- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: When I filed my 2019 taxes, I selected that I could be claimed by my parents for my taxes, however they did not claim me on theirs. Because of this I didn’t get the first stimulus check, what can

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I filed my 2019 taxes, I selected that I could be claimed by my parents for my taxes, however they did not claim me on theirs. Because of this I didn’t get the first stimulus check, what can

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I filed my 2019 taxes, I selected that I could be claimed by my parents for my taxes, however they did not claim me on theirs. Because of this I didn’t get the first stimulus check, what can

the fact that they did not claim you is irrelevant. the question is could they claim you. if they could clai you you don't get the stimulus. however, if your depency status changes where they can not claim you in 2020 you get the stimulus by filing your 2020 return

you could be claimed as a qualifying child (dependent) if all these tests are met

• you have the same principal abode as the other party for more than ½ the tax year. Temporary absences like for school are ignored

• If not a full-time student (5 months per year), under 19 at the end of the tax year. If a full-time student under 24 at end of the tax year.

• you haven't provided over ½ your own support

• you didn't file a joint return unless there was no tax liability but merely filing jointly to facilitate refund of taxes withheld or estimates paid

or as you could be a qualifying relative if all these tests are met

> your related or if not lived with the other party for the entire year

• your gross income for 2019 (2020) less than $4,200 ($4300)

• the other party provided over ½ his support

• you aren't a qualifying child of another taxpayer

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I filed my 2019 taxes, I selected that I could be claimed by my parents for my taxes, however they did not claim me on theirs. Because of this I didn’t get the first stimulus check, what can

I have not been in the same household as my parents for about a year, and I am not a student either. I provide 100% for my own support and I was confused as to why I didn’t get the first stimulus check, and an H&R Block rep told me that it was because I selected that I was unsure whether I could be claimed as a dependent. Even though I later found out they couldn’t claim me. I would think that would outweigh what I selected.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I filed my 2019 taxes, I selected that I could be claimed by my parents for my taxes, however they did not claim me on theirs. Because of this I didn’t get the first stimulus check, what can

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I filed my 2019 taxes, I selected that I could be claimed by my parents for my taxes, however they did not claim me on theirs. Because of this I didn’t get the first stimulus check, what can

@gemack99- wrote:

I have not been in the same household as my parents for about a year, and I am not a student either. I provide 100% for my own support and I was confused as to why I didn’t get the first stimulus check, and an H&R Block rep told me that it was because I selected that I was unsure whether I could be claimed as a dependent. Even though I later found out they couldn’t claim me. I would think that would outweigh what I selected.

What *you* selected on *your* tax return determines it. Amending now will do no good since amended returns will take 6 months or longer to process. Just file your 2020 tax return before April 15, 2021 and indicate that you did not receive the stimulus and the IRS will use the 2020 tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I filed my 2019 taxes, I selected that I could be claimed by my parents for my taxes, however they did not claim me on theirs. Because of this I didn’t get the first stimulus check, what can

@macuser_22 - I think @gemack99- approach may be easier than suggested. Agree that amending prior year does not good - the IRS will stop issuing 1st stimulus payments in January and then stop the 2nd stimulus payments on January 15, 2021.

The simple approach for @gemack99- is just fill out the 2020 tax return and if he fills it out correctly there should be $1100 on Line 30. It's that simple. That is 'telling' the IRS that stimulus is due.

in particular:

Anyone who received the first round of payments earlier this year but doesn’t receive a payment via direct deposit will generally receive a check or, in some instances, a debit card. For those in this category, the payments will conclude in January. If additional legislation is enacted to provide for an additional amount, the Economic Impact Payments that have been issued will be topped up as quickly as possible.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I filed my 2019 taxes, I selected that I could be claimed by my parents for my taxes, however they did not claim me on theirs. Because of this I didn’t get the first stimulus check, what can

@NCperson wrote:

@macuser_22 - I think @gemack99- approach may be easier than suggested. Agree that amending prior year does not good - the IRS will stop issuing 1st stimulus payments in January and then stop the 2nd stimulus payments on January 15, 2021.

The simple approach for @gemack99- is just fill out the 2020 tax return and if he fills it out correctly there should be $1100 on Line 30. It's that simple. That is 'telling' the IRS that stimulus is due.

Isn't that exactally what I said to do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I filed my 2019 taxes, I selected that I could be claimed by my parents for my taxes, however they did not claim me on theirs. Because of this I didn’t get the first stimulus check, what can

@macuser_22 - sorry - this threw me -

"indicate that you did not receive the stimulus"

like it was an extra step or letter that had to be attached to the submission .

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I filed my 2019 taxes, I selected that I could be claimed by my parents for my taxes, however they did not claim me on theirs. Because of this I didn’t get the first stimulus check, what can

@NCperson wrote:

@macuser_22 - sorry - this threw me -

"indicate that you did not receive the stimulus"

like it was an extra step or letter that had to be attached to the submission .

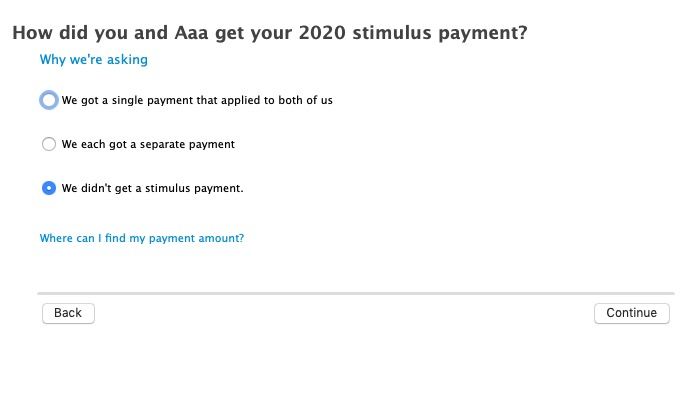

That is the questions that TurboTax 2020 will ask. If you did not receive it in the past check the box that you did not receive it.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

bhilton3791

New Member

ra4677004

New Member

jimdeissler

New Member

user17525148980

New Member

girigiri

Level 3