- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: I am unable to complete my Federal form 8889-S review because it indicates that my spouse can...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am unable to complete my Federal form 8889-S review because it indicates that my spouse can be claimed as a dependent by someone else which is untrue. How do I fix it?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am unable to complete my Federal form 8889-S review because it indicates that my spouse can be claimed as a dependent by someone else which is untrue. How do I fix it?

It sounds like perhaps something is just marked incorrectly in her personal information.

Return to the Personal Info section of TurboTax, click Edit beside her name, and review the information to ensure that the question asking if she is a dependent is marked no.

Let us know if this doesn't resolve the issue.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am unable to complete my Federal form 8889-S review because it indicates that my spouse can be claimed as a dependent by someone else which is untrue. How do I fix it?

Hello, thank you for your reply.

I have already tried to correct my own and my spouses personal information. I even deleted those two forms (following a turbo tax customer service rep's instructions) and retyped the information but the issue remains.

I believe there is a glitch in the SW somewhere. There must be some other check mark that indicates my spouse can be claimed as somebody else's dependent which prevents me from filing the correct HSA coverage (He is on my account).

Turbo Tax Customer Service recommended I delete my entire tax return and start over because the Federal Worksheet is the only form that cannot be deleted. According to the error I get during the review that's where the issue is.

Does anybody know where this dependent issue could be hidden in the Federal Worksheet or how I could resolve this without clearing everything and starting over? That would save me a lot of time.

Thank you so much!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am unable to complete my Federal form 8889-S review because it indicates that my spouse can be claimed as a dependent by someone else which is untrue. How do I fix it?

This may be an issue specifically about the HSA's and not the tax return dependency. Did you post two separate HSAs and then also include your spouse on yours. This could cause a similar error message.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am unable to complete my Federal form 8889-S review because it indicates that my spouse can be claimed as a dependent by someone else which is untrue. How do I fix it?

This does not sound like any option in the HSA interview, rather, it is what was said above - on the federal return, the question "can you be claimed as a dependent?" has been checked...somehow.

I would encourage you to try this.

Do a Search (upper right) for filing status and click on the jump-to link. In the CD/download product, this will take you to the Personal Info or My Info page where you can scroll down to "Your Filing Status" and click Edit.

In the Online product, this will bring you to the same Personal Info or My Info page, but the layout is a bit different. Instead of a subheading of "Your Filing Status", the subheading is likely to be your current filing status, probably "Married Filing Jointly". Click the Edit button here, too.

In both cases, you will want to change your filing status to Single. This should have the effect of removing some or all of your spouse's information.

Next click on Continue. Now, go do the Search again for filing status, and click on the jump-to link (I know you could just hit the back button, but I don't want you to do that).

Now edit the filing status again back to Married Filing Jointly. You will be prompted to re-enter your spouse's information. If you have dependents, TurboTax may say that the dependents' information need to be reviewed - that's OK, just tun through it again, confirming their information.

Now go back to the Federal Review and see if that clears the HSA issue.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am unable to complete my Federal form 8889-S review because it indicates that my spouse can be claimed as a dependent by someone else which is untrue. How do I fix it?

This is the same issue I am facing. I followed the most recent advice and I am still getting the same HSA error.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am unable to complete my Federal form 8889-S review because it indicates that my spouse can be claimed as a dependent by someone else which is untrue. How do I fix it?

OK, let's do this.

Let's do some of the stuff I list above:

Do a Search (upper right) for filing status and click on the jump-to link. In the CD/download product, this will take you to the Personal Info or My Info page where you can scroll down to "Your Filing Status" and click Edit.

In the Online product, this will bring you to the same Personal Info or My Info page, but the layout is a bit different. Instead of a subheading of "Your Filing Status", the subheading is likely to be your current filing status, probably "Married Filing Jointly". Click the Edit button here, too.

In both cases, you will want to change your filing status to Single. This should have the effect of removing some or all of your spouse's information. Hit Continue.

But stop here, and do this next:

***

1. make a copy of your W-2(s) (if you don't have the paper copies)

2. delete your W-2(s) (use the garbage can icon next to the W-2(s) on the Income screen)

*** Desktop***

3. go to View (at the top), choose Forms, and select the desired form. Note the Delete Form button at the bottom of the screen.

*** Online ***

3. go to Tax Tools (on the left), and navigate to Tools->Delete a form

4. delete form(s) 1099-SA (if one), 8889-T, and 8889-S (if one)

5. go back and re-add your W-2(s), preferably adding them manually

***

Now, go do the Search again for filing status, and click on the jump-to link.

Now edit the filing status again back to Married Filing Jointly. You will be prompted to re-enter your spouse's information. If you have dependents, TurboTax may say that the dependents' information need to be reviewed - that's OK, just run through it again, confirming their information.

Next, start the HSA interview again and run through it, answering things the way you did the first time.

Now go back to the Federal Review and see if that clears the HSA issue.

Let us know...

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am unable to complete my Federal form 8889-S review because it indicates that my spouse can be claimed as a dependent by someone else which is untrue. How do I fix it?

thanks @BillM223 - so I followed all of these steps and I still got the same issue.

So I tried the steps again, chose 'file single' and deleted my W2 again, then in the final steps I still had the same HSA/dependent error. Even though technically I hadn't registered a spouse or W2....

This seems like a defect. Any thoughts?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am unable to complete my Federal form 8889-S review because it indicates that my spouse can be claimed as a dependent by someone else which is untrue. How do I fix it?

I don't know what to make of this. The data piece that your spouse is a dependent is lurking somewhere.

Please do me a favor. Please send us a sanitized (all personal data blurred out) version of your return so I can see it. You do this by sending us a "token", which points to your sanitized return in our data base.

