- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: I need to amend my return to show my husband and MYSELF as self employed, owning/working for our Construction Co. How do I show business ownership as both, not just him?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to amend my return to show my husband and MYSELF as self employed, owning/working for our Construction Co. How do I show business ownership as both, not just him?

Will Turbotax split Schedule C up for me and my spouse based on ownership percentage? Or do I have to retype 2 Schedule C?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to amend my return to show my husband and MYSELF as self employed, owning/working for our Construction Co. How do I show business ownership as both, not just him?

Sorry you have to manually fill out 2 schedule Cs, one for each of you. Or you should be filing a partnership return and entering a Schedule K-1 for each of you into your personal return. It might depend if you are in a Community Property State. Someone else will know more about that. Or you should go to a local accountant to do it properly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to amend my return to show my husband and MYSELF as self employed, owning/working for our Construction Co. How do I show business ownership as both, not just him?

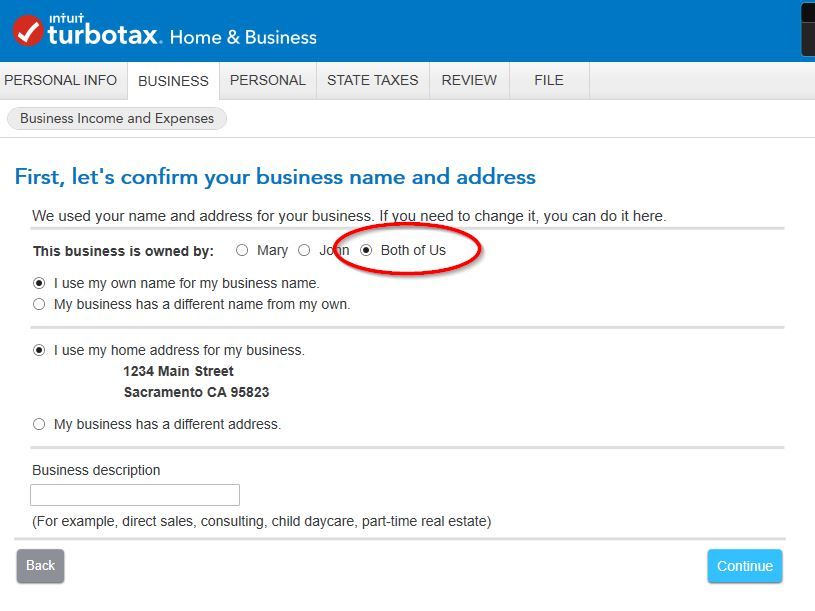

If you are doing a 2019 return then you must be using the Desktop program and not online? I opened my 2019 Home & Business program and for schedule C I picked Both of Us and got this screen. Did you click on owned by Both of Us?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to amend my return to show my husband and MYSELF as self employed, owning/working for our Construction Co. How do I show business ownership as both, not just him?

Here’s some prior posts I found,

https://ttlc.intuit.com/community/taxes/discussion/husband-wife-llc-part-of-married-joint-filing/01/...

To file a Partnership return, you need TT Business. It is only available as a desktop version, and then only for Windows. And you can have both TT Business and TT Home & Business (or any personal version) installed on your computer at the same time.

https://turbotax.intuit.com/small-business-taxes

IRS info Qualified Joint Venture for married couples

https://www.irs.gov/businesses/small-businesses-self-employed/election-for-married-couples-unincorpo...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to amend my return to show my husband and MYSELF as self employed, owning/working for our Construction Co. How do I show business ownership as both, not just him?

if your company is a C Corporation. it files it's own return. income would be reported by it. in general, you would only need to report on your own return any salaries and dividends received.

if it's an S Corp, then it must file a return (1120S) showing each of you as owners and issuing k-1's to each which gets reported on your 1040 along with any slaries paid

if neither, you have a partnership. if it is not an LLC, each of your reports their share on a schedule C

if it is an LLC in a community property state, no partnership return is required. everything gets split 50/50. each files their own schedule C

if it is an LLC in a non-community property state a partnership return is required (1065). it issues a k-1 to each of you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to amend my return to show my husband and MYSELF as self employed, owning/working for our Construction Co. How do I show business ownership as both, not just him?

Thank you so much for your quick response. You have been most helpful.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to amend my return to show my husband and MYSELF as self employed, owning/working for our Construction Co. How do I show business ownership as both, not just him?

Thank you so much for your help.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Simonr78248

New Member

shak0000

Level 1

gilliam4investor

New Member

rataea

Level 1

rataea

Level 1