- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: I filed taxes with Turbotax on Feb 10, 2020. The IRS' stimulus website tells me no return has...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed taxes with Turbotax on Feb 10, 2020. The IRS' stimulus website tells me no return has been transmitted with my SSN when I check status on the stim payment.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed taxes with Turbotax on Feb 10, 2020. The IRS' stimulus website tells me no return has been transmitted with my SSN when I check status on the stim payment.

If you did not receive a confirmation e-mail that TurboTax received your return, please check the SPAM, Deleted, or junk mail folders in your e-mail account.

When you log back in to your TurboTax account, you should see the status of your return. If it does not say that your return was received, try transmitting it again. You can check the e-file status of your return by clicking here: Check your e-file status

You can check the status of your refund by going to the IRS Refunds page. You can click on the Check My Refund Status link or download the IRS2Go app for your mobile device.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed taxes with Turbotax on Feb 10, 2020. The IRS' stimulus website tells me no return has been transmitted with my SSN when I check status on the stim payment.

It's not my refund, I owed $150. I have confirmation from TurboTax that my return was transmitted and accepted. The initial question blank limited me to a few characters.

I'm trying to fill out the IRS stimulus payment information on their website. After receiving no approval or rejection email in two days I checked the status on that website. The IRS website is the one that says no return with my SSN has been transmitted. If I transmitted a return, check the status on that account.

Will TurboTax then show my stimulus approval or rejection? I posted because it says no return submitted on the free fillable forms website the IRS makes you use for stimulus information, even though I have confirmation from TurboTax months ago of my return.

Hope that makes sense, I know it sounds odd.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed taxes with Turbotax on Feb 10, 2020. The IRS' stimulus website tells me no return has been transmitted with my SSN when I check status on the stim payment.

If you filed your 2019 return and it was accepted by the IRS in February then you have filed and don't need to do anything else to receive your stimulus payment. The IRS will mail the check to the address you listed on your return. The free fillable forms website is not used to track your return. It is used to file a return. The link to track your stimulus payment will be available soon and you will be able to provide your direct deposit information as well. Please view this IRS link and use the Get Your Payment application, available mid-April, to check the status of your stimulus payment and update your direct deposit information.

Please view this IRS link if you would like to confirm that the IRS has received your 2019 tax payment.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed taxes with Turbotax on Feb 10, 2020. The IRS' stimulus website tells me no return has been transmitted with my SSN when I check status on the stim payment.

I wanted to enter my direct deposit information. The IRS doesn't have that. I was able to get this to work for both my parents, and my aunt/uncle.

I am very worried that me, being the only one out of three groups with this issue may have had my identity compromised in some fashion. I can't create an IRS account, it won't verify my cell.

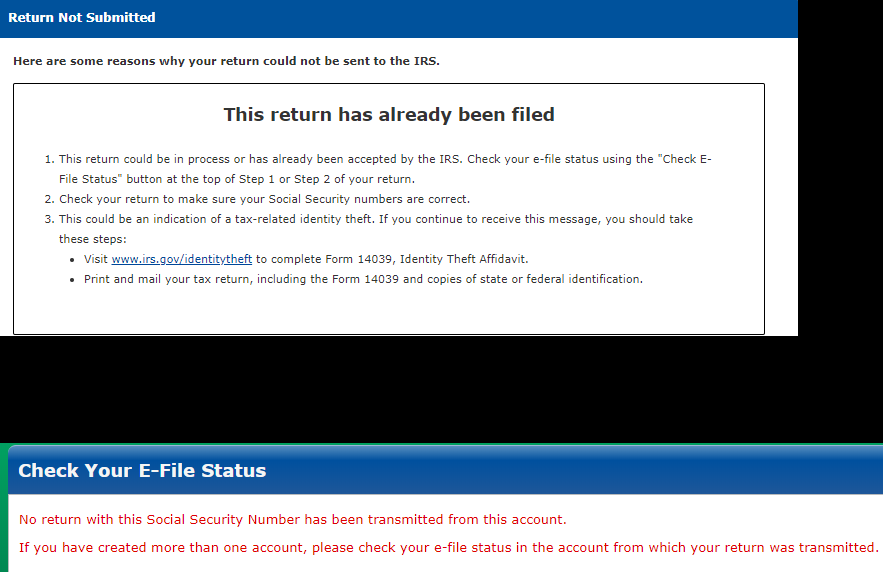

This is what I'm continuing to see. These two errors. Sorry if I seem foolish, but it truly has me worried. The red text is what happens when I check status. My parents' form I completed submitted and returned in less than 2 minutes, the same as my aunt's. They both got transmission and approval emails. Everyone had filed taxes this year and the last, though they used paper forms.

I'm trying to figure out if I need to submit the form 14039 form. I'm thankful for those links you provided, I did not have those. I am an absolute nervous wreck at the moment, worrying about identity theft now.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed taxes with Turbotax on Feb 10, 2020. The IRS' stimulus website tells me no return has been transmitted with my SSN when I check status on the stim payment.

If you filed your 2019 tax return in February and are trying to file for the Stimulus Registration, you can not do both. For the IRS purposes, you have filed two returns.

The IRS rejects e-filed returns that contain incorrect, mismatched, or already-filed Social Security numbers, birth dates, or names. Here are a few ways this can happen:

- You accidentally entered the wrong Social Security number or date of birth

- The name or date of birth you entered doesn't match IRS records for that Social Security number

- A former spouse claimed your dependent on their return and filed before you did

- Your dependent already claimed himself/herself on their own return (or your parent already claimed you as their dependent) and filed before you did

- Someone else filed their return using your, your spouse's, or your dependent's Social Security number

If you verified that the info you entered is correct and you e-file again, the IRS e-file servers will almost certainly reject your return for the same reason. In this case, your only option is to paper-file (mail) your return.

Important: If you believe someone filed a fraudulent return using your Social Security number, we have recommended actions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

helloTT102

New Member

detectorist%79

Returning Member

4taxhelp

New Member

grosiles

Level 1

anri fumoto

Level 1