- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Turbo Tax incorrectly fills out CA Schedule A and will not let me modify the greyed out field...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax incorrectly fills out CA Schedule A and will not let me modify the greyed out fields. How can I correct the entries?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax incorrectly fills out CA Schedule A and will not let me modify the greyed out fields. How can I correct the entries?

You must make the adjustments in the California income adjustment section of TurboTax. (See below)

Federal law allows an exclusion from gross income the value of any medal awarded or prize money received from the U.S. Olympic Committee on account of competition in the Olympic Games or Paralympic Games. The exclusion does not apply to a taxpayer for any year in which the taxpayer’s adjusted gross income exceeds $1 million, or half of that amount in the case of a married individual filing a separate return. California does not conform.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax incorrectly fills out CA Schedule A and will not let me modify the greyed out fields. How can I correct the entries?

Thanks for the reply. I understand that is what needs to be done. The problem is that TurboTax makes the adjustment in Column A of line 9 in the CA Schedule A when it should make the adjustment in Column C of line 9 in the CA Schedule A. Because TurboTax puts the amount in Column A, when the return is reviewed by the California Tax Board, they see the Olympic Prize Money in the Federal Return not listed in Column C, so they add it to Column C and as a result, the Olympic Prize Money is added twice causing my adjusted gross income to be more than it really is. The California Tax Board then says I owe more than I really do. This happened with both my 2019 and 2020 return.

I try to manually change the edit to Column C in CA Schedule A, but TurboTax has the field greyed out so that I cannot make edits. My question is not a Tax Return question. My question is how to correct a TurboTax error in how it handles adjustments. I need to manually make the edit and TurboTax won't let me. How can force the edit in Turbotax or how can Turbotax be corrected so that it reports the adjustment in Column C?

Thanks,

Mary Ann

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax incorrectly fills out CA Schedule A and will not let me modify the greyed out fields. How can I correct the entries?

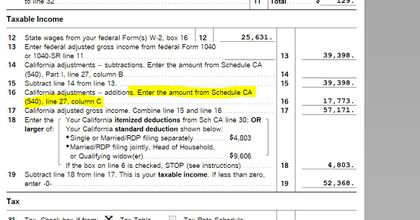

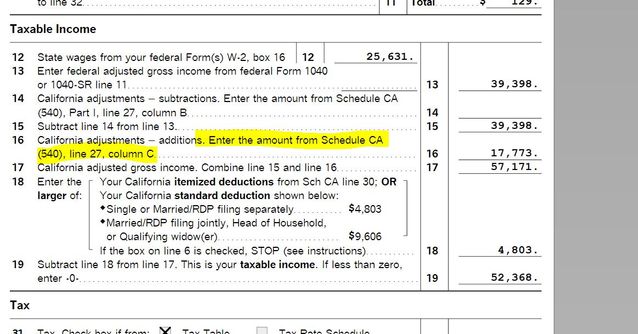

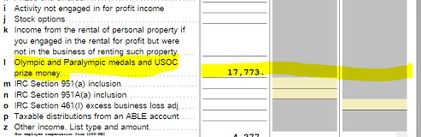

Trying to recreate your scenario in TurboTax Desktop, I see the Olympic Prize on Schedule CA, Line 24c in Col. B (screenshot).

If you can send a screenshot or direct me to where you are, we'll try to help.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax incorrectly fills out CA Schedule A and will not let me modify the greyed out fields. How can I correct the entries?

Hi Marilyn,

Thanks for helping on this.

Line 16 of form 540 says to enter the amount in column C from Schedule CA. Turbotax is putting the amount in Column A of Schedule C and adding it to line 16. So although, the final adjusted Gross is correct, when the Calif. auditors look at the form, they put the amount in Column C and then add it again. As a result, the Olympic Prize money is added 2 times to my gross income. This happened in my 2019 and 2020 return as well.

How do I get TurboTax to enter the amount in Column C of Schedule CA? I can't do it manually because Column C is greyed out.

Thanks,

Mary Ann

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax incorrectly fills out CA Schedule A and will not let me modify the greyed out fields. How can I correct the entries?

