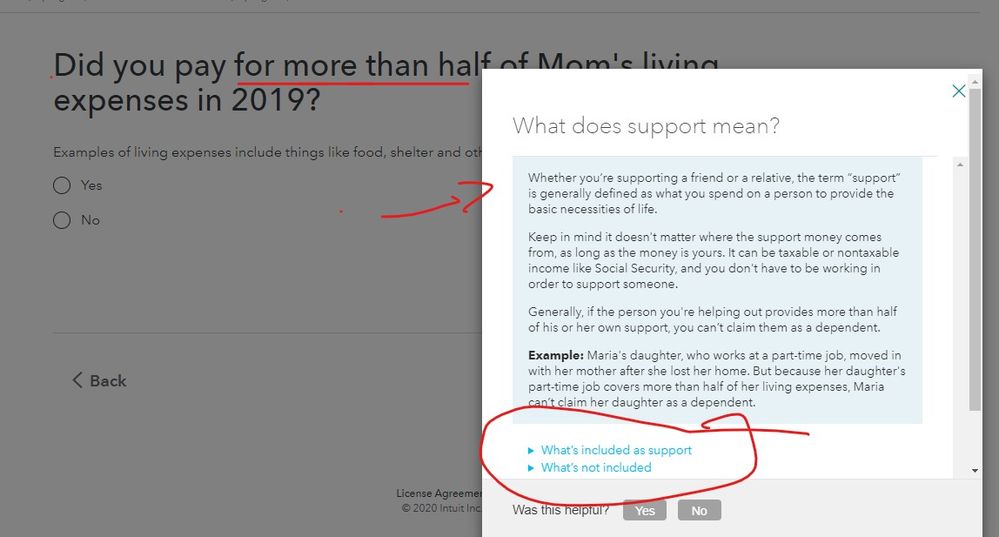

TT cannot guarantee that you entered the correct information ... you must read the screens plus the extra info to make sure you give the proper answer ... so if you said you paid for more than 1/2 the total living expenses for the year and your mom owns the home and pays for most of her own personal expenses then that is on you ...

Who can I claim as my dependent?

You can claim a child, relative, friend, or fiancé (etc.) as a dependent on your 2018 taxes as long as they meet the following requirements:

Qualifying child

- They are related to you.

- They aren't claimed as a dependent by someone else.

- They are a U.S. citizen, resident alien, national, or a Canadian or Mexican resident.

- They aren’t filing a joint return with their spouse.

- They are under the age of 19 (or 24 for full-time students).

- No age limit for permanently and totally disabled children.

- They live with you for more than half the year (exceptions apply).

- They didn't provide more than half of their own support for the year.

Qualifying relative

- They don't have to be related to you (despite the name).

- They aren't claimed as a dependent by someone else.

- They are a U.S. citizen, resident alien, national, or a Canadian or Mexican resident.

- They aren’t filing a joint return with their spouse.

- They lived with you the entire year.

- They made less than $4,150 in 2018 ($4,250 in 2019).

- You provided more than half of their financial support.

When you add someone as a dependent, we'll ask a series of questions to make sure you can claim them.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should I amend my 2019 tax so my dependent mother can receive Stimulus check

@Critter is absolutely correct...it is on YOU to read the questions closely and answers correctly.

yes, mistakes occur but note the statement that each of us signs which is at the bottom of the tax return:

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete.

if you find out later that you made a mistake and the form is no longer true, correct and complete, it's incumbent on your to amend. You just can't shirk the responsibility and say 'oh well'; if the IRS find that out before you correct, there could be files, penalties and in egregious cases, people go to jail!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should I amend my 2019 tax so my dependent mother can receive Stimulus check

@barbjkus - Turbo tax guarantees the software works; they do not guarantee the input is correct.

if the tax due is wrong on a return caused by their software , they will pay the penalties and interest

if the due due is wrong on a return tax because a tax paper incorrectly answered a question or 'fat fingered' a number, they do not guarantee against that

make sense?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should I amend my 2019 tax so my dependent mother can receive Stimulus check

First of all, thank you so much for you answers and opinions! But I do have some follow up questions if I may.

@Critter - On that screen captured question you posted, I clicked "NO" and if I remember it correctly, it led me to questions such as "did you provide more than 10% for your dependent?" And when I clicked yes on that it led me to question such as "Did you and other members support more than 50% for the dependent collectively?" When I clicked YES on that it asked me question such as "will nobody else claim the dependent?" and it told me to file form 2120, "Multiple Support Declaration." (order of questions might be wrong though)

In form 2120, it basically says "During the calendar year 2019, the eligible persons listed below each paid over 10% of the support of dependent" And it goes on saying "I have signed statement from each eligible person waiving his or her right to claim this person as a dependent for any tax year that began in the above calendar year. "

My question now is that since questions asked by Turbotax (such as "do you provide more than 50%?") was so simple and straightforward, I simply clicked yes or no without looking into detailed explanation as suggested by @Critter. And after the question "did you provide more than 10%" there was a specific form 2120 to fill in, I thought as long as family members collectively provide more than 50% and only one person who provide more than 10% claim the dependent, then it is ok.

