- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Why are you charging $39.99 refund processing fee?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why are you charging $39.99 refund processing fee?

Considering that Turbo Tax software and electronic filing service is what customers pay for, why are customers being charged an additional $39.99 "Refund Processing Fee" when the IRS and state tax agencies actually electronically deposit the refunds directly to the customer's account? Why pay an additional "$40.00" for a service that's part of the normal processing by IRS and my state tax authority? Appears this is just a scheme to get additional payment from your customers. Please provide a detailed explanation. Thank you

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why are you charging $39.99 refund processing fee?

If you choose the totally optional Refund Processing Service to have your TurboTax account fees paid from the federal tax refund instead of paying the TurboTax account fees upfront with a credit card, then there is a service charge for this option of $39.99.

After the tax return has been e-filed and received by the IRS, the IRS will Process, Approve and then Send the federal tax refund to the third party processor where they will deduct the TurboTax account fees and their $39.99 service charge. The remainder of the federal tax refund is then sent to the bank you indicated for direct deposit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why are you charging $39.99 refund processing fee?

Although it is not crystal clear ... the screen does mention the extra fee to use that option ... if you have not filed yet you can return to step 1 of the FILE tab to remove the fee by choosing the other option.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why are you charging $39.99 refund processing fee?

I DID NOT ASK FOR ME CHARGE TO BE DEDUCTED FROM MY REFUND. I'M NOT GETTING A REFUND. I ASKED THAT THE MONEY BE DEDUCTED FROM MY BANK ACCOUNT. NOW WHAT?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why are you charging $39.99 refund processing fee?

@eiuol wrote:

I DID NOT ASK FOR ME CHARGE TO BE DEDUCTED FROM MY REFUND. I'M NOT GETTING A REFUND. I ASKED THAT THE MONEY BE DEDUCTED FROM MY BANK ACCOUNT. NOW WHAT?

If you have taxes owed on a federal tax return, the option to pay from the federal tax refund would not even be available. In the File section of the program in Step 2 with taxes owed you are given several option on how to pay the taxes. If you chose direct debit from your bank account the tax return will include that information and the IRS will debit your account,

If you are still working on the 2019 tax return then you can view your fees by clicking on Tax Tools on the left side of the screen. Click on Tools. Click on My Fees. What is the breakdown of those fees?

If you have filed your tax return -

To access your current or prior year online tax returns sign onto the TurboTax website with the userID you used to create the account - https://myturbotax.intuit.com/

Scroll down to the bottom of the screen and on the section Your tax returns & documents click on Show. Click on the Year and Click on View order details

How you chose to pay the taxes owed will be on the Filing Instructions page included with your tax return.

Sign onto your TurboTax online account - https://myturbotax.intuit.com/

Scroll down and click on Add a State. This will take you back to the 2019 online tax return.

Click on Tax Tools on the left side of the online program screen. Then click on Print Center. Then click on Print, save or preview this year's return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why are you charging $39.99 refund processing fee?

It appears that your question was not answered and I want to know also why this fee exists and why are we being charged the additional $40 for processing our federal tax refund(s). Does anyone have an answer to this question before I file my taxes? I've used Turbo Tax for many many years and I'm not happy with the additional charge after paying for the software and now this charge too?

My question still remains, what is this charge? How can we get around not paying this fee whether it be deducted from your refund or charged to a credit or debit card and still file our taxes electronically?

Help...pls!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why are you charging $39.99 refund processing fee?

@sbolin1955 wrote:

It appears that your question was not answered and I want to know also why this fee exists and why are we being charged the additional $40 for processing our federal tax refund(s). Does anyone have an answer to this question before I file my taxes? I've used Turbo Tax for many many years and I'm not happy with the additional charge after paying for the software and now this charge too?

My question still remains, what is this charge? How can we get around not paying this fee whether it be deducted from your refund or charged to a credit or debit card and still file our taxes electronically?

Help...pls!

The question was answered. Th;e poster stated "I'M NOT GETTING A REFUND" so there would not have been an option to pay the TurboTax account fees from the federal tax refund since they were NOT receiving a federal tax refund. They must pay the TurboTax account fees with a credit or debit card.

This is not a new charge, it has been an option for years to have the TurboTax account fees paid from the federal tax refund instead of paying the account fees with a credit or debit card.

The $40 service charge is Not imposed by TurboTax. It is the service charge of the third party processor who received the federal tax refund from the IRS then deducts the TurboTax account fees and their service charge from the federal tax refund. The third party processor then sends the remaining federal tax refund as a direct deposit to the bank account selected by the user of the TurboTax software.

For the status of your tax refund you will need to contact the third party processor, Santa Barbara Tax Product Group, using their website - https://www.sbtpg.com/

Tax Products Group Contact Information - https://help.sbtpg.com/hc/en-us/articles/230084587-Contact-Information

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why are you charging $39.99 refund processing fee?

@sbolin1955 How to remove the pay with refund fees and pay the account fees with a credit card - https://ttlc.intuit.com/community/downgrading/help/how-do-i-remove-pay-with-my-refund-fees-in-turbot...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why are you charging $39.99 refund processing fee?

Thank you for your quick response to my inquiry however, I disagree with your answer. I've never been charged or paid the $40 for processing my refunds in all the years I've used Turbo Tax whether it be to a third party or not. I've never paid it and I don't want to pay it now!

