- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Our taxes were not e-filed even though I completed all steps in September

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Our taxes were not e-filed even though I completed all steps in September

TurboTax seems to have erased what we filled out in September (we got an extension in April), and the IRS has no record of our e-filing anything (I just checked online). I luckily have a PDF version of both state and federal returns and an email from TurboTax confirming my payment, but even if I print and send the forms off today, we'll be late filing our taxes.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Our taxes were not e-filed even though I completed all steps in September

And please no gaslighting responses implying that I'm at fault for not clicking that last "submit" button. I've read the answers to other questions similar to mine, and it's not possible for so many of us to be confused by the process of filing. There's clearly some kind of glitch, and it has huge consequences for people who trusted TurboTax to e-file their taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Our taxes were not e-filed even though I completed all steps in September

You say you received an email confirming payment. And you do not want to hear this, but paying TurboTax does not file your return. You do have to click that big orange button that says "Transmit my returns."

Did you receive emails that told you your e-file was accepted when you e-filed in September?

When you e-file your federal return you will receive two emails from TurboTax. The first one will say that your return was submitted. The second email will tell you if your federal return was accepted or rejected. If you e-filed a state return, there will be a third email to tell you if the state accepted or rejected your state return.

Check your e-mail from September--including your spam folder.

What does it say when you use the e-file lookup tool?

https://turbotax.intuit.com/tax-tools/efile-status-lookup/

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Our taxes were not e-filed even though I completed all steps in September

@rd - indiana wrote:

And please no gaslighting responses implying that I'm at fault for not clicking that last "submit" button. I've read the answers to other questions similar to mine, and it's not possible for so many of us to be confused by the process of filing. There's clearly some kind of glitch, and it has huge consequences for people who trusted TurboTax to e-file their taxes.

Paying the TurboTax account fees does not file a tax return.

Did you e-file your tax return and was it accepted?

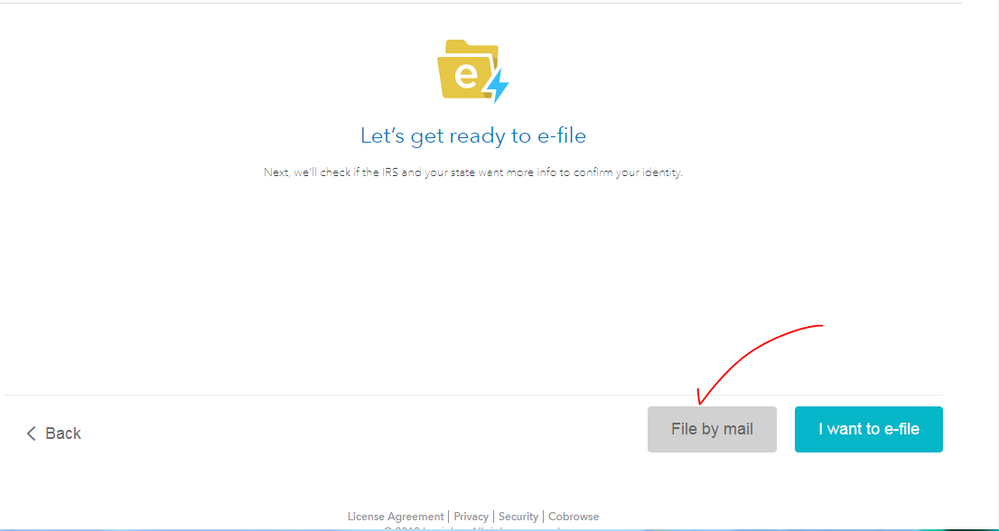

You complete your tax return by finishing all 3 Steps in the File section. In Step 3, to e-file your tax return, you must click on the large Orange button labeled "Transmit my returns now".

After completing the File section and e-filing your tax return you will receive two emails from TurboTax. The first email when your tax return was transmitted and the second email when the tax return has either been accepted or rejected.

Use this TurboTax website to check the status of an e-filed return and if it was either accepted or rejected - https://turbotax.intuit.com/tax-tools/efile-status-lookup/

If the status is anything other than Accepted then you will have to print and mail your 2018 tax return since e-filing has closed for 2018 tax returns.

To access your current or prior year tax returns sign onto the TurboTax website with the userID you used to create the account - https://myturbotax.intuit.com/

Scroll down to the bottom of the screen and on the section Your tax returns & documents click on Show. Click on the Year and Click on Download/print return (PDF)

Print, sign, date and mail the tax return to the IRS. Include with the mailed return any forms W-2 and 1099 which have taxes withheld. Go to this IRS website for mailing addresses - https://www.irs.gov/filing/where-to-file-paper-tax-returns-with-or-without-a-payment

There are no penalties for filing a tax return after the due date if filing for a tax refund or there are no taxes owed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Our taxes were not e-filed even though I completed all steps in September

1. Please explain why I have PDFs of my completed taxes if I didn't actually complete them. I entered everything including the bank info where our refund should be sent. If there is a mystery button that I (and many others apparently) missed clicking then that is an enormous design flaw that Turbo Tax needs to address.

2. Back in September when I e-filed my taxes, I received the following from TurboTax. It is the first page of the PDF of my tax documents. Given this thanks-and-see-you-next-year message, could you explain why I should still be looking around for that "submit" button?:

"We just want to thank you for using TurboTax this year! It's our goal to make

your taxes easy and accurate, year after year.

With TurboTax Premier:

Your Head Start On Next Year:

When you come back next year, taxes will be so easy! All your

information will be saved and ready to transfer in to your new return.