And here is the portion of Turbotax blog titled "can you claim a parent as a dependent?" https://blog.turbotax.intuit.com/tax-deductions-and-credits-2/family/can-you-claim-a-parent-as-a-dep...

"If support for your parent was given by a group of individuals or family members, you may want to sign a Multiple Support Declaration (Form 2120) if you also supported your parent and you want to claim them. A Multiple Support Declaration (Form 2120) is a signed statement from each eligible person, waiving his or her right to claim the parent as a dependent."

So in case where family members collectively support the dependent, then can one person out of that collective group can claim the dependent if he/she provides more than 10% yet not quite 50%? That is how I understood it as I was answering questions on Turbotax and filling out the form 2120 as instructed by Turbotax... But if I understood it wrong, then I better amend it asap!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should I amend my 2019 tax so my dependent mother can receive Stimulus check

And when I clicked yes on that it led me to question such as "Did you and other members support more than 50% for the dependent collectively?"

Who else supported mom ? "Other members" does not include mom... I think that is where you made the error. Did you really have help from others ? Other working dependents in the home do not count.

You mentioned that your mom owns the home not you ... support of mom means she brings the home into the picture and with her income paying all her personal bills I doubt you can say you paid more than 1/2 by yourself. There is a good worksheet in the IRS pub 17 to review ... see page 30 : https://www.irs.gov/pub/irs-pdf/p17.pdf

That section about other members supporting mom comes into play when say you have siblings and you all pay in more than 1/2 the cost of mom's living expenses combined then you can agree that one of you can claim mom hense the form 2120. For instance mom is in a nursing home that runs $3K a month ... and her income is only $1K and the rest comes from you and your 2 siblings ...you pay only $500 but they pay $750 each ... then combined you all pay more than 1/2 the cost and ONE of you may claim mom if you all agree.

The subject of dependents is so complicated that when I taught the H&R BLOCK tax courses we spent 6 hours on this item all by itself ... in fact the filing status, dependents and child related credits took up the first 3 weeks of the 18 week course because it can be that confusing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should I amend my 2019 tax so my dependent mother can receive Stimulus check

Well I think you did not continue reading the screens ... it told you to fill in the form 2120 and have everyone sign one ... if you had looked at the form and instructions you may have realized you had it wrong ... Not sure who else supported the household if you cannot claim mom since she is the dependent you are trying to claim. Again ... if the "person" you are trying to claim as the dependent owns the home and pays the taxes, insurance and utilities I doubt you can claim them. Look at the support worksheet in the other answer.

https://www.irs.gov/forms-pubs/about-form-2120

Purpose of Form

Use Form 2120 to:

• Identify each other eligible person (see below) who paid over 10% of the

support of your qualifying relative whom you are claiming as a dependent,

and

• Indicate that you have a signed statement from each other eligible person

waiving his or her right to claim that person as a dependent.

An eligible person is someone who could have claimed a person as a

dependent except that he or she didn’t pay over half of that person’s

support.

If there are more than four other eligible persons, attach a statement to

your return with the required information.

Note: The rules for multiple support agreements apply to claiming an

exemption for a qualifying relative and don't apply to claiming an exemption

for a qualifying child. For the definitions of “qualifying relative” and “qualifying

child,” see the instructions for your tax return and Pub. 501.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should I amend my 2019 tax so my dependent mother can receive Stimulus check

Again thank you for your reply!

Oh my... when I simply followed Turbotax questions I didn't expect it to be this complicated!

So in our case my mom does not own her house, she lives in the apartment by herself and my sister and I are paying for her rent collectively. And there is one aunt who helps her out with some of the living cost. I would say I don't quite provide 50% of the living cost, but it is more like 40%. But when combined between my sister and aunt and I, we definitely support way more than 50% for my mom. So in this case is it ok for us with the form 2120? Or should I go ahead and amend my return? I did collect signed forms from each supporting members as instructed by from 2120.

Thank you so much for your replies and sharing expertise in this matter.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should I amend my 2019 tax so my dependent mother can receive Stimulus check

@Critter I think it was other user who was asking questions earlier who had mom who owns her home 🙂

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should I amend my 2019 tax so my dependent mother can receive Stimulus check

So there is no way that turbo tax didn't skip a few prompts and wouldn't the file turned in to the irs have to have the worksheets filled out like who are you claiming, how, much does this person make, etc to prove you can claim them. There is a margin of error for a tax payer who doesn't know every tax law, but there should be no margin of error for turbo tax. Anyway, the file ill tell what questions were asked and what imput was given.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should I amend my 2019 tax so my dependent mother can receive Stimulus check

SO it is not tax fraud, what i did? My mom can't turn me in?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should I amend my 2019 tax so my dependent mother can receive Stimulus check

if you consciously filled out the tax return wrong, or now know it's wrong and fail to fix it, yes, that could constitute tax fraud.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

kaylinflores30-g

New Member

eyeluvmyboys

New Member

DomN9

New Member

loco125359

New Member

sopa643479

New Member