To send us a token, please do the following:

TurboTax Online:

Click Tax Tools in the menu to the left.

Click Tools, and then

Click Share my file with Agent.

A pop-up message will appear. Click OK to send the sanitized diagnostic copy to us.

Provide the token number that is generated onto this thread.

TurboTax Desktop:

Select Online menu if the customer is using Windows. Select “Help” if using a Mac.

Select Send Tax File to Agent.

A pop-up message will appear, and the customer will select, Send. If using Mac "Send Tax File to TurboTax Agent"

Note: Desktop will save a file to your computer unless you uncheck the box.

Another message will appear. Provide the token number that is generated onto this thread.

At the bottom of your reply (with the token) add "@" "BillM223" without the space in between) so I will be notified.

This will let us see what is happening on your return. Thanks.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am unable to complete my Federal form 8889-S review because it indicates that my spouse can be claimed as a dependent by someone else which is untrue. How do I fix it?

Thanks @BillM223 ! I was about to just give up and file via mail and scratch out if it's counting my spouse as a dependent (which I'd like to avoid) token is 919849

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am unable to complete my Federal form 8889-S review because it indicates that my spouse can be claimed as a dependent by someone else which is untrue. How do I fix it?

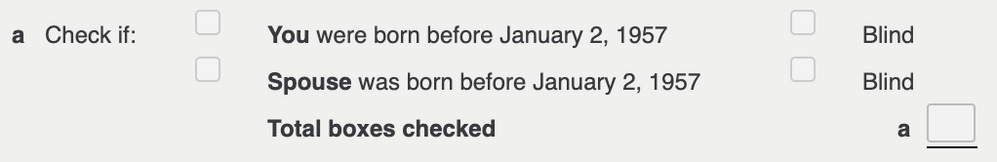

And in looking at my 1040 preview, the boxes are not checked - though it continues to throw this error.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am unable to complete my Federal form 8889-S review because it indicates that my spouse can be claimed as a dependent by someone else which is untrue. How do I fix it?

This is what I see so far (although the sanitization process does mess with what I see to some extent):

1. In your W-2 interview, there is a question at the end of it: "Did any of your HSA contributions go to [your spouse's] account?" If your spouse does not have an HSA, then please go look at this screen and make sure that you checked "No, I put all my contributions into my own HSA account." This will be one reason why the screen in the line above will be checked by TurboTax for your spouse, even if your spouse does not have an HSA. (In your sanitized return, neither option is checked, please make sure that the No option is checked if your spouse does not have an HSA).

2. The check for YES in the line above will cause TurboTax to check the spouse has an HSA on the "Tell us about your health-related accounts" (the start of the HSA interview)? I am guessing that your spouse does not have an HSA, yet it is marked that your spouse did. If your spouse does not have an HSA, please go uncheck that box, after doing the line above first.

3. I saw in your HSA interview that you claimed $XXX as a personal contribution, but this is the same amount as your code W amount in box 12 on your W-2. Please do not duplicate contributions in the code W amount anywhere else on the return. Entering it also as a personal contribution duplicates your contribution and lead to an error in your tax. This amount is probably the amount you withheld by payroll deduction so you consider "yours", but the IRS considers it to be the "employer contribution" and not a personal contribution. Believe me, it is better for you this way. The code W amount is subtracted from Wages in boxes 1, 3, and 5 on your W-2 before your W-2 is printed, so you save on income tax, SS tax, and Medicare tax, but the "personal" contribution saves you only on your income tax.

Please check this and let me what know what happens.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am unable to complete my Federal form 8889-S review because it indicates that my spouse can be claimed as a dependent by someone else which is untrue. How do I fix it?

Hi @BillM223 ,

Thank you for your help, my apologies as it seems to still be an issue.

1. I cannot get this prompt to come up. I have went and refilled out the information on the My Info Page and also to Federal > Wages & Income > W2 edit. After going through those prompts again I did not see it so went to Federal > Deductions & Credits > Health > HSA and filled out the questions again, but it has not asked for "Did any of your HSA contributions go to [your spouse's] account?"

2. my spouse does have an HSA, but it is separate from mine and we do not contribute to each others

3. Thank you for pointing that out - I have changed the number to be $0 from my HSA contributions

919926 is the new token

Thanks for your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am unable to complete my Federal form 8889-S review because it indicates that my spouse can be claimed as a dependent by someone else which is untrue. How do I fix it?

oops I just realized I had sent the wrong screenshot above as well, apologies

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am unable to complete my Federal form 8889-S review because it indicates that my spouse can be claimed as a dependent by someone else which is untrue. How do I fix it?

1. I cannot get this prompt to come up. I have went and refilled out the information on the My Info Page and also to Federal > Wages & Income > W2 edit. After going through those prompts again I did not see it so went to Federal > Deductions & Credits > Health > HSA and filled out the questions again, but it has not asked for "Did any of your HSA contributions go to [your spouse's] account?"

This screen ("Did any of your HSA contributions go to [your spouse's] account?") is in the W-2 interview, near the end of it. It's not in the HSA interview.

This screen will be only in your W-2 interview, because of the code W in box 12 on your W-2. Your spouse will not have this question for your spouse's W-2, because your spouse does not have a code W in box 12 on your spouse's W-2.

"2. my spouse does have an HSA, but it is separate from mine and we do not contribute to each others"

And, to be clear, your spouse did not contribute to her/his HSA, neither through the employer nor directly?

I am going to let you go back through the W-2 interview before looking at your token.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

DJ144

New Member

theresa-chiang

New Member

0813angel

New Member

drwhitfill

New Member

dthrower15

New Member