I understand the concept of having a third party involved something like the banking institutions have when doing wire transfers the money goes through a clearing house after the money has left one bank to arrive at another. It just seems like an unnecessary and costly process to implement. I still do not want to pay it! How do I get around that process?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why are you charging $39.99 refund processing fee?

@sbolin1955 wrote:

Thank you for your quick response to my inquiry however, I disagree with your answer. I've never been charged or paid the $40 for processing my refunds in all the years I've used Turbo Tax whether it be to a third party or not. I've never paid it and I don't want to pay it now!

I understand the concept of having a third party involved something like the banking institutions have when doing wire transfers the money goes through a clearing house after the money has left one bank to arrive at another. It just seems like an unnecessary and costly process to implement. I still do not want to pay it! How do I get around that process?

You have not had to pay the service charge because you either used the Free edition or you have always selected to pay the TurboTax account fees with a credit or debit card.

How to remove the pay with refund fees and pay the account fees with a credit card - https://ttlc.intuit.com/community/downgrading/help/how-do-i-remove-pay-with-my-refund-fees-in-turbot...

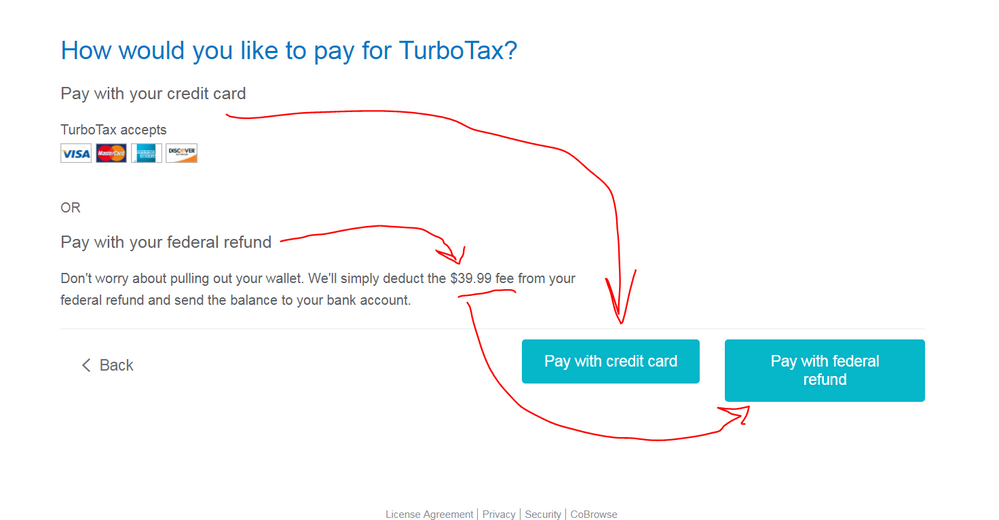

Screenshot for selecting how to pay the TurboTax account fees -

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why are you charging $39.99 refund processing fee?

Again thank you for your quick response however, you are still incorrect in your answer. I have always paid to download Turbo Tax software every year for more than 20 years and never paid for any additional account fees or third party fees. I've never had to use a credit or debit card to pay for these fees that simply have appeared out of nowhere this year.

Obviously I'm frustrated and I apologize if I seem impossible. But I am outraged!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why are you charging $39.99 refund processing fee?

@sbolin1955 wrote:

Again thank you for your quick response however, you are still incorrect in your answer. I have always paid to download Turbo Tax software every year for more than 20 years and never paid for any additional account fees or third party fees. I've never had to use a credit or debit card to pay for these fees that simply have appeared out of nowhere this year.

Obviously I'm frustrated and I apologize if I seem impossible. But I am outraged!

Ohhh...You are using the TurboTax desktop CD/Download editions. That changes all my responses. Wish I would have known sooner.

In the TurboTax desktop editions when you e-file a state tax return, there is an e-file charge that is currently $24.99. Before paying the e-file charge there is a screen in the Payment section of File which asks you if you want to pay with a credit card or pay with the federal refund. The screen also shows the price of $39.99 for the fee of using the pay with refund option.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why are you charging $39.99 refund processing fee?

@sbolin1955 Clicked on reply to soon before I could show you how to get rid of the pay with refund option.

Click on File. Click on File a Return.

Choose e-file and continue through all the screens in the File section until you are back in the Payment section. There will be the following screen so that you can change to using your credit card from paying with the refund.

The following screen will ask how you want to pay, there you choose credit card.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why are you charging $39.99 refund processing fee?

I agree with you! I was going to be charged the additional $40 whether I used the account or the refund. Can anyone explain why? If that's the case I won't use turbotax next year.

Thanks for nothing!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why are you charging $39.99 refund processing fee?

I got to admit that this is absolutely awful. I remember that last year, it was FREE to file my state return. Now, I have to pay $59 to upgrade to deluxe since I had an HSA and now it's also an additional $39 to file my state, plus they want an additional $39.99 if you pay with your federal return. This is ridiculous and honestly, I'm going to start looking at other sites to file my tax return. What a joke, It would cost me over $150 to file on Turbo tax if i paid with my federal return, so I'd be better off going to H&R block, but I have to wait until 02/10 to get some stupid form for my Health Insurance anyways to finish filing, so hopefully, I'll have the stupid $98 then.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Martin Yue

New Member

crash345u

Level 4

hellbitch24

New Member

lynette2736

New Member

John9900

New Member