We'll ask you questions about what changed since we last talked, and

we'll be ready to get you the credits and deductions you deserve, no

matter what life throws at you.

Here's the final wrap up for your 2018 taxes:

Your federal refund is: xxxx

You qualified for these important credits:

xxxx

Your Guarantee of Accuracy:

Breathe easy. The calculations on your return are backed with our

100% Accuracy Guarantee.

- We double checked your return for errors along the way.

- We helped with step-by-step guidance to get your answers on the right

IRS forms.

- If you sold investments, our Cost Basis Lookup calculated cost

basis for those sales.

- We helped you out with extra guidance for rental property income,

expenses, and refinancing.

- We made sure you didn't miss a deduction even if something in your life

changed, like a new job, new house - or more kids!

Also included:

- We provide the Audit Support Center free of charge, in the unlikely

event you get audited.

Many happy returns from TurboTax.

3. You keep telling people that there are two emails that all customers receive after completing their taxes. As a customer, we would not know that this is standard operating procedure. We only come to this page when we start wondering a month later (in my case) why the return has still not be processed and the refund issued. I understand that on your end it looks clear, but for a user of the TurboTax site, this isn't clear until you start asking questions--after you've discovered a problem (missing refund).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Our taxes were not e-filed even though I completed all steps in September

You were able to save a pdf and print because you paid your TT fees. If you had not paid, you would have been unable to do those things. Again, it is unfortunate that you misunderstood and did not go all the way to the last step to e-file. BUT the reality now is that you did not file. It is too late to e-file. Print, sign, and mail the returns. That is the only way you can file now.

We are not TurboTax employees. We are volunteers.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Our taxes were not e-filed even though I completed all steps in September

Once you pay the TurboTax account fees you can download the complete tax return as a PDF. Being able to download the tax return as a PDF does not mean that the tax return has been e-filed.

If it was e-filed there would be a Postmark Report included with the PDF download if you selected to download the return to include all worksheets.

The Postmark Report would show the date/time the tax return was electronically filed and the date it was Accepted by the IRS for a federal tax return.

TurboTax support FAQ for e-filing a tax return - https://ttlc.intuit.com/community/e-file/help/how-do-i-e-file-my-personal-individual-tax-return/00/2...

TurboTax support FAQ for checking the status of an e-filed tax return - https://ttlc.intuit.com/community/return-status/help/how-do-i-check-my-e-file-status/00/25538

This is a TurboTax user forum and we are just users of the software like yourself. Only trying to explain the procedures that have been in place for many years for e-filing tax returns.

If you would like to contact TurboTax support and speak with a TurboTax agent then please use the following links to access Support.

Use this website to contact TurboTax support during business hours - https://support.turbotax.intuit.com/contact/

Support can also be reached by messaging them on these pages https://www.facebook.com/turbotax/ and https://twitter.com/TeamTurboTax

Or use this phone number and select TurboTax - 1-800-4-INTUIT (1-800-446-8848)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Our taxes were not e-filed even though I completed all steps in September

Thanks for the info. I'm not sure why you would volunteer to do this work for the company gratis. Many of your answers sound like they're straight from TurboTax. May I suggest that you stop telling fellow users of the site that they have "misunderstood" when we are talking about a design flaw on the company's part.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Our taxes were not e-filed even though I completed all steps in September

You said in your top question your info was erased? That's common to end up with multiple accounts. First LOG OUT of whatever TurboTax account you're logged into right now. Then use this TurboTax account recovery website to get a list of user ID's for an email address. Run the tool against any email addresses you may have used

https://myturbotax.intuit.com/account-recovery/

But I don't know if you can log in right now as online is closed to get ready for next year.

If you used the Desktop CD/Download program then the only copy is on your computer and not saved or stored online.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Our taxes were not e-filed even though I completed all steps in September

If you can log in and find your account you should also see the status and if it was Accepted or Rejected, Started, Printed, Ready to Mail, etc. what does it say?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Our taxes were not e-filed even though I completed all steps in September

Sorry but the TT program interview holds your hand every step of the way and all you have to do is follow the screen instructions .... if you fail to READ the screens to complete the filing then you (and all the others that have posted about this) have no one to blame but yourselves.

In the FILE tab there are 3 steps ... (1)payment (2) choose how to get the refund or pay balance due and finally (3) the review/print the return to mail the return OR efile it. In step 3, where you were able to save the PDF you have, you are given access to the entire return before filing ... per the IRS rules where you cannot file in the blind.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Our taxes were not e-filed even though I completed all steps in September

Critter, your reply is exactly the type of gaslighting, corporate-shilling answer that I wrote about above. If a number of people are having the same issue when e-filing, then it makes no sense to suggest they're all idiots, have trouble reading, made a mistake, etc.

Volvogirl, I don’t think it’s possible that I have another account, but thanks. I’ve been filing with TurboTax for many years, and every other years’ tax forms are still on the site as is our extension (e-filed in April 2019). But there’s no mention of our September 2019 e-filing, and I have searched my in-box and don’t have any emails from TurboTax about my supposedly unfinished return either. (But to answer someone's point above, I completed the forms online rather than downloading the program to my computer).

If TurboTax customers are skipping a crucial transmit-my-returns step, they aren't being warned or reminded. TurboTax needs to build in more safeguards to let people know that their forms have not be submitted. I want to stress, though, that I don’t think I skipped that final step. I believe there is a glitch that kept my forms from being e-filed, and I’m only now noticing because I assumed they were with the IRS and state revenue office.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

jcroeder

New Member

mrshankly01

New Member

Rscollege

Returning Member

igpx330176

New Member

auntsoup66

New Member