- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Getting state tax back for having no CA sourced income as nonresident

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting state tax back for having no CA sourced income as nonresident

My previous CPA has been filing CA state tax for me on year 2018, 2017, and 2016. I live in Germany since 2013 and has no CA sourced income. I would like to make amendments from 2016 - 2018 and get the tax paid to the State back. How would I do that? Should I file a 1040X and 540 NR again and adjust all the dividend/interest/ income to 0 on the 540 NR? I've purchased 2018 Turbotax and would like to start with it.

I made an amendment on year 2016 on a different topic in Feb 2019. Now I would have to file a second amendment on year 2016 because of the state tax. I have not heard anything back from the 1st amendment. The due date for me based on the 3-year rule is 15 Apr 2020. How should I do it properly?

thank you!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting state tax back for having no CA sourced income as nonresident

I recommend you start with your 2016 tax return as you can still amend that return. (You have 3 years from the date you filed or 2 years after you paid the tax due, whichever is later, to amend a return.)

I have attached a link to help you get the prior year TurboTax software so you can start that amended return.

You may not need to amend your federal returns if that information is the same.

It sounds like you only need to update California as it is no longer your place of residence. You will need to enter the information into the program but will only amend the CA to reflect that you were a nonresident and were not subject to any state income taxes assuming none of the income was CA sourced.

If anything was from California sources, be sure to leave that as you would be taxed on anything sourced in California even as a nonresident.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting state tax back for having no CA sourced income as nonresident

Thank you for being so clear and attaching the link!

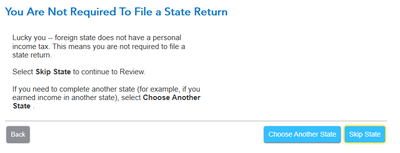

In my 2016 return, 540NR was filed but also had the non-CA sourced income reported and taxed. I put all the info into Turbotax the way my prev. CPA did and it says I don't need to file any State return.

When I amend it continues to tell me I don't need to file a State return. How do I actually do the amendment?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting state tax back for having no CA sourced income as nonresident

No, if you entered everything correctly then you do not need to file a state return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

embedded_guy

Level 2

acb7b540bec1

New Member

med87-aol-com

New Member

StaceyVA

New Member

ryanf312

New Member