- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: I am trying to amend my 2019 tax return the IRS said I need to update the 1040x form. Instead of putting other dependent I need to put child tax credit.... HELP ?????!!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am trying to amend my 2019 tax return the IRS said I need to update the 1040x form. Instead of putting other dependent I need to put child tax credit.... HELP ?????!!!!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am trying to amend my 2019 tax return the IRS said I need to update the 1040x form. Instead of putting other dependent I need to put child tax credit.... HELP ?????!!!!

What? If you qualified for the child tax credit, it would have been added automatically to your refund when you entered your child as a dependent and entered the income you earned from working. So what are you trying to do? If your child was 17 or older at the end of 2019 you do not get the child tax credit, or if your child does not have a Social Security number you do not get the child tax credit. If your child is 17 or older, or if the child has an ITIN, then you get the $500 credit for other dependents.

Did you prepare your tax return without including your dependent at all? What information about your dependent did you enter when you filed your original tax return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am trying to amend my 2019 tax return the IRS said I need to update the 1040x form. Instead of putting other dependent I need to put child tax credit.... HELP ?????!!!!

When I entered my son's information as my dependent it put him as OTHER DEPENDENT as if he's older then 17. He's only 1 and I qualify for the child tax credit but I don't know how to change that error. I got a letter from the IRS saying I qualify for the Additional Child Tax Credit . I need help figuring this out really bad

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am trying to amend my 2019 tax return the IRS said I need to update the 1040x form. Instead of putting other dependent I need to put child tax credit.... HELP ?????!!!!

The IRS said they see where I entered his information but it's put as OTHER DEPENDENT instead of CHILD TAX CREDIT . This is why I didn't get the 500 for my son with my stimulus check. Said it was based off the CHILD TAX CREDIT which I didn't have him in for.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am trying to amend my 2019 tax return the IRS said I need to update the 1040x form. Instead of putting other dependent I need to put child tax credit.... HELP ?????!!!!

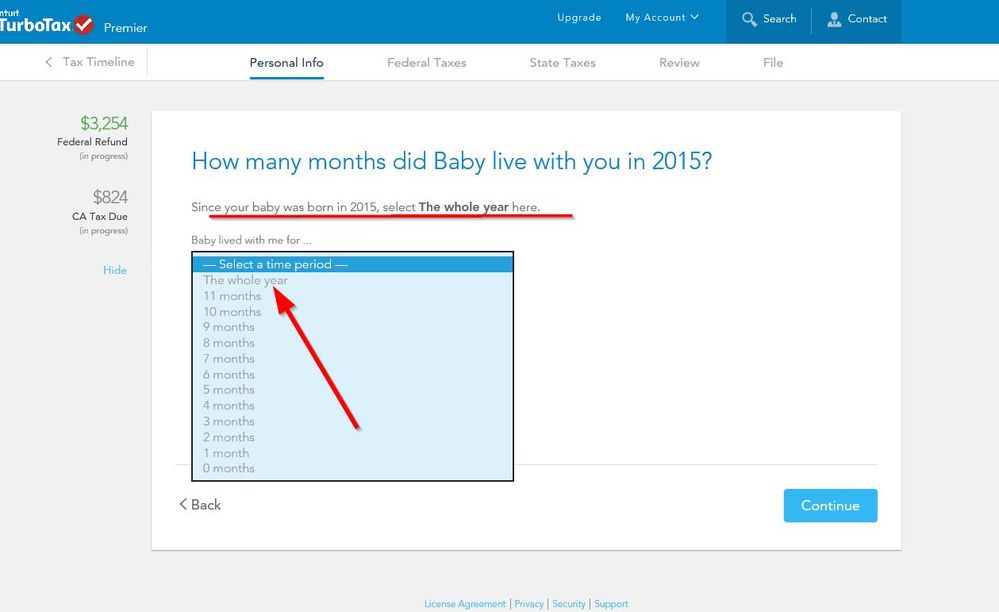

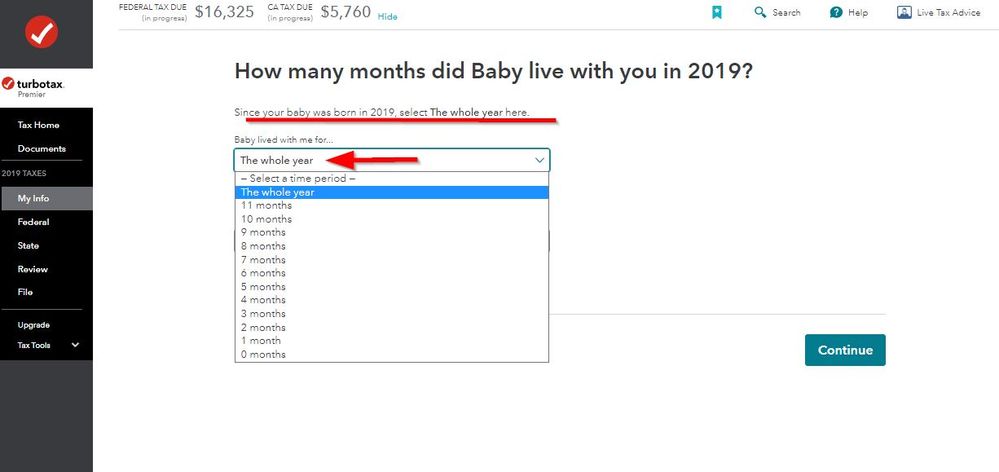

Was he born in 2019? You need to pick he lived with you the WHOLE year, not just the months. This is a screen shot from 2015 but should be the same for 2019. I try to make a newer one.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am trying to amend my 2019 tax return the IRS said I need to update the 1040x form. Instead of putting other dependent I need to put child tax credit.... HELP ?????!!!!

