- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Eitc/Actc pathers only.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2019 Eitc/Actc pathers only 2018 tax year

i am so jealous!!!!!!!!!!!!!!!!!!!!!! did you still have the processing message

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2019 Eitc/Actc pathers only 2018 tax year

Or there is a typo in the account or routing number. It takes about 3 to 5 days to kick back to irs as wrong account info at which point they mail a check the same day it kicks back to them. Irs refunds are not supposed to forward they only go to address on the return. Sometimes they slip through post office but they are not supposed to forward IRS letters.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2019 Eitc/Actc pathers only 2018 tax year

FILED 1/30

ACCEPTED1/30

DDD 2/22

Nothing yet still waiting :( direct deposit in my credit union account but still not showing .Hoping for tomorrow then !!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2019 Eitc/Actc pathers only 2018 tax year

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2019 Eitc/Actc pathers only 2018 tax year

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2019 Eitc/Actc pathers only 2018 tax year

I had this and I still have this on WMR website...

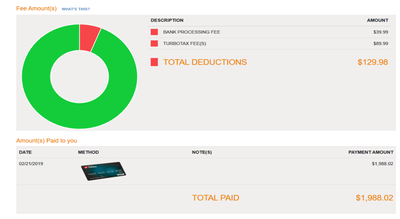

I have this on the sbtpg bank website...

Things are a lil different for me having a DDD of 2/21/19 I guess...

Refund Status Results

Your return has been processed and refund amount approved.

Your tax refund is scheduled to be sent to your bank by February 22, 2019.

If your refund is not credited to your account by February 27, 2019, check with your bank to see if it has been received.

Please Note:

For refund information, please continue to check here, or use our free mobile app, IRS2Go. Updates to refund status are made no more than once a day.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2019 Eitc/Actc pathers only 2018 tax year

JUST THOUGHT ID SHARE SINCE I BEEN STALKING THIS THREAD

I filled my taxes 1/14/2019

ON THE OTHER HAND I FILED MY HUSBANDS TAXES ON

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2019 Eitc/Actc pathers only 2018 tax year

Billyray youre lucky

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2019 Eitc/Actc pathers only 2018 tax year

no for 2/22 but I checked to see if it was pending they said no

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2019 Eitc/Actc pathers only 2018 tax year

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2019 Eitc/Actc pathers only 2018 tax year

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2019 Eitc/Actc pathers only 2018 tax year

I paid my fees upfront . Does anyone know if it straight to my bank account or if it goes through sbtg then to my account?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2019 Eitc/Actc pathers only 2018 tax year

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2019 Eitc/Actc pathers only 2018 tax year

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2019 Eitc/Actc pathers only 2018 tax year

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

momon3y1c

New Member

bzinicola

New Member

poppagene

New Member

xratedpoptarts

New Member

sc0ttk0lasinski

New Member