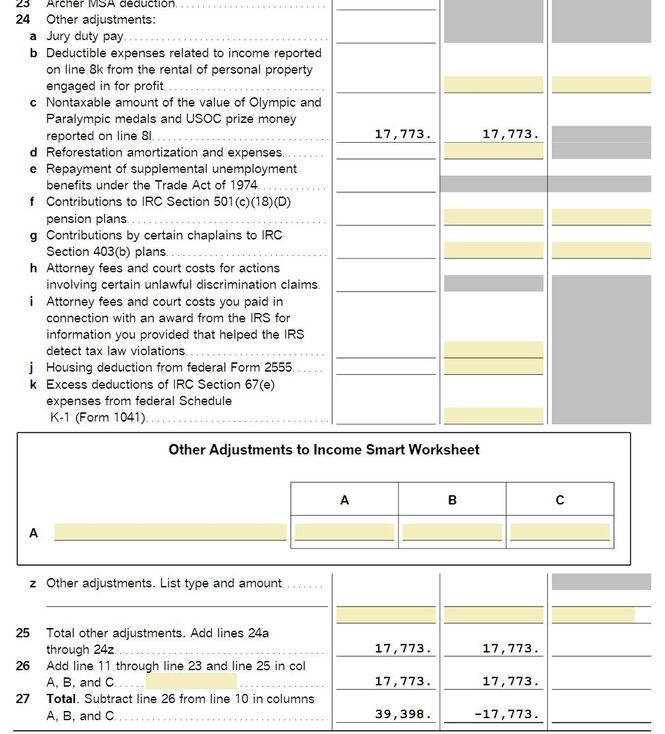

Prize amount shows in Section B, Line l, Column A (like your screenshot). Then again below under Section C, Line 24c, in Col A (Federal) and Col B (CA Subtractions). Do you see your prize amount in the 'Subtractions' Col B on Line 24c?

Column C is grayed out for 'Additions' which it should be.

The amount transferring to Line 16 on Form 540 is from Line 27, Col C on the Schedule CA. Your prize amount should not be included there (only items from 'Additions').

Can't understand why FTB would want to add it back in, when Schedule CA shows it clearly as a 'Subtraction'.

If you have letters from California FTB about this, you may want to Contact TurboTax Help.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax incorrectly fills out CA Schedule A and will not let me modify the greyed out fields. How can I correct the entries?

Hi Marilyn,

I really do appreciate your help on this. I will contact TurboTax help, but I have a couple more questions for you.

I agree that line 16 on form 540 is from Line 27, Column C. Please see my original screen shot that shows $17,773 has been added to line 16 and if you see the screen shot below of Schedule CA, that number does not exist in line 27 Column C. It appears that TurboTax is getting it from Column A or Column B line 25 or 26 but not line 27.

Does that make sense? Am I missing something?

Just FYI, in the chat with FTB last year (using different numbers), here is the response.

"Dustin[1:47 PM]:

So if the IRS does not tax that you would leave that out of Column A since the IRS is not taxing that portion and then the taxable amount to CA would have been the $27,409 in column C. So line 9 column A should have been $20,154 and then line 9 column C would be the $27,409 for a total income of $47563"

Any help you can provide is appreciated, including how I should phrase my question to TurboTax help.

Thanks again,

Mary Ann

Original screen shot of form 540

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax incorrectly fills out CA Schedule A and will not let me modify the greyed out fields. How can I correct the entries?

I would like to take a deeper look at this. However, I need a diagnostic file which is a copy of your tax return that has all of your personal information removed. You can send one to us by following the directions below:

TurboTax Desktop/Download Versions:

- Open your return.

- Click the Online tab in the black bar across the top of TurboTax and select “Send Tax File to Agent”

- This will generate a message that a diagnostic copy will be created. Click on OK and the tax file will be sanitized and transmitted to us.

- Please provide the Token Number that was generated in the response.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax incorrectly fills out CA Schedule A and will not let me modify the greyed out fields. How can I correct the entries?

Hi Marilyn,

Thanks for looking at the return. The token number is 974704

Regards,

Mary Ann

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax incorrectly fills out CA Schedule A and will not let me modify the greyed out fields. How can I correct the entries?

Hi Marilyn,

I checked "Save a copy for yourself" when sending the diagnostic file to an agent. I can't find where the copy is saved. Do you know?

Thanks,

Mary Ann

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax incorrectly fills out CA Schedule A and will not let me modify the greyed out fields. How can I correct the entries?

Search for *.tax2021 on your computer.

I'll send your token file to our Investigations team. I think it may be the negative amount you have on your Schedule CA, Line 27, Column B.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax incorrectly fills out CA Schedule A and will not let me modify the greyed out fields. How can I correct the entries?

Hi Marilyn,

Again, thanks for all the help on this. I downloaded the 540-CA instructions from the FTB website and found the following:

c. Nontaxable amount of the value of Olympic and Paralympic medals

and USOC prize money reported on line 8l – Federal law allows an

exclusion from gross income for the value of any medal awarded or prize

money received from the U.S. Olympic Committee on account of competition

in the Olympic Games or Paralympic Games. The exclusion does not apply

to a taxpayer for any year in which the taxpayer’s adjusted gross income

exceeds $1 million, or half of that amount in the case of a married individual

filing a separate return. California does not conform. If you deducted the

amount for federal purposes, enter that amount in column B

Line 27, column B to Form 540, line 14

If column B is a negative number, transfer the amount as a positive

number to Form 540, line 16.

So, it appears TurboTax is calculating it correctly, even though the tax form only says to transfer line 27 Column C, the instructions provide more detail.

I am concerned since this contradicts what the FTB advised during my 2020 tax return, but I will cross that bridge again when I get there.

I don't think it is necessary for your investigation team to review my file.

Again, thanks for all the help.

Regards,

Mary Ann

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

kevin-chow

New Member

dlif2

Returning Member

JeanneE

Returning Member

tbuser6686

Level 1

T_G_D

Level 2