Yes he was born January 1st 2019 ... I put that he lived with me the whole year and nobody helped me take care of him..... Still lost

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am trying to amend my 2019 tax return the IRS said I need to update the 1040x form. Instead of putting other dependent I need to put child tax credit.... HELP ?????!!!!

Sounds like he got added as over 17. Go back and check the birthdate under My Info or Personal Info.

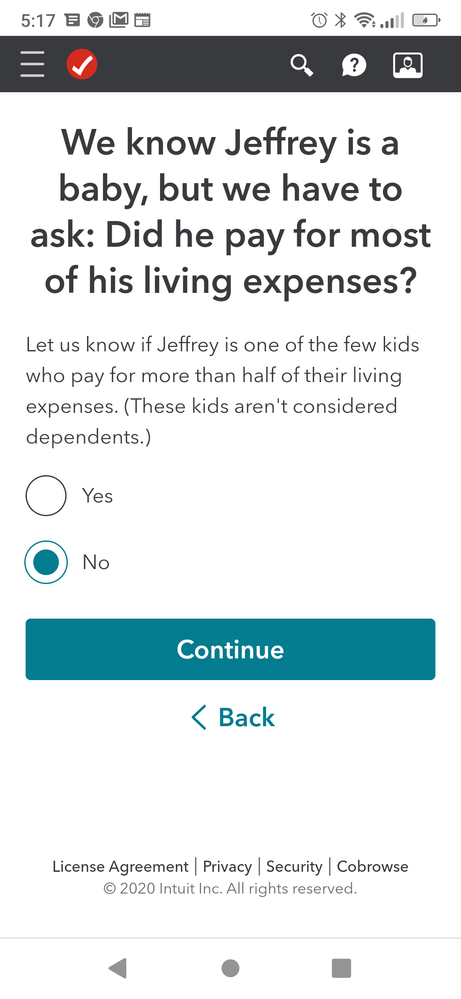

There are a couple questions you could have answered wrong under My Info or Personal Info. Like the one that says did your CHILD pay more than half of their support. It's not asking if you did.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am trying to amend my 2019 tax return the IRS said I need to update the 1040x form. Instead of putting other dependent I need to put child tax credit.... HELP ?????!!!!

But he's a baby how would that work?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am trying to amend my 2019 tax return the IRS said I need to update the 1040x form. Instead of putting other dependent I need to put child tax credit.... HELP ?????!!!!

Is this the question you were talking about?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am trying to amend my 2019 tax return the IRS said I need to update the 1040x form. Instead of putting other dependent I need to put child tax credit.... HELP ?????!!!!

Should I hit YES instead of NO ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am trying to amend my 2019 tax return the IRS said I need to update the 1040x form. Instead of putting other dependent I need to put child tax credit.... HELP ?????!!!!

Right. It used to be more confusing so people answered the wrong way.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am trying to amend my 2019 tax return the IRS said I need to update the 1040x form. Instead of putting other dependent I need to put child tax credit.... HELP ?????!!!!

We were typing at the same time. Answer NO.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am trying to amend my 2019 tax return the IRS said I need to update the 1040x form. Instead of putting other dependent I need to put child tax credit.... HELP ?????!!!!

I had selected NO. I'm still getting the same result

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am trying to amend my 2019 tax return the IRS said I need to update the 1040x form. Instead of putting other dependent I need to put child tax credit.... HELP ?????!!!!

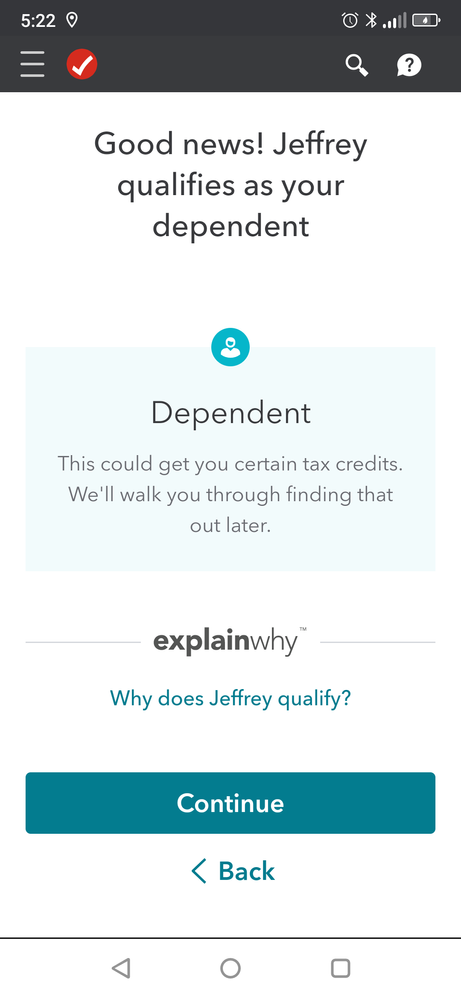

Try deleting the dependent and starting over to enter his information. You have answered something incorrectly. Did you also say NO to a question about whether anyone else contributes to his support? NO to him paying his own support. Say he lived with you the WHOLE year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am trying to amend my 2019 tax return the IRS said I need to update the 1040x form. Instead of putting other dependent I need to put child tax credit.... HELP ?????!!!!

I deleted him & added him back ....

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

xxrubyxxmacxx

New Member

thewildkateaton

New Member

aoiryuu4346

New Member

petervan80

New Member

petervan80

New Member