- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Can an adjust for the attorney fee deduction be made in the online version for the labor discrimination litigation?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can an adjust for the attorney fee deduction be made in the online version for the labor discrimination litigation?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can an adjust for the attorney fee deduction be made in the online version for the labor discrimination litigation?

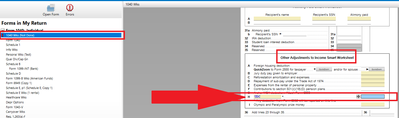

In the desktop editions Forms mode, on the Form 1040 Worksheets there is an Other Adjustments to Income Smart Worksheet. If you enter on Line H of the worksheet UDC and then the amount, that will flow to the Schedule 1 Line 36 with a write-in on Line 36 of UDC and the amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can an adjust for the attorney fee deduction be made in the online version for the labor discrimination litigation?

You can look for it, but I do not think you are going to be successful since the adjustment cannot be made in the desktop version (at least not in Step-by-Step Mode) without entering Forms Mode and doing an override [EDIT: see @DoninGA's post below re the 1040 worksheet entry]

In fact, there is not even a line for the adjustment on Schedule 1; the IRS suggests writing "UDC" on the dotted line next to Line 36 and entering the amount.

See https://www.irs.gov/instructions/i1040gi#idm139844915239968

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can an adjust for the attorney fee deduction be made in the online version for the labor discrimination litigation?

Remove incorrect reply

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can an adjust for the attorney fee deduction be made in the online version for the labor discrimination litigation?

Hmmm... I thought the legal fees were not deductible at all, but you pointed out they are on schedule 1 line 36 using UDC.

Thanks, learned something new.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can an adjust for the attorney fee deduction be made in the online version for the labor discrimination litigation?

In the desktop editions Forms mode, on the Form 1040 Worksheets there is an Other Adjustments to Income Smart Worksheet. If you enter on Line H of the worksheet UDC and then the amount, that will flow to the Schedule 1 Line 36 with a write-in on Line 36 of UDC and the amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can an adjust for the attorney fee deduction be made in the online version for the labor discrimination litigation?

The simple, direct answer to your question is No. There is no way to enter the above-the-line deduction for attorney fees for an unlawful discrimination claim in TurboTax Online. It can only be entered in forms mode, which is available only in the CD/Download TurboTax software, not in TurboTax Online. Officially the deduction is not supported in TurboTax at all. It was added to the list of unsupported calculations for 2018. However, it can still be entered in forms mode in TurboTax for 2018, as described by DoninGA.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can an adjust for the attorney fee deduction be made in the online version for the labor discrimination litigation?

Does it mean the update to line 36 UDC will flow through on the entire tax filing such as AMT, standard deduction calculation, etc??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can an adjust for the attorney fee deduction be made in the online version for the labor discrimination litigation?

@GoldenRose wrote:

Does it mean the update to line 36 UDC will flow through on the entire tax filing such as AMT, standard deduction calculation, etc??

I conducted a brief test and the entry, as described by @DoninGA, propagated to all of the requisite forms in my test return.

Again, note that you need the desktop (CD/Download) version of TurboTax as mentioned by @rjs is his post; the Online version will not work.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can an adjust for the attorney fee deduction be made in the online version for the labor discrimination litigation?

The line 36 UDC deduction does not affect your standard deduction. The line 36 UDC deduction, when entered as described by DoninGA, will flow through to all the appropriate places on your tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can an adjust for the attorney fee deduction be made in the online version for the labor discrimination litigation?

Thank you TagTeam!

Can you please describe steps you took to test this? I'm trying to amend my 2017 taxes with this adjustment and would greatly appreciate the steps to do so in the Desktop version. Thx!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can an adjust for the attorney fee deduction be made in the online version for the labor discrimination litigation?

@GoldenRose wrote:

Thank you TagTeam!

Can you please describe steps you took to test this? I'm trying to amend my 2017 taxes with this adjustment and would greatly appreciate the steps to do so in the Desktop version. Thx!

I am using the 2018 version of Home & Business but, hopefully, the screenshot below will be roughly similar to what you are seeing. First, enter Forms Mode (click the Forms icon in the upper right side of the screen). In Forms Mode, open the 1040 Worksheet (1040 Wks), scroll down to the Other Adjustments to Income Smart Worksheet, type "UDC" on Line H and the amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can an adjust for the attorney fee deduction be made in the online version for the labor discrimination litigation?

There's no 1040 Worksheet in 2017 TurboTax. The 1040 Worksheet was added for 2018. To enter the adjustment in 2017 TurboTax, go to forms mode and open Form 1040. Scroll down to the "Other Adjustments to Income Smart Worksheet" between lines 35 and 36. Enter the attorney's fees on line H of the Smart Worksheet. In the text entry box on the left side, right after the H, enter UDC. Enter the amount in the space on the right. The letters UDC and the amount will then appear on the dotted line to the left of the amount on line 36, and the fees will be added to any other amount that was already on line 36. Enter the amount as a positive number. It will be subtracted from your income.

Note that for 2017 the adjustment is made on line 36 of Form 1040. There is no Schedule 1 for 2017.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

elahoo

Level 1

cmancuso

New Member

sbmendes1984

New Member

Opus 17

Level 15

marino-t233

Level 1