- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: What is the scorp timeline of forms to file for federal

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the scorp timeline of forms to file for federal

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the scorp timeline of forms to file for federal

See this TurboTax website for S Corp Business forms availability - https://care-cdn.prodsupportsite.a.intuit.com/forms-availability/turbotaxbusiness_fed_windows_scorp....

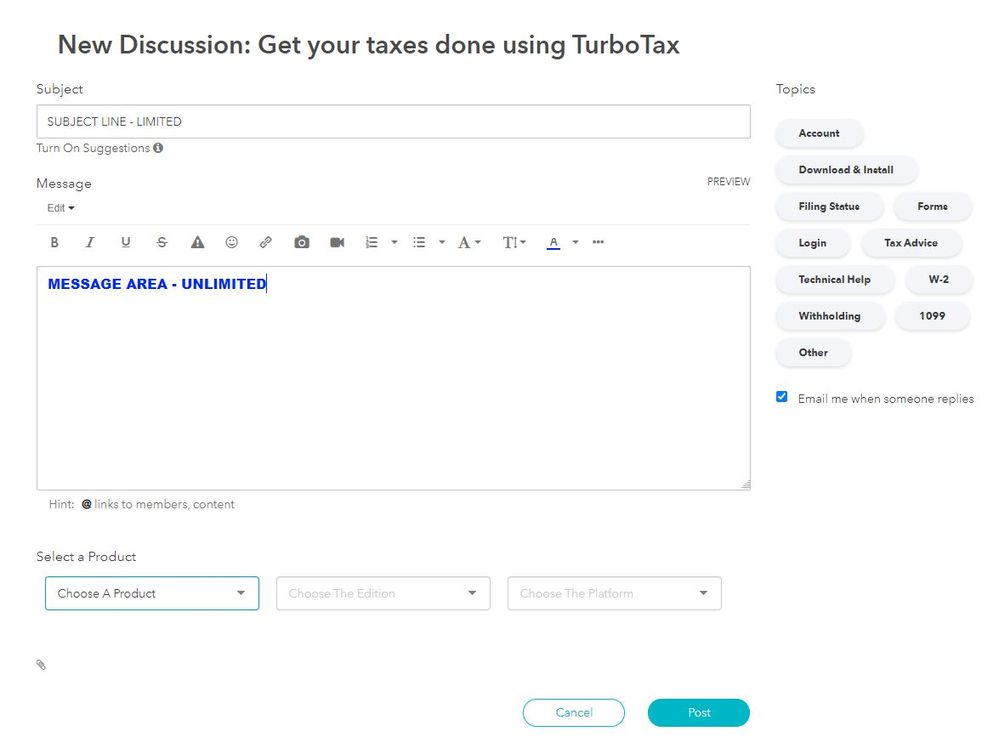

The subject line of a question is limited in the number of characters. However just below the subject line is where you can write a message and there is no limit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the scorp timeline of forms to file for federal

calendar year 2019 - 3/16/2020

calendar year 2020 -3/15/2021 as of now

these are the normal due dates without extension

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the scorp timeline of forms to file for federal

If anyone has the timeline for forms to file fir scorp, please share. I believe there is a form for December and January to file before March 15th filing. I thought one was w-2 but I can't find any info online and the customer service lines are closed when I'm off work.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the scorp timeline of forms to file for federal

Do you have answers to my original questions?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the scorp timeline of forms to file for federal

@stephanie24 wrote:

I thought one was w-2 but I can't find any info online.....

Generally, Forms W-2, W-3,1096 and most common 1099 variants are due January 31st after the close of the calendar year (i.e., they would be due January 31, 2021).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the scorp timeline of forms to file for federal

I'm still seeking a cohesive list for yearly tax forms for Scorp.

My guesses so far:

Something is filed by December 31 that estimates filing?

W-2 by January 31st

Schedule k by March 15th?

1120s by March 15th?

Federal and state return by March 15th

If someone has an excel sheet, list or clearer outline, I could use it. I've done consultations and showered the internet but nothing. Soneone has to have an organized list.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the scorp timeline of forms to file for federal

The link below has information on federal filing dates for S corporations.

https://turbotax.intuit.com/tax-tips/small-business-taxes/s-corp-federal-tax-filing-dates/L1U6tYGMt

If you have a spreadsheet program (e.g., Excel), you should be able to easily make your own, personalized, spreadsheet, which should include filings required by your specific state (e.g., annual reports, workers' comp, sales tax, et al).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the scorp timeline of forms to file for federal

Something is filed by December 31 that estimates filing? - nothing for the S-Corp for federal purposes but maybe something for the state. generally, states have a franchise tax return/annual report (due dates vary) for a corporation but that mat not apply if it were an LLC that elected S-Corp status. may states impose a fee for being an LLC again due dates vary

W-2 by January 31st? - actually 2/1/21 because 1/31 is a Sunday

Schedule k by March 15th? yes but actually k-1 to shareholders

1120s by March 15th? yes

Federal and state return by March 15th - the only federal income tax return is the 1120s (as above) unless you elected a fiscal year other than one ending 12/31. some states require that a tax return be filed have a different due date than the federal and some of those impose an income tax on the S-Corp net income. others have no filing requirements.

you also have to file form 940 federal unemployment tax return. you may have state filing requirements for state unemployment. those are usually filed quarterly

Who Must File Form 940?

Except as noted below, if you answer “Yes” to either one

of these questions, you must file Form 940.

• Did you pay wages of $1,500 or more to employees in

any calendar quarter during 2019 or 2020?

• Did you have one or more employees for at least some

part of a day in any 20 or more different weeks in 2019 or

20 or more different weeks in 2020? Count all full-time,

part-time, and temporary employees.

If your business was sold or transferred during the year,

each employer who answered “Yes” to at least one

question above must file Form 940. However, don't

include any wages paid by the predecessor employer on

your Form 940 unless you’re a successor employer. For

details, see Successor employer under Type of Return,

later.

If you’re not liable for FUTA tax for 2020 because you

made no payments to employees in 2020, check box c in

the top right corner of the form. Then go to Part 7, sign the

form, and file it with the IRS.

If you won’t be liable for filing Form 940 in the future

because your business has closed or because you

stopped paying wages, check box d in the top right corner

of the form. For more information, see Final: Business

closed or stopped paying wages under Type of Return,

later.

these are the normal due dates. there is no telling if the IRS and/or state will automatically extend the due dates if the pandemic is still going on.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

jhigh2118

New Member

koursaros

Level 2

karrie-taplin

New Member

nicholas-r-fish

New Member

rpozzy

Level 1